ARTICLE AD BOX

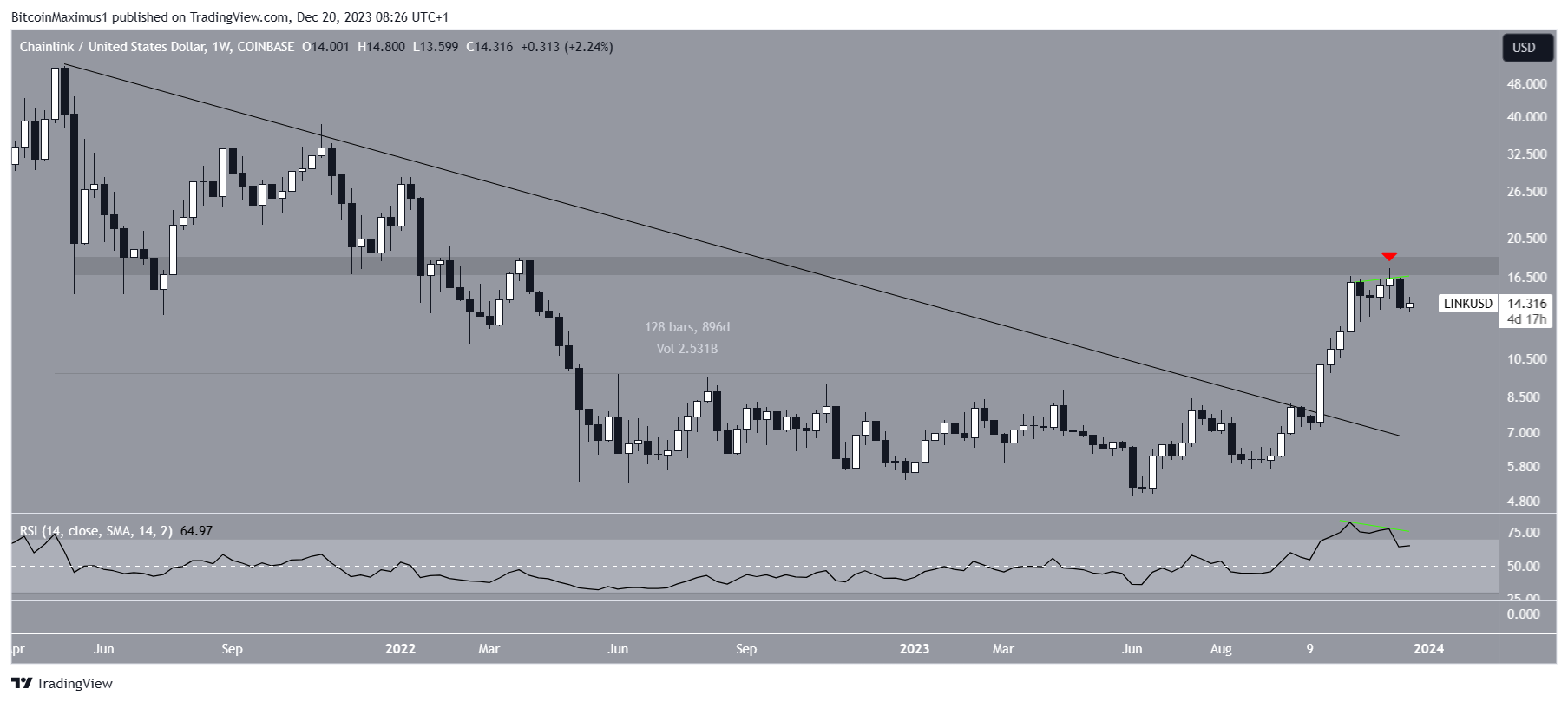

The Chainlink (LINK) price has decreased since its yearly high of $17.30 on December 9.

This is LINK’s first sign of weakness since the price broke out from a long-term descending resistance trend line. Can LINK regain its footing before the end of the year?

Chainlink Creates Bearish Engulfing Candlestick

The LINK price has increased since June, when it traded at a low of $4.90. The increase accelerated in September, and the price broke out from a long-term descending resistance trend line the next month. At the time of the breakout, the trend line had been in place for almost 900 days.

The increase accelerated afterward, and the LINK price reached a new yearly high of $17.30 two weeks ago. However, it has fallen since and created a bearish engulfing candlestick last week, the first such candlestick since August.

The decrease validated a long-term horizontal resistance area.

LINK/USDT Weekly Chart. Source: TradingView

LINK/USDT Weekly Chart. Source: TradingViewWhen evaluating market conditions, traders use the RSI as a momentum indicator to determine whether a market is overbought or oversold and whether to accumulate or sell an asset. If the RSI reading is above 50 and the trend is upward, bulls still have an advantage, but if the reading is below 50, the opposite is true.

The RSI shows signs of weakness since it is falling and has generated bearish divergence (green).

Read More: How to Buy Chainlink With a Credit Card

LINK Price Prediction: Is the Bottom In?

Utilizing the Elliott Wave theory, technical analysts examine long-term price patterns and investor psychology that recur to determine the direction of a trend.

The most likely wave count suggests that LINK completed a five-wave upward movement that began in June. The bearish divergence that developed in November indicates the upward movement is complete.

Read More: What is Chainlink (LINK)?

Despite this LINK price weakness, cryptocurrency trader The CryptoBull is bullish on the long-term trend. He tweeted:

If you’re emotional about $LINK price, simply put a sell order at $250, delete related apps, enjoy life, come back in 1-2 year tops. Profit.

Steve is also bullish because the Grayscale Chainlink Trust currently trades near $50, and he believes the price will follow.

In any case, if the count is correct, LINK has begun an A-B-C corrective structure (white). The first potential target for the bottom of this movement is at $12.50, 12% below the current price, while the second is at $11.05, 23% below the price.

The targets are found by the 0.382 and 0.5 Fib retracement support levels, respectively.

LINK/USDT Daily Chart. Source: TradingView

LINK/USDT Daily Chart. Source: TradingViewDespite this bearish short-term LINK price prediction, increasing above the yearly high of $17.30 will mean the upward movement is ongoing. The LINK price could increase by nearly 40% to the next resistance at $20.

For BeInCrypto‘s latest crypto market analysis, click here

The post Chainlink (LINK) Price Gives First Bearish Signs Since August – What’s Next? appeared first on BeInCrypto.

.png)

1 year ago

11

1 year ago

11

English (US)

English (US)