ARTICLE AD BOX

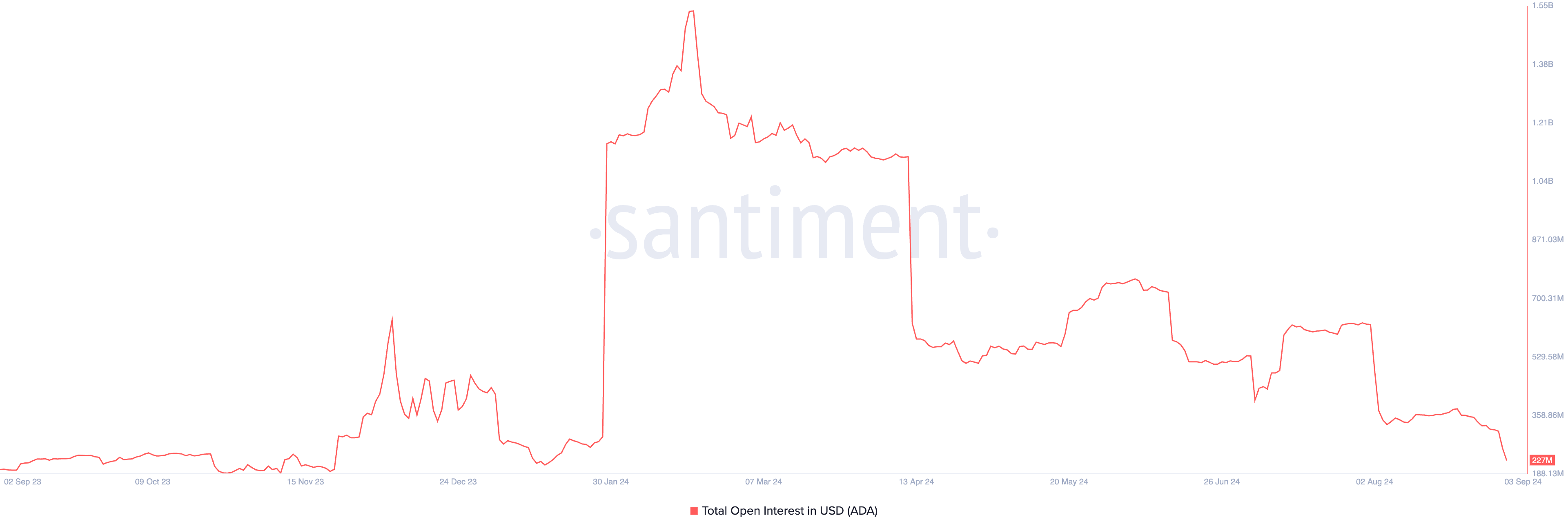

Cardano’s (ADA) open interest began a new downward trend on August 1, plummeting by 63% since then. Currently sitting at $227 million, the metric has reached its lowest point since January.

Recent on-chain data shows a surge in short positions, reflecting a growing bearish sentiment around the altcoin.

Cardano Futures Traders Exit the Market

Open interest measures the total number of outstanding futures or options contracts that remain unsettled or open. A decline in open interest suggests that traders are closing out their positions, indicating fewer active contracts in the market and a reduction in overall trading activity.

Currently, ADA’s open interest stands at $227 million, a level last seen on January 13.

Cardano Open Interest. Source: Santiment

Cardano Open Interest. Source: SantimentAlthough the decline in ADA’s open interest began on August 1, futures traders initially maintained a bullish outlook, continuing to demand long positions. This was reflected in ADA’s positive funding rate between August 1 and 30.

However, as ADA’s value continued to drop, traders shifted their strategy. So far this month, ADA’s funding rate has turned consistently negative, showing a strong demand for short positions.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

Cardano Funding Rate. Source: Santiment

Cardano Funding Rate. Source: SantimentFunding rates in perpetual futures contracts help keep the contract price aligned with the spot price. When an asset’s funding rate is negative, it means more traders expect the price to fall than those anticipating a rise. As of now, ADA’s funding rate is -0.013%, signaling bearish sentiment.

ADA Price Prediction: Traders Await Catalyst

At press time, ADA is trading at $0.33. The coin’s flat relative strength index (RSI) indicates a balance between buying and selling pressure over the past few days. A flat RSI suggests a period of market indecision or consolidation.

This is further confirmed by ADA’s declining Average True Range (ATR), an indicator that measures price volatility over a specified period. A falling ATR value signals decreased market volatility, meaning that daily price movements are shrinking, and the market is experiencing fewer price swings.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

Cardano Price Analysis. Source: TradingView

Cardano Price Analysis. Source: TradingViewAs the market awaits a catalyst, a surge in bullish momentum driven by increased demand for ADA could push its price toward $0.39. However, if bearish pressure gains, the altcoin’s price may plummet to its August 5 low of $0.27.

The post Cardano (ADA) Open Interest Hits Nine-Month Low: What’s Next appeared first on BeInCrypto.

.png)

2 months ago

1

2 months ago

1

English (US)

English (US)