ARTICLE AD BOX

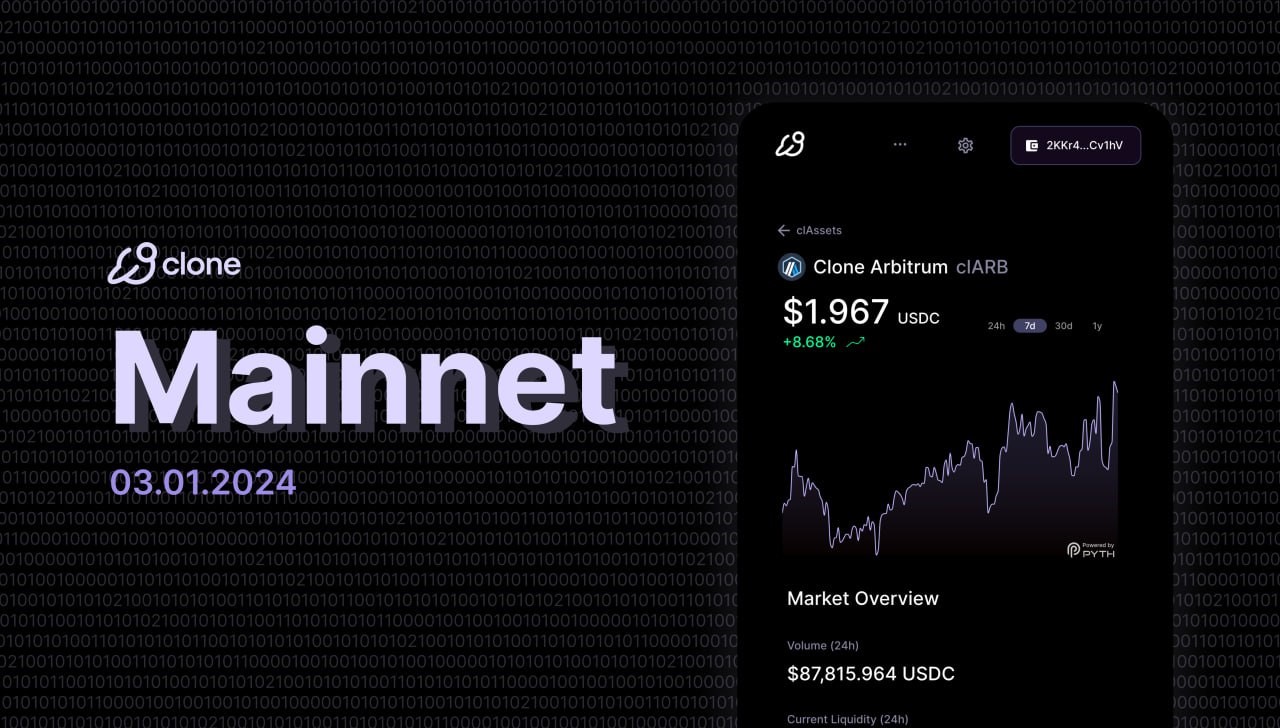

Clone, which is a game-changer open-source protocol for trading non-native tokens on the Solana blockchain, has announced the public mainnet debut of Clone Markets and Clone Liquidity. With the debut of March 1st, Clone’s novel “cloned assets” (clAssets) will make it easier to create extremely liquid markets for non-native assets, giving Solana users access to a more smooth, effective, and convenient trading environment.

The goal of Clone is to enable users to trade a variety of non-native tokens on the Solana blockchain with ease, using its cheap fees and quick transaction processing. Despite having one of the busiest DeFi ecosystems, Solana does not have a stable spot trading environment since users are hesitant to provide liquidity to trading pools that bridge assets, particularly for tokens that are not native to the platform.

By bringing non-native assets to Solana in the form of its cutting-edge clAssets—unique, cloned versions of pre-existing on-chain assets—hosted on the Clone protocol, Clone seeks to address this problem. It’s a cutting-edge system for trading non-native tokens where liquidity providers may benefit from the unmatched adaptability of Clone’s cutting-edge Comet Liquidity System to enable smooth trading of clAssets with minimal slippage and deep liquidity.

Within the Clone protocol, each of the two user interfaces—Clone Markets and Clone Liquidity—has a specific function. While Clone Liquidity gives liquidity providers access to the cutting-edge and very effective Comet Liquidity System, which offers leveraged, cross-margin liquidity pools with just USDC as collateral, Clone Markets is the decentralized trading platform where users may buy and sell clAssets. LPs are able to concurrently provide liquidity to each Clone pool using a single source of USDC collateral. The distinctive arrangement of Clone’s liquidity pools, based on the notion of clAssets, renders them at least twice as capital-efficient as those of any rival AMM.

The core values of Clone, which combine the principles of effectiveness, inclusiveness, and usability to produce an integrated platform with high liquidity and minimal capital needs, are embodied by Clone Markets and Clone Liquidity. With the help of these developments, Clone will be able to expand swiftly to a wide variety of on-chain, non-native assets on a single exchange.

On February 1st, Clone released its private mainnet product. The initial clAssets on Clone, clARB and clOP, allowed network tokens from Optimism and Arbitrum to be traded with deep liquidity on Solana for the first time. Along with making these clAssets publicly accessible tomorrow, Clone will also be publishing a brand-new token called cloned SUI (clSUI). The first market on Solana where users may exchange SUI tokens is the clSUI pool. Clone is able to quickly generate markets for new clAssets because of the very effective Comet Liquidity System. This allows traders to benefit from a greater variety of trading options on Solana, therefore boosting its DeFi environment and growing its community.

The ability for traders to manage their whole portfolio on a single platform on the Solana blockchain and take advantage of speedier, less expensive transactions is one of Clone’s key advantages. Liquidity providers will have chances to profit significantly from Clone in the meantime. In the end, Clone will allow users to trade the tokens they are most comfortable with and significantly expand Solana’s token variety.

Evan Deutsch, Co-Inventor of Clone said in a statement:

“With Clone’s mainnet launch on Solana, we’re not just enabling trading of non-native tokens; we’re envisioning a future where Solana becomes a universal trading platform. Our mission is to make any token tradable without leaving Solana, expanding our community and unlocking the blockchain’s true potential.”

A significant turning point for the firm, Clone’s mainnet debut ushers in a new age of scaled cloned asset trading on the Solana blockchain with never-before-seen deep liquidity.

.png)

9 months ago

6

9 months ago

6

English (US)

English (US)