ARTICLE AD BOX

Coinbase, the leading cryptocurrency exchange, has marked a significant milestone by posting its first quarterly profit since 2021, as revealed in its latest earnings report released on Thursday. The company’s financial performance exceeded analysts’ expectations, leading to a surge in its stock price by almost 13% during after-hours trading.

Stellar Financial Performance

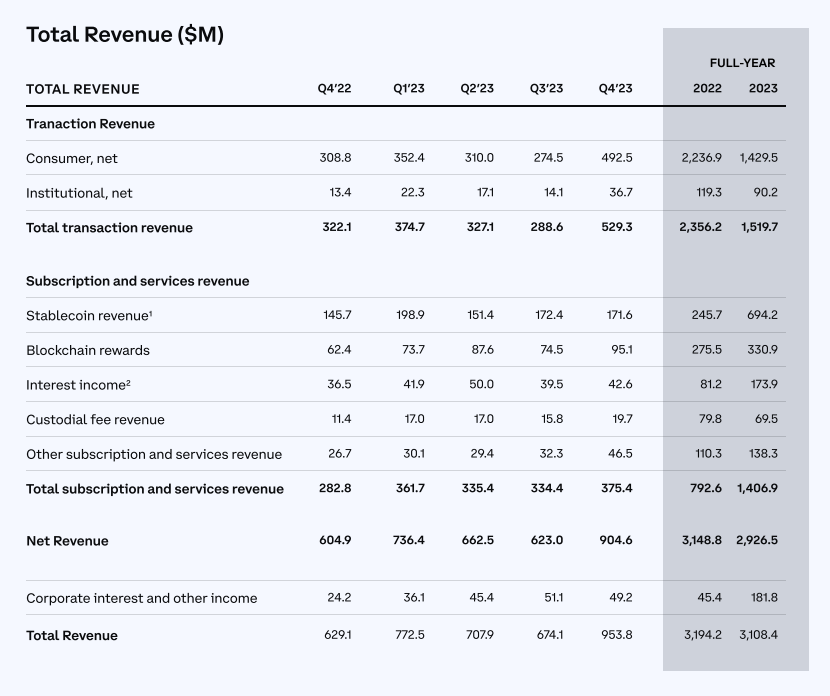

Coinbase reported revenue of $953.8 million, surpassing analysts’ forecasts of $826.1 million. This stellar financial performance indicates a remarkable turnaround for the exchange, with its stock price experiencing a 150% increase over the past 12 months. Additionally, trading volume on Coinbase more than doubled to $154 billion from the last quarter, outstripping analysts’ projections of $142.7 billion.

Bitcoin ETFs: A Game-Changer for Coinbase

The recent approval of Bitcoin exchange-traded funds (ETFs) by the Securities and Exchange Commission (SEC) has proven to be a game-changer for Coinbase. Anil Gupta, Coinbase’s vice president of investor relations, highlighted the significance of ETFs for the exchange, describing them as a “win-win” scenario. With Coinbase providing custodial services to eight out of ten spot Bitcoin ETFs, the company has positioned itself as a key player in this burgeoning sector.

According to Gupta, the introduction of ETFs has revitalized the entire crypto sector, leading to increased activity and engagement on the Coinbase platform. CFO Alesia Haas echoed Gupta’s sentiments, emphasizing the positive impact of ETFs on Coinbase’s business.

Institutional Interest on the Rise

Investors believe that the approval of Bitcoin ETFs will attract more institutional money into the crypto industry. In Q4, Coinbase witnessed a significant surge in institutional transaction revenue, which jumped by 161% compared to the previous quarter. This uptick in institutional interest underscores the growing credibility of cryptocurrencies as an asset class.

Strategic Initiatives for Growth

To further bolster its institutional business, Coinbase recently announced a fee reduction aimed at attracting high-volume traders. The exchange is waiving fees for Coinbase Advanced customers trading crypto on its professional market, provided they meet specific trading thresholds. This move reflects Coinbase’s commitment to catering to the evolving needs of its user base and enhancing its competitive edge in the market.

Analysts’ Optimism

Even traditional financial institutions like JP Morgan have taken note of Coinbase’s impressive performance, upgrading its stock rating to “Neutral” from “Underweight” ahead of its earnings report. Analysts at JP Morgan anticipate continued growth in Coinbase’s earnings power, driven by the sustained uptrend in cryptocurrency prices.

In conclusion, Coinbase’s resurgence in profitability and its strategic initiatives to capitalize on the growing demand for cryptocurrencies position it as a formidable player in the digital asset space. With Bitcoin ETFs opening up new avenues for growth, Coinbase is well-positioned to capitalize on emerging opportunities and drive further expansion in the crypto market.

.png)

8 months ago

3

8 months ago

3

English (US)

English (US)