ARTICLE AD BOX

- Bitcoin’s price drop has sparked debate, but CryptoQuant CEO Ki Young Ju sees a historic rally ahead, hinging on institutional demand and ETF activity.

- Robert Kiyosaki views Bitcoin’s dip as a buying opportunity, rejecting fiat currency while market uncertainty tests short-term holders’ resolve.

Bitcoin (BTC) recent price drop has fueled speculation that the bull market may be over, but not everyone is convinced. CryptoQuant CEO Ki Young Ju believes Bitcoin is still on track for a historic rally despite short-term volatility. The market has been teetering on the “bull-bear boundary,” leaving traders searching for clarity.

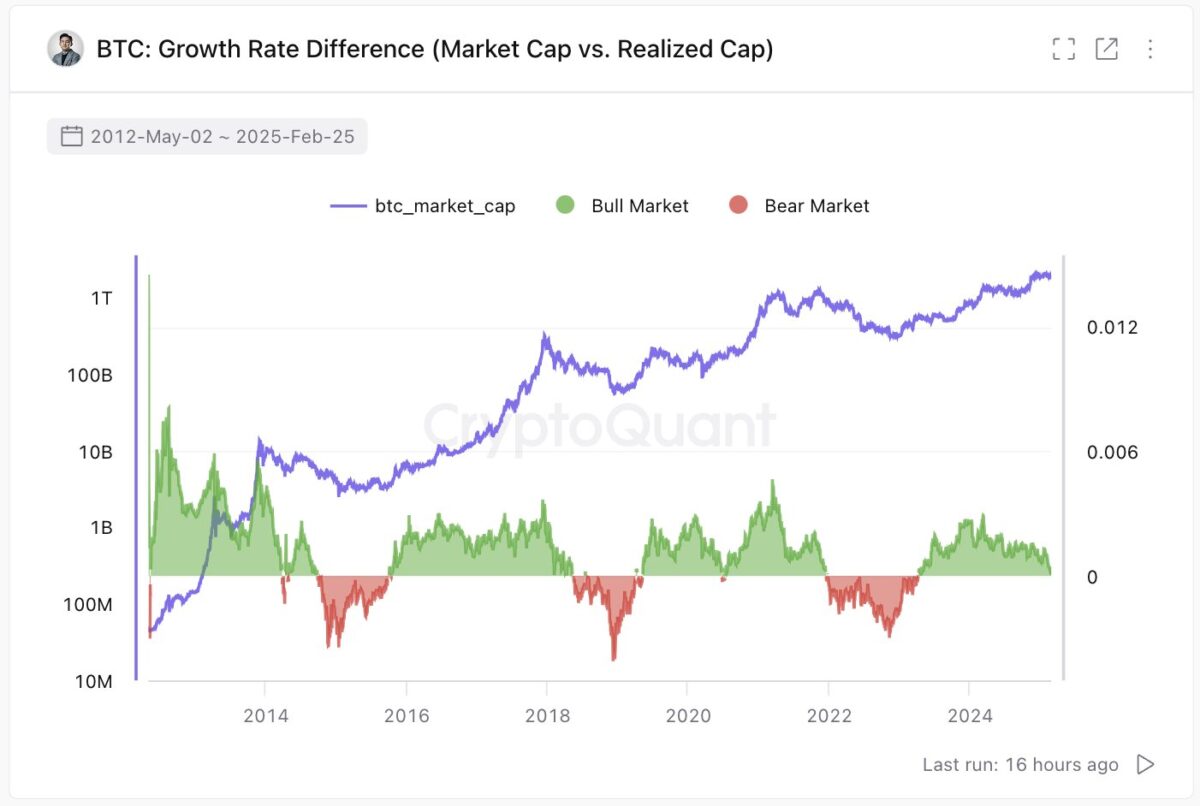

#Bitcoin on-chain indicators are at the bull-bear boundary.

I expect this to be the longest bull run in history, but I could be wrong. We need at least another month of data to confirm whether we’re entering a bear market. If demand doesn’t recover, indicators may fully signal a… https://t.co/QkaZx7wmAt pic.twitter.com/4iHbuitW4o

— Ki Young Ju (@ki_young_ju) February 27, 2025

Ju pointed out that institutional demand is the biggest indicator of Bitcoin’s direction. With exchange-traded funds (ETFs) seeing some outflows, the next few weeks could determine whether BTC moves higher or consolidates. If history repeats itself, Bitcoin could be on track for the longest bull run ever, stretching into 2025.

Source: Ki Young Ju

Source: Ki Young JuThe theory hinges on Bitcoin’s well-known two-year cycle. Ju suggested that April 2025 could mark the peak of this cycle, potentially pushing the top cryptocurrency to record-breaking highs. However, he tempered his optimism with caution, admitting:

I expect this to be the longest bull run in history, but I could be wrong.

BTC Worst-Case Scenario: Holding at $77K

While many traders fear deeper corrections, Ju does not see BTC slipping below $77,000 in the near term. He believes the worst-case scenario would be a prolonged consolidation at that level before prices regain upward momentum.

Bitcoin is currently trading at $85,000 after dropping 20% in just a week. The decline coincided with broader market uncertainty, including concerns over potential tariff wars and other macroeconomic risks.

“Even in the worst case, I see a high probability of consolidating around 77K for a few months before moving back up,” Ju noted. However, he also warned traders to avoid leveraged bets, as sudden market shifts could still trigger volatility.

Robert Kiyosaki Sees a Buying Opportunity

Amid Bitcoin’s recent dip, “Rich Dad Poor Dad” author Robert Kiyosaki remains unfazed. Instead of panic-selling, he has confirmed his intention to buy more, calling fiat currency “fake money.” He remains skeptical of traditional financial systems, including U.S. bonds and the country’s growing debt burden.

“I’ll trade fake money for gold, silver, and Bitcoin anytime they go on sale,” Kiyosaki stated. His confidence in Bitcoin aligns with many long-term believers who see the cryptocurrency as a hedge against inflation and economic instability.

Despite short-term price swings, Bitcoin’s long-term narrative remains intact. With institutional demand, key on-chain metrics, and investor sentiment all playing a role, the market’s next move could be crucial in determining if BTC will push higher or face further consolidation.

Short-Term Holders Face Crucial Moment

Bitcoin’s Short-Term Holder Spent Output Profit Ratio (STH-SOPR) is hovering near the 1.0 breakeven mark, according to a Feb. 24, 2025, report by Glassnode. Historically, crossing above 1.0 has signaled renewed bullish momentum, while falling below it has led to more selling pressure.

Source: Glassnode

Source: GlassnodeOver the past few months, this metric has fluctuated between 0.98 and 1.04, reflecting uncertainty among short-term investors. The last breakout in early January was short-lived, making the current level a major test. If BTC fails to push the ratio above 1.0, selling could intensify, driving prices lower.

Glassnode also highlighted that the STH-SOPR Multiple is currently in the red zone, meaning recent short-term holders have been selling at losses. This suggests stress in the market. If sentiment improves, Bitcoin could regain strength, but continued selling pressure may delay any major rally.

.png)

3 hours ago

2

3 hours ago

2

English (US)

English (US)