ARTICLE AD BOX

- Ark Invest’s Tactical Moves: Ark Invest’s decision to offload Coinbase and Robinhood shares indicates a strategic response to the evolving market conditions influenced by the approval of spot Bitcoin ETFs.

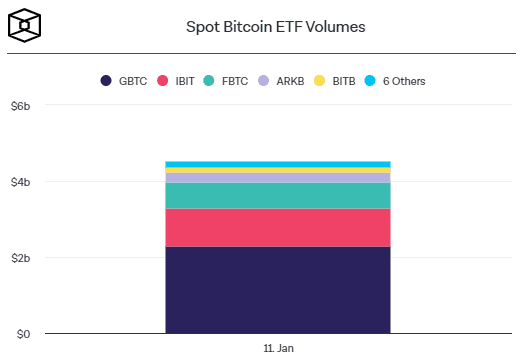

- Bitcoin ETF Impact: The sell-off in Coinbase and Robinhood shares underscores the immediate impact of regulatory decisions on key players in the crypto and trading sectors. As Bitcoin ETFs gain traction, their influence on market dynamics becomes increasingly evident.

Cathie Wood’s Ark Invest made notable moves in the market as it shed $4.4 million in Coinbase shares and nearly $4.3 million in Robinhood shares on Thursday. The sell-off coincided with both stocks experiencing a dip at the market close.

Bitcoin ETF Impact:

As the news of the U.S. approval of spot Bitcoin ETFs broke on Thursday, investors grappled with the implications. Coinbase, a crypto custodian for several of these ETFs, and Robinhood offering spot Bitcoin ETFs for clients saw a decline in their stock prices. Coinbase shares closed 6.7% lower at $141.16, while Robinhood ended the day down by 3.5% at $11.71.

Source: The Block

Source: The BlockArk Invest’s Trades:

Ark Innovation ETF, managed by Cathie Wood’s firm, executed strategic moves by selling 26,301 shares of Coinbase Global Inc. and 341,592 shares of Robinhood Markets Inc. The ARK Next Generation Internet ETF also participated in the sell-off by offloading 4,980 Coinbase shares and 23,838 Robinhood shares on the same day.

Bitcoin ETF Buzz Creates Ripples: Impact on Coinbase and Robinhood

The buzz around the U.S. approval of spot Bitcoin ETFs resonated across the market, influencing the decisions of major players like Ark Invest. As investors digested the news, Coinbase and Robinhood, significant players in the crypto and trading space, faced downward pressure on their stock prices. This sell-off by Ark Invest adds an intriguing layer to the evolving narrative of the impact of Bitcoin ETFs on key market players.

Also Read: Whale Alert: Ethereum Transfers Worth $136 Million to Binance, Coinbase

Market Dynamics on Display: Coinbase, Robinhood, and the Bitcoin ETF Surge

The dynamics of the market were vividly displayed as Coinbase and Robinhood reacted to the surge in Bitcoin ETFs. While Ark Invest took measures to trim its holdings, the broader market sentiment was influenced by the approval of spot Bitcoin ETFs.

Understanding the interplay between major investment firms, key stocks, and the larger cryptocurrency market provides insights into the evolving landscape shaped by regulatory decisions and investor sentiments.

.png)

10 months ago

5

10 months ago

5

English (US)

English (US)