ARTICLE AD BOX

The post Circle CEO Expects U.S. Stablecoin Regulations in 2024 appeared first on Coinpedia Fintech News

The year 2024 might witness significant progress in U.S. regulations for stablecoins, according to Circle CEO Jeremy Allaire. In an interview at the World Economic Forum in Davos, Jeremy Allaire expressed optimism about lawmakers approving a stablecoin bill, highlighting the global momentum in digital currency regulations.

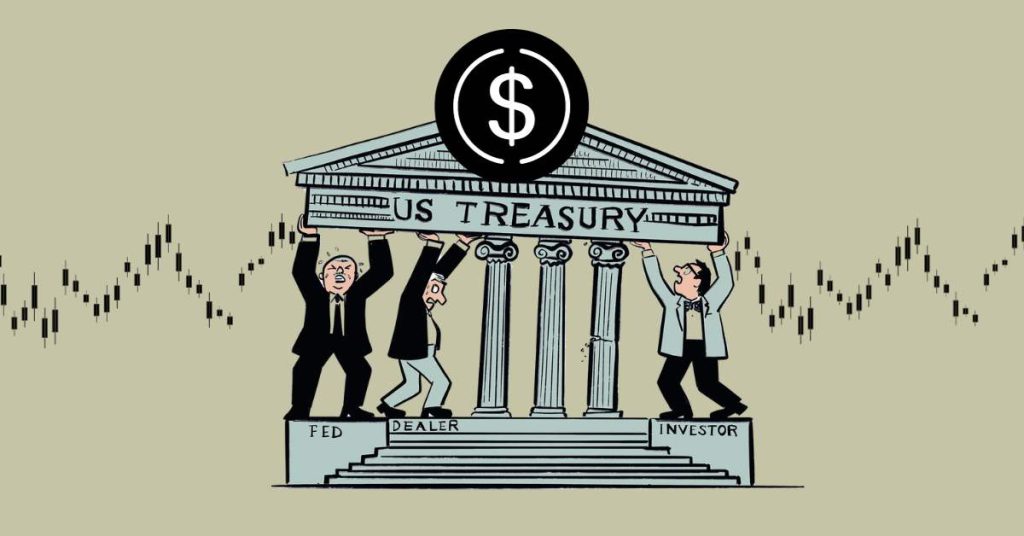

Regulatory Landscape

CEO Jeremy Allaire emphasized the increasing global regulatory developments, with governments around the world actively working on digital currencies.

He noted that although the United States is lagging behind in this aspect, the U.S. is likely to take substantial steps to assert leadership, aligning with bipartisan desires for crypto consumer protection and regulatory clarity.

The Clarity for Payment Stablecoins Act, currently under consideration in the House of Representatives, aims to subject stablecoins to regulatory frameworks similar to traditional financial services. Allaire acknowledged the Act by suggesting a favourable environment for the approval of the same in the States in 2024.

Both Allaire and Circle’s Chief Strategy Officer, Dante Disparte, expressed optimism about 2024 being a pivotal year for stablecoin regulations in the U.S. Disparte highlighted the bipartisan support for stablecoin policies and suggested that concerns over illicit usage of certain cryptocurrencies might expedite regulatory actions.

Circle’s IPO Filing

Circle, the company behind the popular stablecoin USD Coin, recently filed a confidential S-1 registration with the U.S. Securities and Exchange Commission, indicating its intention to go public.

Citing regulatory restrictions, Allaire refrained from commenting on whether the timing of Circle’s IPO filing was influenced by the SEC’s approval of the first U.S. spot Bitcoin ETFs.

All in all ..

Allaire reiterated the significance of stablecoins, labelling them as the “killer app” for blockchain technology. He anticipates a broader adoption of stablecoins globally in 2024, fueled by developments like the spot ETF and increased regulatory clarity.

.png)

11 months ago

2

11 months ago

2

English (US)

English (US)