ARTICLE AD BOX

- CEX saw a 19-22% drop in trading volumes in September 2024, reflecting seasonal and macroeconomic challenges.

- Crypto.com gained market share with increased trading activity, while KuCoin, Coinbase, and BitMart faced steep declines.

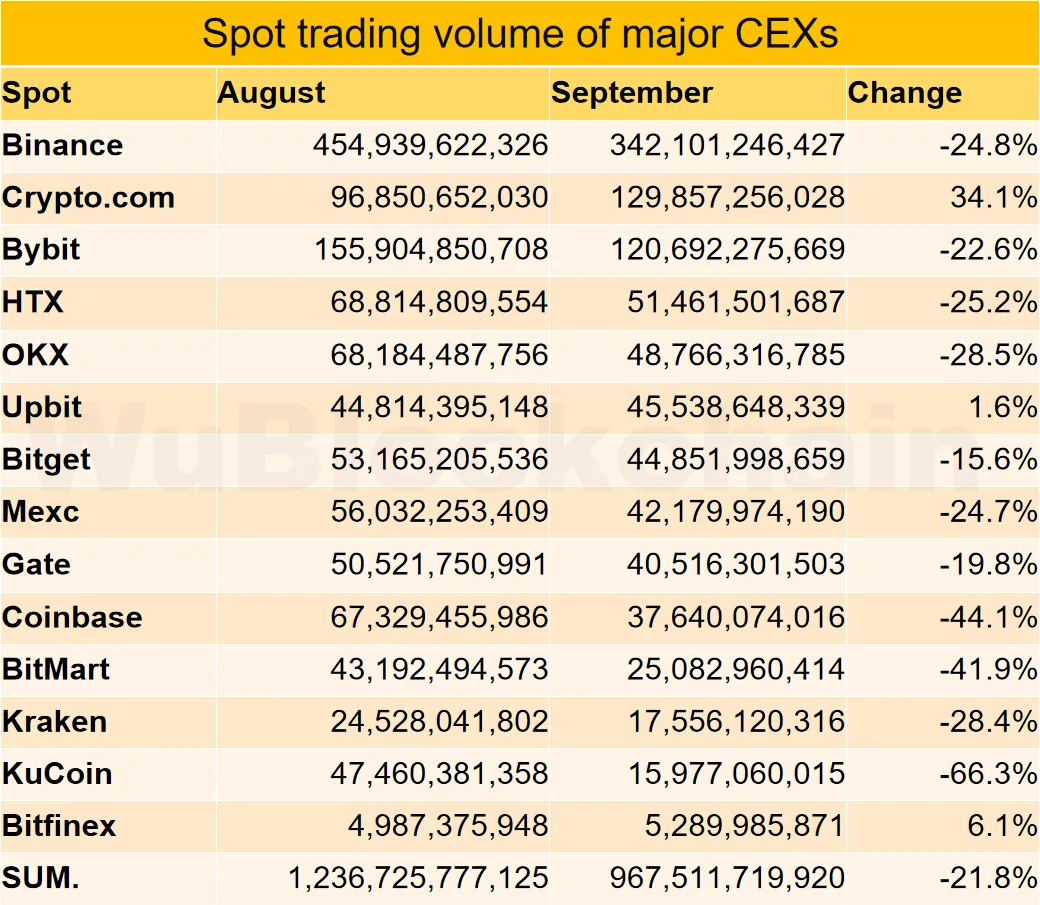

The centralized crypto exchange (CEX) sector saw substantial difficulties in September 2024 since the aggregate spot trading volume across main platforms dropped by roughly 19–22% compared to the month before. Reflecting a larger trend of lower activity in the sector, this decline represented the lowest trade levels since late 2023.

Some exchanges, including Binance, saw significant drops in spot and futures trades. With a spot volume of about 22.9%, Binance dropped $344 billion; its derivatives trading followed a similar declining trend. Binance’s market share fell to its lowest level since 2020, therefore underscoring the challenges larger competitors in the sector face.

Mixed Outcomes Amid Market Downturn: Crypto.com Defies the Trend

Not all interactions, meanwhile, were equally impacted. On several platforms, the general decreasing trend was broken. With growth rates of 34% and 42.8% respectively, Crypto.com, for example, noticed an amazing increase in both spot and futures trading volumes.

Source: Wublock

Source: Wublock

By trading volume, this increase in activity enabled Crypto.com to land the fourth-largest centralized exchange position. The strategic emphasis of the exchange on onboarding new institutional clients and aiming at sophisticated retail traders explains its better market share.

With growth rates of 6% and 2%, respectively, Bitfinex and Upbit also showed significant momentum, therefore adding complications to the generally difficult market conditions.

For some interactions, the circumstances were significantly less favorable. Among the worst affected were KuCoin, Coinbase, and BitMart; trade volumes dropped 66%, 44%, and 42%, respectively. These sharp drops highlight how differently market dynamics affect various platforms.

Analysts cite a number of elements, including macroeconomic uncertainties and seasonal influences, that might be driving the general drop in trading activity. The term “sell in May and go away” has been mentioned as a possible reason since many traders usually cut their market exposure throughout the summer months, into September.

Further sapping market enthusiasm is investor caution amid world geopolitical concerns, especially in the run-up to the U.S. elections.

Federal Reserve’s Policies and the Rise of Decentralized Exchanges Shape Market Dynamics

Furthermore, greatly influencing market attitude have been the monetary policies of the Federal Reserve. Many investors have taken a wait-and-see attitude, hoping for more favorable market conditions even if interest rate decreases are much awaited.

For many centralized exchanges, which still struggle with limited liquidity and smaller trade volumes, these elements taken together create a difficult situation. With an 8.4% increase in September, Bitcoin exhibited strength, although trading volumes on several big platforms remained low, implying that market players were cautious to significantly re-enter the market.

The slump in trade activity extended beyond the spot markets. With global derivatives volume dropping by 16.9% to $3.07 trillion, derivatives trading on certain markets also suffered.

With combined trading volumes reaching the lowest monthly levels since mid-2023, the simultaneous drop in spot and derivatives trading helped to cause an overall fall in CEX market performance. On a possible comeback in the last quarter of the year, analysts are still wary nonetheless.

According to historical data, especially as significant economic stimulus like interest rate changes play effect, the fourth quarter usually sees higher trade volumes.

The emergence of decentralized exchanges (DEXs) gives the problems CEXs face still another level of complexity. Driven by traders who want distributed setups for their pseudo-anonymity and security characteristics, DEX platforms have seen a consistent increase in market share while CEX volumes have dropped.

This tendency reflects in part a response to the shortcomings of several centralized systems in recent years, which drove a change to distributed alternatives.

DeXs have also profited from providing access to a wider spectrum of assets, which occasionally are not accessible on centralized exchanges. The inclination of some traders for decentralized solutions has added to the continuous pressure on CEX volumes.

Potential for Recovery as Economic Policies Shift

Some market experts believe that as global monetary policy develops, the scene might change despite the present difficulties. The Federal Reserve’s mid-September 2024 interest rate cut could enhance market activity and hence inspire additional money flow into riskier assets, including cryptocurrency.

Historically, interest rate reductions have been linked to more liquidity, which could revive trading activity in the cryptocurrency market. Many thus expect a comeback in trading volumes in the months before the end of the year, particularly if the general state of the economy starts to fit risk-taking.

On the other hand, new breakthroughs in the crypto sector can affect the dynamics among several exchanges. For instance, as we previously noted, it has been said that between October 15 and October 18, 2024, Binance would assist Orion Protocol with switching to its new Lumia blockchain.

Users tokens will be swapped to LUMIA at a 1:1 ratio during the upgrade; ORN trading pairs will be deleted as part of this change.

This action marks Binance’s ongoing contribution to enable important blockchain transitions despite more general market difficulties. Such advancements can affect market mood and maybe modify the competitive environment among cryptocurrency exchanges as the year goes on.

.png)

4 weeks ago

2

4 weeks ago

2

English (US)

English (US)