ARTICLE AD BOX

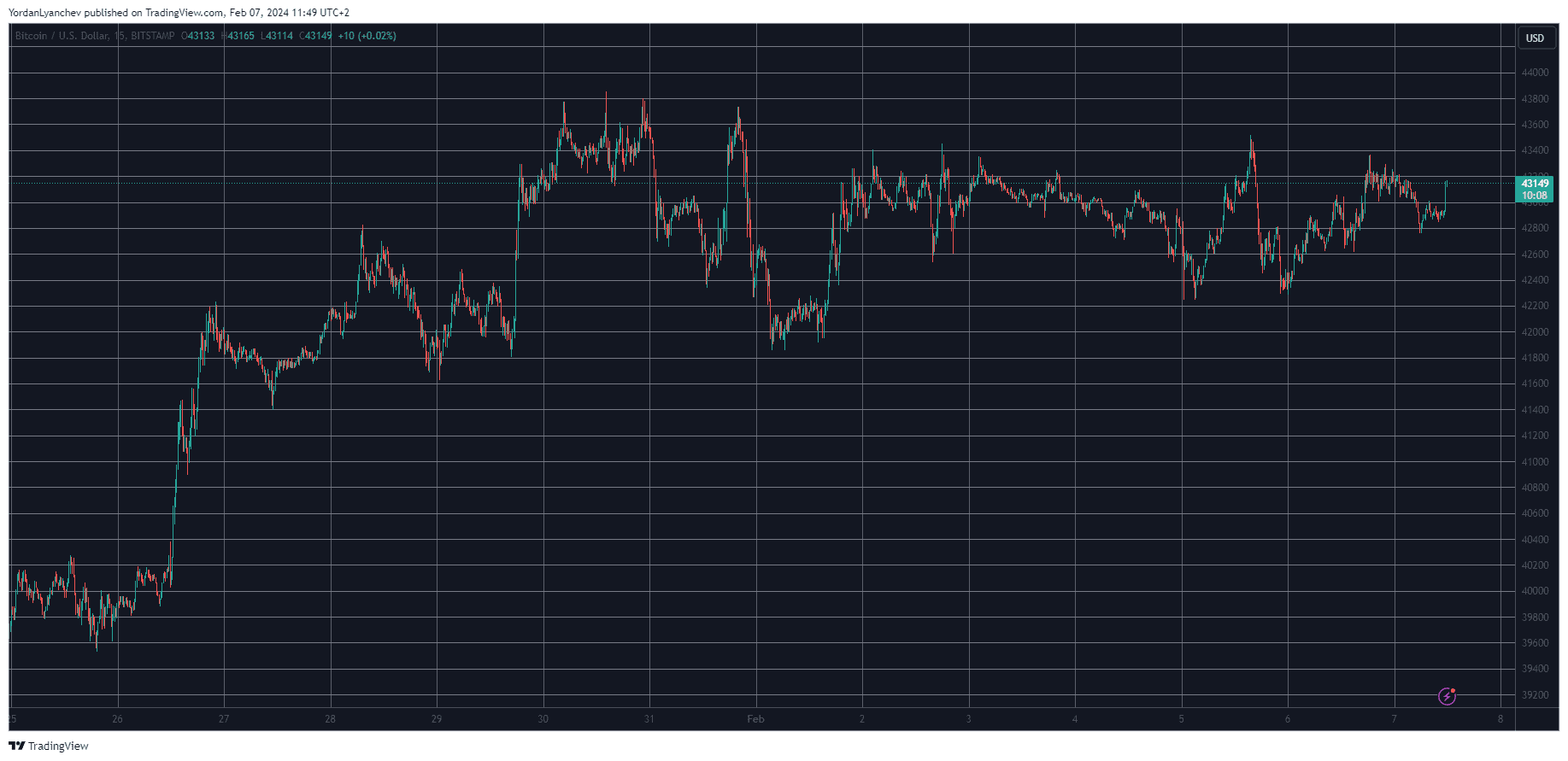

Bitcoin’s price movements continue in a very unimpressive fashion as the asset fails to move from its $43,000 level.

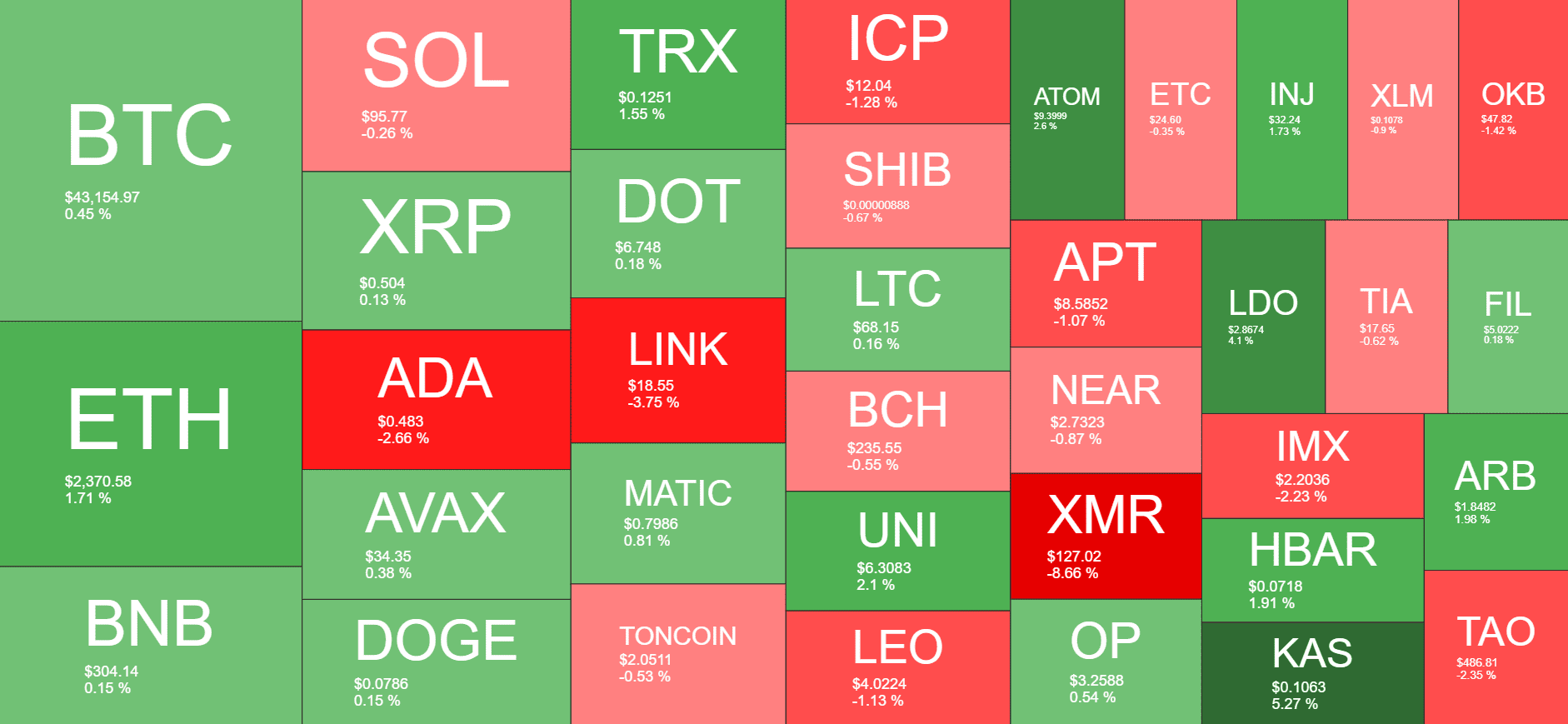

The altcoins are also quite sluggish, with ETH jumping by nearly 2% and LINK declining by more than 3%.

BTC Fails to Move

The primary cryptocurrency has shown little movement for the past several days and even weeks. In fact, the asset’s last major moves came in the middle of last week when it pumped to $43,750 on a few occasions but was rejected every time.

The last such rejection came on Thursday, and the asset plummeted by nearly two grand in hours. However, it managed to recover some ground when the weekend arrived and stood at $43,000. Since then, Bitcoin has failed to make any major moves, aside from a $1,000 pump and dump yesterday.

As of now, the cryptocurrency trades inches above $43,000. Its market capitalization has increased to just over $845 billion on CMC, and its dominance over the alts stands still at 51.2%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingViewXMR Plummets

Arguably, the most significant news from the altcoin space yesterday came when Binance announced the delisting of the privacy token Monero (XMR). As expected, the underlying asset dropped by double digits when the news came out. On a weekly scale, XMR is down by over 20% and sits just inches above $120.

The larger cap alts are a lot less volatile. ETH is among the best performers, having gained just under 2% and sitting close to $2,400. BNB, XRP, AVAX, DOGE, TRX, DOT, and MATIC are also slightly in the green.

In contrast, LINK and ADA have declined the most – by 4% and 3%, respectively. SOL and TON are with minor losses as well.

The total crypto market cap remains at $1.650 trillion on CMC for the third day in a row.

Cryptocurrency Market Overview. Source: Quantify Crypto

Cryptocurrency Market Overview. Source: Quantify CryptoThe post BTC’s Stagnation Continues, XMR Slumps Double Digits Following Binance Delisting (Market Watch) appeared first on CryptoPotato.

.png)

10 months ago

1

10 months ago

1

English (US)

English (US)