ARTICLE AD BOX

Friday is Bitcoin options expiry day with almost $1 billion in contracts poised to be settled or renewed. Crypto markets have been in retreat for most of the first week of the year but will this event move them upwards again?

Around 21,900 Bitcoin options contracts are set to expire on January 5, according to Deribit. The event is about a tenth of the size of last week’s whopping expiry event which was a year-ender.

Bitcoin Options Expiry Sparks Speculation

The notional value of today’s batch of Bitcoin contracts is around $955 million on options market leader Deribit.

The put/call ratio for this tranch is 0.62, meaning there are around half as many more call (long) contracts expiring than puts (shorts).

The max pain point remains around $43,000. However, there is still a lot of interest in the $50,000 strike price with 23,884 calls.

The fact that there is such a large concentration of call options at $50,000 suggests that traders are anticipating that BTC prices will rise by the end of the January expiration date.

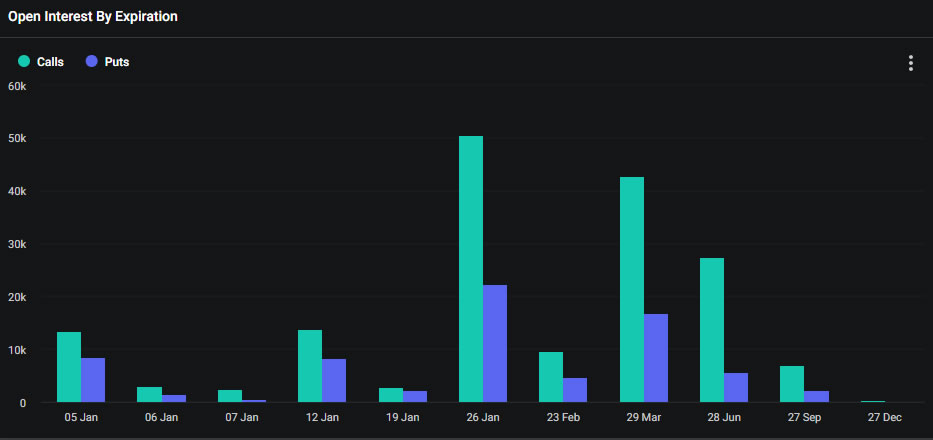

Bitcoin open interest by expiration. Source: Deribit

Bitcoin open interest by expiration. Source: DeribitTotal OI has fallen from last year’s record levels to around $10.7 billion, according to Deribit.

Earlier this week, Greeks Live commented on the market retreat on the possibility of the SEC rejecting spot Bitcoin ETFs next week.

It noted that options implied volatility plummeted to 52% for the week and below 65% for the January 12 expiration, before adding:

“Current month puts are now cheaper, and block trades are starting to see active put buying, with options market data suggesting that institutional investors are not very bullish on the ETF market.”

Read More: 9 Best AI Crypto Trading Bots to Maximize Your Profits

Ethereum Derivatives Outlook

Earlier this week, crypto markets tanked 5% in the latest leverage flush out. Around $700 million in liquidations occurred with 85% of them being calls dominated by Bitcoin positions.

In addition to the billion-dollar Bitcoin options expiry event, 255,245 million Ethereum contacts will also expire according to Deribit. The notional value of these options is $574 million, and the put/call ratio is 0.54.

Spot markets are flat on the day during Friday morning trading in Asia, with total capitalization remaining at yesterday’s level of $1.73 trillion.

It is unlikely that today’s expiring Bitcoin options will impact spot prices as all eyes remain on the ETF scene.

Best crypto platforms in Europe | January 2024

The post Can Almost $1B in Bitcoin Options Expiring Shift BTC Prices Higher? appeared first on BeInCrypto.

.png)

10 months ago

6

10 months ago

6

English (US)

English (US)