ARTICLE AD BOX

The post Coinbase vs SEC Final Showdown: What to Expect on January 17th? appeared first on Coinpedia Fintech News

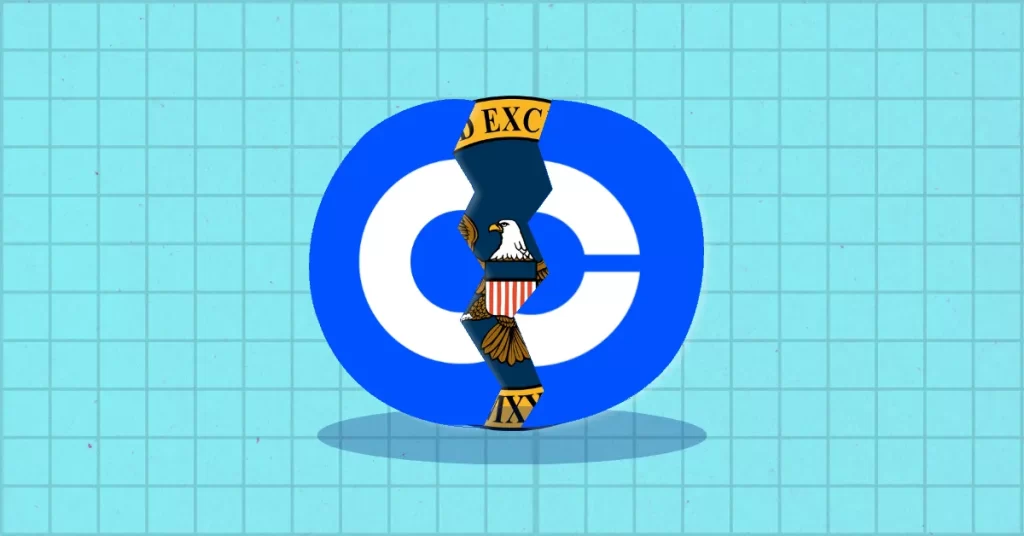

In a landmark case that could reshape the regulatory landscape of the cryptocurrency industry, Coinbase, one of the largest crypto exchanges, stands at the forefront of a legal battle against the U.S. Securities and Exchange Commission (SEC). The much-anticipated hearing, set for January 17, 2024, is stirring the crypto community, as it could potentially rebuke the SEC’s approach to crypto regulation.

The dispute centers around the SEC’s lawsuit against Coinbase, alleging unregulated securities transactions. Crypto Capital Venture’s Dan Gambardello highlights this case as pivotal, eclipsing even the Bitcoin spot ETF deadline. According to James A. Murphy, lawyer and founder of Metalawman, a victory for Coinbase could signal a significant setback for the SEC’s current regulatory approach, marked as “regulation by enforcement.”

At the core of Coinbase’s defense is a critical statement made by SEC Chairman Gary Gensler. In his May 6, 2021, testimony to Congress, Gensler asserted that the SEC does not have the authority from Congress to regulate crypto exchanges. This statement forms a central argument in Coinbase’s case, challenging the SEC’s legal standing in this domain.

Implications of a Coinbase Victory

The outcome of this case is not just vital for Coinbase but for the entire crypto sector. A victory for Coinbase could set a precedent, influencing how cryptocurrencies are regulated and treated legally in the United States. However, the reverse could also hold true, potentially leading to adverse market reactions. The Ripple case, though significant, pales in comparison to the potential impact of this lawsuit.

Underlining their determination, Coinbase’s legal team, led by Chief Legal Officer Paul Grewal, has expressed readiness to fight this battle, highlighting the SEC’s deviation from established legal precedents and due process.

The Role of Judge Failla

Presiding over the case, Judge Failla’s approach and eventual decision are under intense scrutiny. Historically, motions to dismiss are rarely granted without discovery, but the uniqueness of this case might prompt an exception. The judge’s skepticism towards the SEC’s stance, as observed in preliminary hearings, suggests a deep understanding of the complexities involved in crypto regulation.

As the crypto community eagerly awaits the January 17 hearing, the outcome of Coinbase vs. SEC could very well dictate the future trajectory of cryptocurrency regulation globally.Coinba

.png)

1 year ago

7

1 year ago

7

English (US)

English (US)