ARTICLE AD BOX

- U.S. Treasury Secretary Scott Bessent emphasized the administration’s focus on lowering the 10-year Treasury yield without urging Fed rate cuts.

- The administration’s “3-3-3” economic framework aims to cut the fiscal deficit to 3% of GDP, boost oil production, and maintain 3% growth.

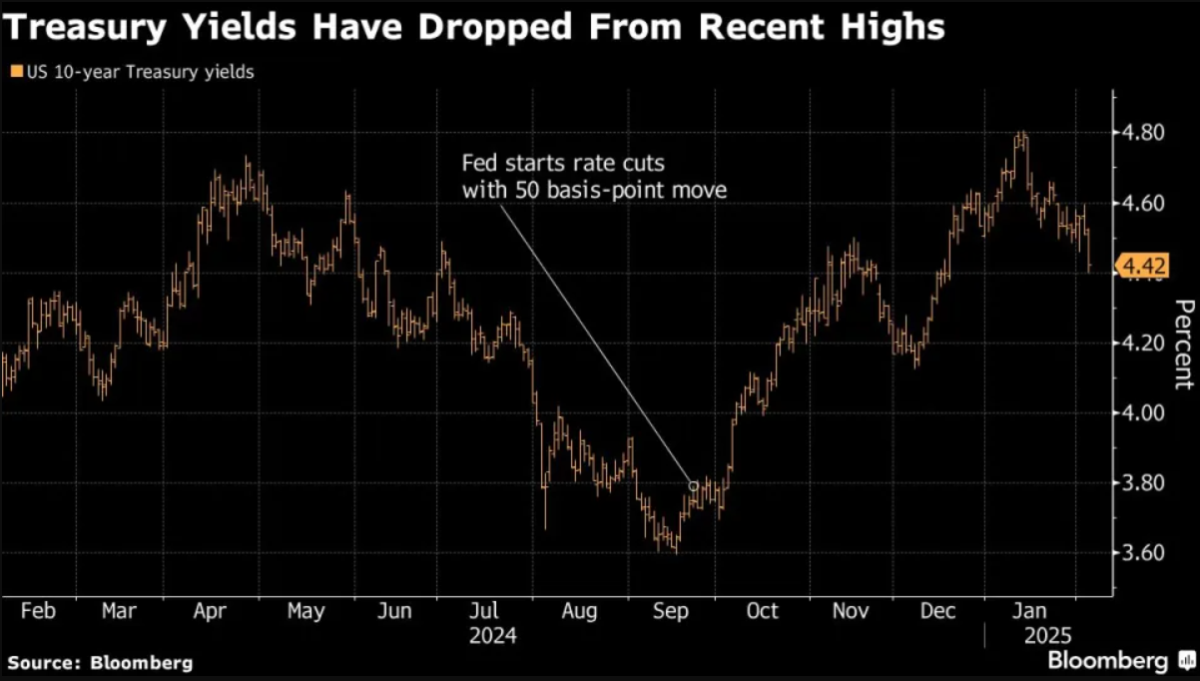

U.S. Treasury Secretary Scott Bessent laid out the Trump administration’s strategy to reduce borrowing costs, focusing on lowering the 10-year Treasury yield. Bessent clarified that President Donald Trump is not pushing the Federal Reserve to cut interest rates directly. Instead, the administration’s approach hinges on managing inflation and tackling the budget deficit, aiming to decrease long-term yields.

“He and I are focused on the 10-year Treasury. He is not calling for the Fed to lower interest rates,” said Bessent stated.

The 10-year yield serves as a benchmark for most long-term loans, including mortgages and business lending. A decline in that rate often encourages more borrowing, boosting financial markets and, by extension, assets like Bitcoin.

A softer 10-year yield is generally bullish for risk assets, including cryptocurrencies. Lower yields make traditional financial products less attractive, pushing investors toward alternative assets. However, Trump’s plan to trim the budget deficit could have a mixed effect on the market, as reduced fiscal spending may limit liquidity.

Source: Bloomberg

Source: Bloomberg3-3-3 Economic Plan Takes Center Stage

Bessent also reinforced the administration’s “3-3-3” economic framework: cutting the fiscal deficit to 3% of GDP, ramping up oil production by 3 million barrels per day, and sustaining a 3% economic growth rate. He described the initiative as a cornerstone of the administration’s strategy to foster private-sector-driven growth rather than relying on government spending.

.@BBKogan and I did the math on Bessent's 3-3-3 plan.

Even if you (wrongly) assume persistent 3% economic growth, Bessent's 3% deficit target requires massive middle-class tax increases and a 31% cut to programs like SNAP/Medicaid.

All while cutting taxes for the rich. https://t.co/yOyAcAqoe6 pic.twitter.com/074J45RPGk

— Brendan Duke (@Brendan_Duke) February 5, 2025

“Now that I’m in the seat, I believe in it more than ever,” Bessent said, explaining that under President Joe Biden, government spending had fueled economic expansion. However, the new plan seeks to shift that momentum toward capital investment and domestic manufacturing. That shift could create both opportunities and risks for financial markets.

Meanwhile, the Federal Reserve has already cut its benchmark borrowing cost by 100 basis points since September, bringing the rate down to the 4.25%-4.5% range. If inflation cools further, the Fed might continue easing, adding momentum to risk assets. That scenario could strengthen Bitcoin’s appeal, particularly among institutional investors looking for alternatives in a low-rate environment.

Budget Deficit Plans Could Shake Markets

One of the administration’s key tools for driving down yields is addressing the massive budget deficit through reduced government spending. Less spending would mean fewer Treasury bonds issued, leading to higher bond prices and lower yields. However, market observers note that slashing fiscal expenditures could also curb liquidity, potentially unsettling financial markets.

During the Biden administration, expansive government spending helped counterbalance elevated interest rates, keeping markets steady. Any abrupt spending cuts under Trump could destabilize that balance, impacting riskier assets, including cryptocurrencies. Some analysts warn that while lower yields might attract investors to Bitcoin, financial market volatility could also drive them away.

Bessent also weighed in on reports that some Republican lawmakers are considering a temporary extension of Trump’s 2017 tax cuts, which are set to expire at the end of the year. He firmly backed making those tax reductions permanent, stating that keeping them in place would cement the United States as the top economy in terms of growth.

In a separate discussion, Bessent addressed concerns over Elon Musk’s DOGE group and its involvement with Treasury payment systems. He reassured the public that the department’s infrastructure remains intact. “At the Treasury, our payments system is not being touched,” he confirmed.

.png)

3 hours ago

3

3 hours ago

3

English (US)

English (US)