ARTICLE AD BOX

Bitcoin is undergoing a fascinating evolution, with various perspectives on its nature. Some view it as a currency for everyday transactions, others as a modern equivalent of gold for storing value, and yet others as a decentralized global platform for securing and validating off-chain transactions. While these views all hold some truth, Bitcoin is increasingly establishing itself as a digital base money.

Functioning akin to physical gold as a bearer asset, inflation hedge, and providing currency denominations like the dollar, Bitcoin is reshaping the concept of monetary base assets. Its transparent algorithm and fixed supply of 21 million units ensure a non-discretionary monetary policy. Contrastingly, traditional fiat currencies like the US dollar rely on centralized authorities to manage their supply, raising questions about their predictability and effectiveness in an age of volatility, uncertainty, complexity, and ambiguity (VUCA).

This contrast is particularly notable in light of Nobel laureate Friedrich August von Hayek's critique of centralized monetary decision-making in his work "The Pretense of Knowledge." Bitcoin's transparent and predictable monetary policy stands in stark contrast to the opaque and potentially unpredictable nature of traditional fiat currency management.

To Leverage, or Not to Leverage Bitcoin

For staunch Bitcoin proponents, the immutable 21 million supply cap is sacred. Altering it would fundamentally alter Bitcoin itself, making it something entirely different. Thus, within the Bitcoin community, skepticism towards leveraging Bitcoin is widespread. Many see any form of leverage as akin to fiat currency practices, undermining Bitcoin's core principles.

This skepticism towards leveraging Bitcoin is rooted in the distinction between commodity credit and circulation credit, as outlined by Ludwig von Mises. Commodity credit is based on real savings, whereas circulation credit lacks such backing, resembling unbacked IOUs. Bitcoiners view leveraging that creates “paper Bitcoin” as economically risky and destabilizing.

Even nuanced perspectives within the community are cautious about leveraging, aligning with figures like Caitlin Long, who has been warning against the dangers of leveraging Bitcoin. The collapse of leveraged-based Bitcoin lending companies in 2022, such as Celsius and BlockFi, further reinforced the concerns voiced by Long and others about the risks associated with leveraging Bitcoin.

Celsius and Co. Proved the Point

The crypto market witnessed a significant upheaval reminiscent of the Lehman Brothers collapse in 2022, triggering a widespread credit crunch that affected various players in the crypto lending sector. Contrary to assumptions, most crypto lending activities were not peer-to-peer and carried considerable counterparty risks, as customers lent directly to platforms, which then deployed these funds into speculative strategies without adequate risk management.

It was the rise of major DeFi protocols during the DeFi summer of 2020 that offered promising avenues for yield generation. However, many of these protocols lacked sustainable business models and tokenomics. They relied heavily on protocol token inflation to sustain attractive yields, resulting in an unsustainable ecosystem disconnected from fundamental economic principles.

The 2022 crypto credit crunch highlighted various issues with centralized yield instruments, emphasizing concerns about transparency, trust, and risks such as liquidity, market, and counterparty risks. Moreover, it underscored the pitfalls of centralization and off-chain risk management processes, which, when applied to blockchain-based “banking services,” mimic traditional banking flaws.

So despite the optimism surrounding the bull market of 2020/21, many institutions due to the lack of these processes, including Voyager, Three Arrows Capital, Celsius, BlockFi, and FTX, went under. The inability to implement necessary checks and balances transparently and independently often leads to over-regulation and recurrent failures and fraud, mirroring the historical challenges of traditional banking systems. However, the absence of regulation is not a solution either

Bitcoin-based Yield is not Optional

Where does this leave us? Given this 2022 episode, more and more Bitcoiner have been posting the question: Should we embrace Bitcoin yield products, or do they pose too great a risk, echoing characteristics of the fiat system? While valid concerns exist, it's unrealistic to expect Bitcoin-based yield products to vanish entirely.

The question is becoming all the more prevalent with the newly emerging Bitcoin ecosystem. Increasingly projects are building (or are claiming) to build out financial infrastructure as well as applications on Bitcoin directly. Could this create the same issues again we already witnessed in the wider crypto sphere?

Most likely yes. That is just the nature of the game. And since Bitcoin is a permissionless protocol, everyone can build on top of it, including the people who want to build Bitcoin-powered finance. And finance will inevitably need credit and leverage.

This is a historical fact: In any thriving society, the necessity for credit and yield naturally arises, serving as a catalyst for economic growth. Without credit, underdeveloped economies struggle to escape the confines of subsistence living. It's only through access to credit that a more sophisticated and productive economic structure can emerge.

To realize the vision of a Bitcoin-based economy, proponents recognize the need for credit and yield mechanisms to develop atop the Bitcoin protocol. While Bitcoin's role as a form of money is often lauded, the reality is that for it to function effectively as a currency, it requires a native economy to support it.

This underscores the importance of Bitcoin-based yield products in fostering the growth of a robust Bitcoin-centric economy. Such an ecosystem would leverage Bitcoin as its digital base money while utilizing yield products to drive adoption and utilization.

It’s All a Trust Spectrum, Anon

Bitcoin-powered finance will necessarily be built in layers. From a system’s point of view, this isn’t much different from today’s financial system, where there is an inherent hierarchy in money-like assets. To properly understand the inevitable trade-offs that come with this, it is important to have a high-level framework to distinguish the different implementations of Bitcoin residing on different layers.

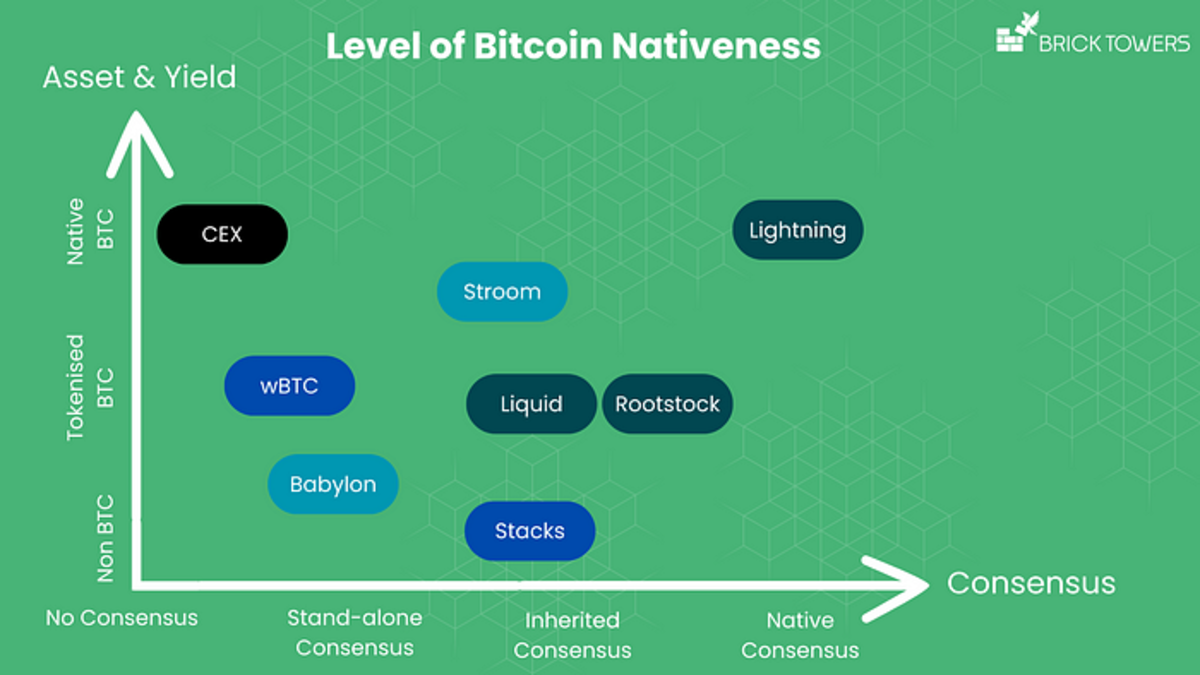

When it comes to offering yield on Bitcoin, it is essential to understand that options can be built along a three-folded trust spectrum. The primary aspects to look at are:

- Consensus

- Asset

- Yield

Assessing Bitcoin-like assets and Bitcoin yield products based on their degree of Bitcoin nativeness provides a valuable framework for evaluating their alignment with Bitcoin's ethos. Assets and products scoring higher on this spectrum are typically more trust-minimized, reducing reliance on intermediaries in favor of transparent and resilient code.

This shift mitigates counterparty risks, as reliance transitions from off-chain intermediaries to code. The code's transparency enhances resilience compared to intermediaries that have to be trusted.

This is a progression worth exploring, and creating options for a native yield on Bitcoin should be the gold standard and the ultimate goal of the Bitcoin community.

Consensus Angle

This assessment categorizes Bitcoin yield products based on their alignment with the Bitcoin blockchain's consensus, distinguishing between four categories.

- No Consensus: This category represents centralized platforms where the base infrastructure remains off-chain. Examples include centralized platforms like Celsius or BlockFi, which hold full custody over users' assets, exposing them to counterparty risks and dependency on intermediaries. While these platforms utilize Bitcoin, their yield strategies are primarily executed off-chain through traditional finance mechanisms. Despite being a step towards Bitcoin adoption, these platforms remain highly centralized, resembling traditional financial institutions, yet often unregulated in contrast.

- Standalone Consensus: In this category, the base infrastructure is decentralized, represented by public blockchains such as Ethereum, BNB Chain, Solana, and others. These blockchains have their own consensus mechanisms independent of Bitcoin's and are not explicitly tied to Bitcoin's consensus.

- Inherited Consensus: Here, the base infrastructure is decentralized, represented by Bitcoin sidechains or Layer-2 solutions with distributed consensus. While these sidechains have their own consensus mechanisms, they aim to align more closely with Bitcoin's blockchain. Examples include federated sidechains like Rootstock, Liquid Network or Stacks.

- Native Consensus: This category relies on Bitcoin's native consensus mechanism as the underlying security model. Instead of a separate blockchain or sidechain, it utilizes off-chain state channels cryptographically linked to the Bitcoin blockchain. The Lightning Network is a prime example of this approach, offering a high level of trust-minimization by fully relying on Bitcoin's consensus.

The closer a Bitcoin yield product is to Bitcoin's native consensus, the more aligned it is with Bitcoin and generally the more trust-minimized it is perceived to be. However, nuances exist within the standalone and inherited consensus categories, where the level of decentralization and security of the underlying infrastructure varies.

Overall, while no consensus yields the lowest level of decentralization and trust-minimization, native consensus is believed to offer the highest level of trust-minimization, although considerations of consensus security and decentralization require further analysis.

Source: Brick Towers

Source: Brick Towers

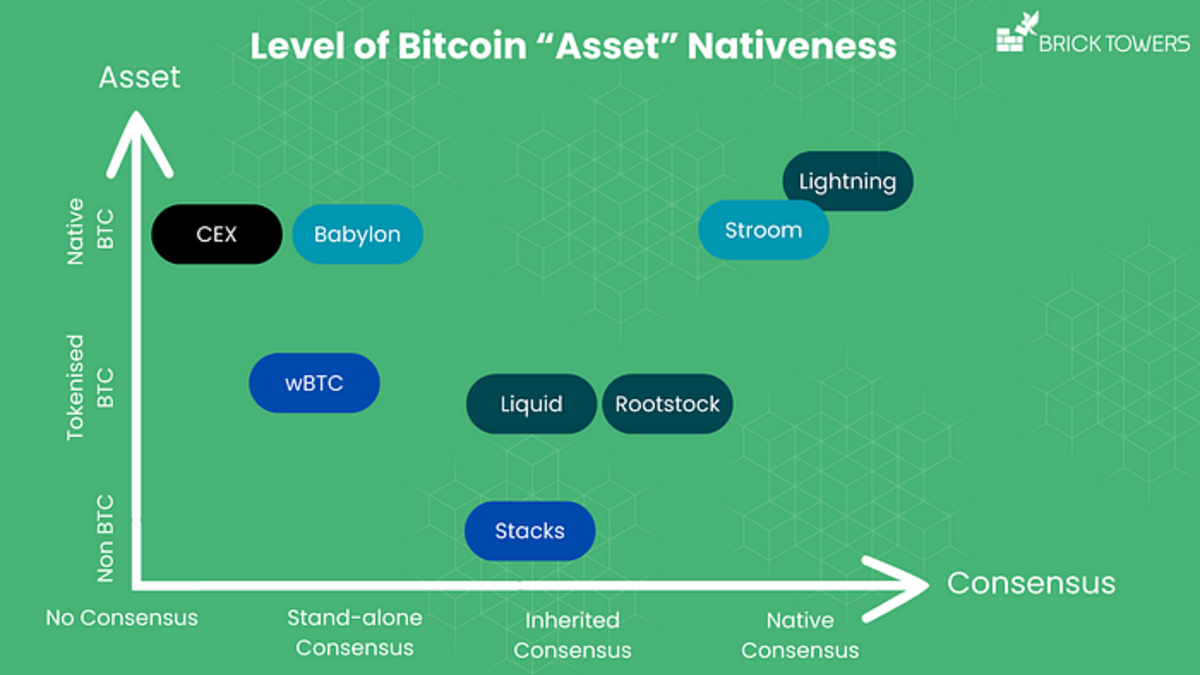

Asset Angle

When considering the asset used by Bitcoin yield products, alignment with Bitcoin (BTC) can be categorized into three main groups.

- Non-BTC: This category includes solutions that use assets other than BTC, which results in a low level of alignment with Bitcoin. An example is Stack's stacking option, where Stack's native coin STX is used to generate a yield in BTC.

- Tokenized BTC: Here, the asset used is a tokenized version of BTC, increasing alignment with Bitcoin compared to non-BTC assets. Tokenized BTC can be found on public blockchains like Ethereum (WBTC, renBTC, tBTC), BNB Chain (wBTC), Solana (tBTC), and others. Additionally, tokenized BTC is hosted on Bitcoin sidechains with inherited consensus mechanisms, such as sBTC, XBTC, aBTC, L-BTC, and RBTC.

- Native BTC: This category features assets that are on-chain Bitcoin (BTC) without any tokenized versions involved, offering the highest level of alignment with Bitcoin. Various CEX solutions and Babylon's Bitcoin staking protocol utilize BTC directly. Babylon aims to scale Bitcoin's security by adapting Proof-of-Stake mechanisms for Bitcoin staking. Furthermore, projects like Stroom Network leverage the Lightning Network to enable Liquid Staking, where users can earn Lightning Network revenue by depositing BTC and minting wrapped tokens like stBTC and bstBTC on EVM-based blockchains for use in the wider DeFi ecosystem.

Source: Brick Towers

Source: Brick Towers

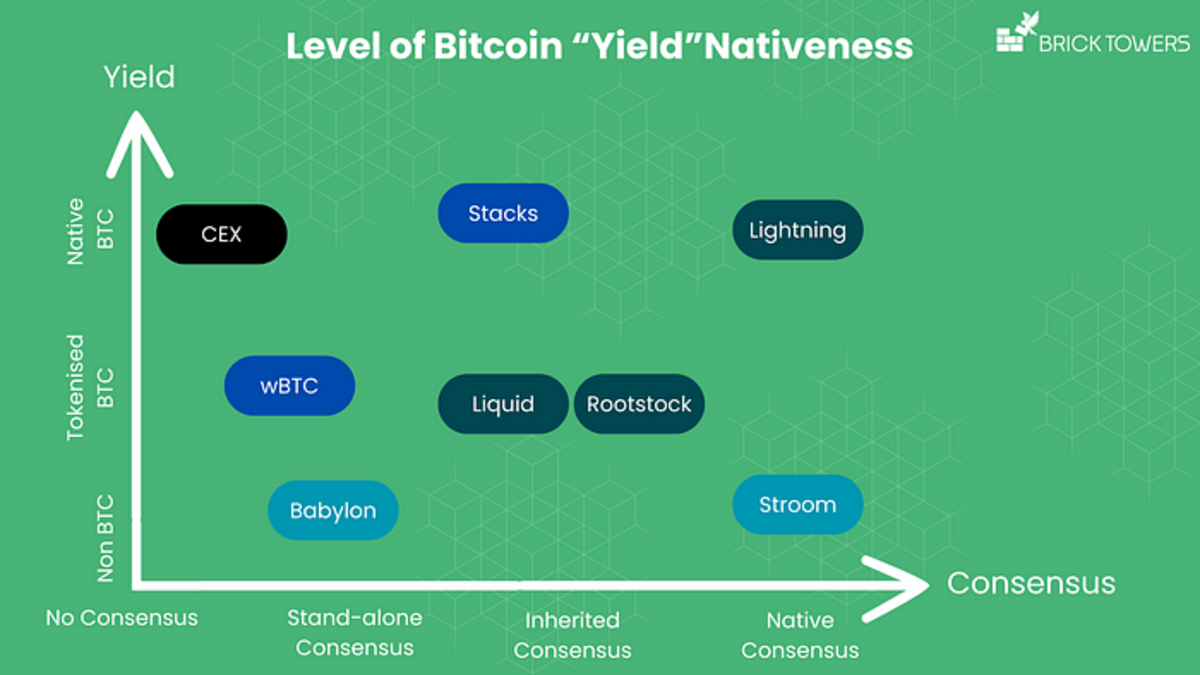

Yield Angle

When examining the yield side of Bitcoin yield products, the question of Bitcoin alignment also arises, leading to similar categorizations as with the asset side: non-BTC, tokenized BTC, and native BTC.

- Non-BTC Yield: Babylon offers yields in the native asset of the Proof-of-Stake (PoS) blockchain, enhancing the blockchain's security through Babylon's staking mechanism.

- Tokenized BTC Yield: Stroom Network provides yields in the form of lnBTC tokens. Sovryn, operating on Rootstock, facilitates lending and borrowing on Bitcoin using tokenized BTC (RBTC) as yield. On the Liquid Network, the Blockstream Mining Note (BMN) offers yields in BTC or L-BTC at maturity, providing qualified investors access to Bitcoin hashrate through an EU-compliant security token in USDT.

- Native BTC Yield: Stacks offers various options, including yields paid out in tokenized BTC for some yield applications utilizing sBTC. However, for Stacks' stacking option, yields accrue in native BTC. Similarly, centralized yield products provided by certain CEXs deliver native BTC as yield to users.

Source: Brick Towers

Source: Brick Towers

Bitcoin’s Gold Standard: Native All the Way Through

Contemplating the ideal Bitcoin-based yield product, the gold standard product would combine the following three attributes: Native Bitcoin consensus, native Bitcoin asset and native Bitcoin yield. Such a product would mimic near-perfect Bitcoin alignment.

As of now, such solutions are only just being built. One such project in active development is Brick Towers. Their vision for the ideal Bitcoin-based yield product embodies near-perfect Bitcoin alignment by incorporating native Bitcoin consensus, asset, and yield. With a focus on Bitcoin as a long-term savings solution, Brick Towers aims to provide customers with a trust-minimized and native approach to utilizing Bitcoin.

Their planned solution revolves around generating a native yield in Bitcoin, leveraging Brick Towers' automation service for other nodes within the Lightning Network. Through an optimization algorithm solving for economic utility, capital is strategically deployed to meet the liquidity demands of other network participants, optimizing capital efficiency while minimizing counterparty risks.

This approach not only fosters the growth of the Lightning Network but also enhances Bitcoin's utility as an asset, all while providing customers with a seamless and secure means of earning yield on their Bitcoin holdings. Importantly, Brick Towers' solution avoids the use of wrapped coins, further reducing counterparty risks and reinforcing their commitment to Bitcoin's native ecosystem.

This article was researched and written by Pascal Hügli in collaboration with Brick Towers. Hügli is a dedicated Bitcoin analyst and researcher, deeply immersed in all facets of the Bitcoin ecosystem. He has been studying the development of a proper and robust Bitcoin-based financial system for years. This article has originally been published in a longer form version here.

This is a guest post by Pascal Hügli. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

.png)

5 months ago

4

5 months ago

4

English (US)

English (US)