ARTICLE AD BOX

Chainlink has recently experienced a significant price increase, jumping from $13 to $17.

This analysis delves into the factors driving this impressive rise. Focusing on the spike in on-chain activity and Bitcoin’s concurrent rally.

Chainlink Bullish Outlook Backed by Key Levels

On the daily timeframe, Chainlink has tested the upper boundary of the Ichimoku cloud, which is currently around the $17.41 mark. This test suggests a strong resistance level. A successful break above this boundary could indicate further bullish momentum.

The Ichimoku Cloud is a tool used in technical analysis to help identify trends in the market. Here’s a simple breakdown:

Cloud: The shaded area on the chart shows potential support and resistance levels.

When the price is above the cloud, it suggests an upward trend (bullish). When the price is below the cloud, it suggests a downward trend (bearish).

Lines: There are several lines in the Ichimoku Cloud:

Conversion Line (Tenkan): Shows the average price over the last 9 periods (candles).

Base Line (Kijun): Shows the average price over the last 26 periods (candles).

Leading Span A and B: These form the cloud and project future support and resistance levels.

Read More: How To Buy Chainlink (LINK) and Everything You Need To Know

LINK/USDT (1D). Source: TradingView

LINK/USDT (1D). Source: TradingViewChainlink has retraced to the Fibonacci levels, with significant support observed at $16.41 (0.236), $15.525 (0.382 level), and $14.09 (0.618 level). Holding above these levels, especially the $15.525 support, will maintain the bullish outlook.

Chainlink vs Bitcoin: LINK Price Expected to Climb Against BTC

Additionally, LINK/BTC on the daily timeframe has just entered the Ichimoku cloud, signaling a potential upward trajectory. The entry into the cloud is often a precursor to a price increase, suggesting that LINK could see further gains against Bitcoin.

LINK/BTC (1D): TradingView

LINK/BTC (1D): TradingViewOn the 4-hour timeframe, LINK is trading above the Ichimoku cloud against Bitcoin and is currently testing its upper boundary. If LINK can maintain this position, it supports the bullish outlook. However, if LINK fails to hold above this level and breaks downward, it could change the market sentiment.

LINK/BTC (4H). Source: TradingView

LINK/BTC (4H). Source: TradingViewThe bullish scenario becomes more favorable considering Bitcoin’s potential rise to $73,000. If Bitcoin continues its upward trend, LINK could potentially trade back at $19 in the mid-term.

Overall, the technical indicators and key support/resistance levels suggest a strong bullish potential for Chainlink, provided it can hold above critical levels and capitalize on Bitcoin’s upward momentum.

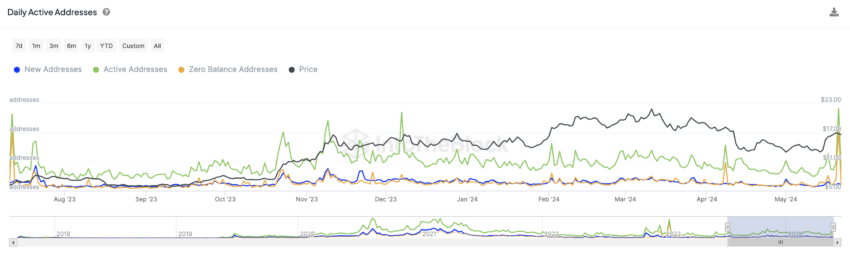

LINK Daily Active Addresses. Source: IntoTheBlock

LINK Daily Active Addresses. Source: IntoTheBlockThe recent spike in on-chain activity for Chainlink has helped propel its price from $13 to $17. This surge in activity is evident in the sharp increase in daily active addresses, as shown in the chart.

The green line representing active addresses has notably spiked, indicating heightened network usage and engagement.

Read More: Chainlink (LINK) Price Prediction 2024/2025/2030

Additionally, Bitcoin’s concurrent rise to $72,000 has provided a favorable macro environment for Chainlink’s price increase. The bullish momentum in the broader cryptocurrency market, led by Bitcoin, has likely contributed to the positive price action observed in Chainlink.

Strategic Recommendations

Bullish Outlook:

Key levels to watch are $16.41 (the upper boundary of the Ichimoku cloud), $15.52 (the 0.382 Fibonacci level), and $14.09 (the 0.618 Fibonacci level). These indicators can help you optimize your trading strategy.

While LINK shows strong potential, diversify your portfolio with other high-potential assets to mitigate risk.

Stay informed about Chainlink’s developments and participate in community discussions to gain insights into upcoming projects.

The post Chainlink (LINK) Price Sees Bullish Momentum Continue appeared first on BeInCrypto.

.png)

5 months ago

2

5 months ago

2

English (US)

English (US)