ARTICLE AD BOX

The Cardano (ADA) price has been inches away from cementing its gains over the past few weeks. However, considering the current circumstances, ADA holders might lose hope for further increases.

The question remains – Would Cardano be able to stay afloat, or will investors be the cause of its decline?

Cardano Holders Must Hold Back

Cardano is noting a slowdown in its rally after charting a rally near 60% since the end of January this year. The third-generation cryptocurrency is struggling to breach a crucial resistance level of $0.76 after failing to break through it once.

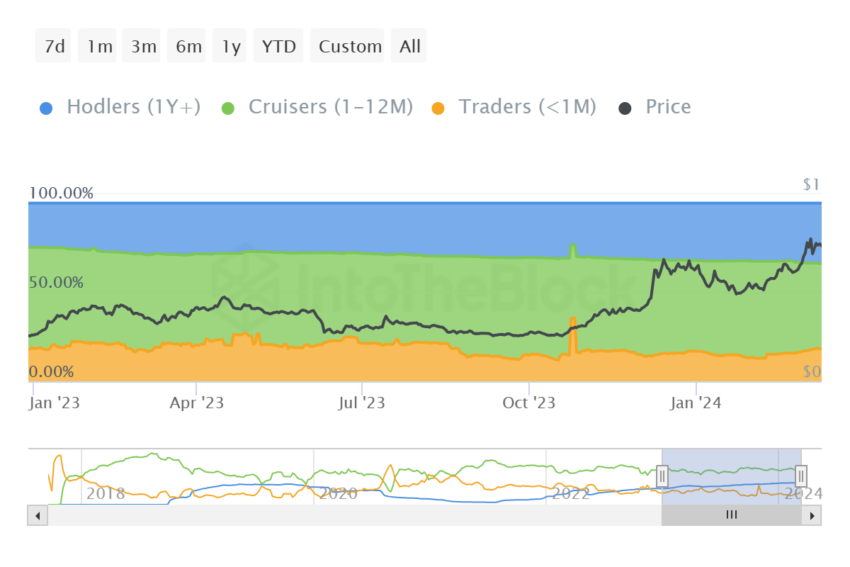

To add to this bearishness are the investors exhibiting increasingly negative signals. The supply distribution, which was mostly concentrated among the mid-term holders (addresses holding their assets between one and 12 months), is changing hands.

In particular, short-term traders have seen a surge in the concentration of ADA they hold. These investors known to hold their tokens for less than a month usually buy and sell rapidly, making the price susceptible to volatility.

In the case of ADA, their holdings have risen by 12.9% to 18.4% in the past month. This makes Cardano vulnerable to potential selling at their hands. Furthermore, whale transactions have also noted a considerable increase.

Cardano Supply Distribution. Source: IntoTheBlock

Cardano Supply Distribution. Source: IntoTheBlockDespite holding less than 9% of the entire circulating supply of Cardano, these whales account for about 90% of the total transactions taking place on-chain. Over the past week, total transactions reached $30 billion, whereas whale transactions reached $25 billion.

Cardano Whale Transactions. Source: IntoTheBlock

Cardano Whale Transactions. Source: IntoTheBlockTheir spiking interest suggests that there is a chance that these whales might also be looking to secure their profits before Cardano’s price begins declining.

Cardano Price Prediction: ADA Still Has a Chance at Comeback

Cardano’s price has slowed, and all indications suggest a price decline is likely. The altcoin has been testing the local resistance of $0.74 for the past week and is still unable to breach through.

If it fails to push past the barrier, it will probably return to $0.68 or fall to test $0.63 as a support floor.

ADA/USDT 1-day chart | Source: Tradingview

ADA/USDT 1-day chart | Source: TradingviewHowever, the Relative Strength Index (RSI) is still in the bullish-neutral zone. This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

Thus, as long as Cardano is above the neutral line marked at 50.0, ADA can recover. A breach of $0.74 would ascertain recovery, and a flip above $0.76 into support would invalidate the bearish thesis.

The post Can Cardano (ADA) Sustain Its Rally Amid Bearish Signals? appeared first on BeInCrypto.

.png)

8 months ago

2

8 months ago

2

English (US)

English (US)