ARTICLE AD BOX

Arbitrum’s recent price slip to $1.43 on April 10th followed by a modest recovery hinted at a potential upswing in price. While one metric hinted at Arbitrum being overvalued, technical indicators painted a bullish picture for the token.

Arbitrum recently underwent a correction, nullifying gains from the previous week. Despite a bearish trend, recent hours have shown signs of recovery.

According to CoinMarketCap, ARB gained momentum last week, reaching $1.58 on April 9th before slipping back to $1.43.

There’s been improvement lately, with Arbitrum currently trading at $1.46 with a market capitalization exceeding $3.8 billion, ranking it as the 32nd largest cryptocurrency.

Renowned crypto analyst Michael Van de Poppe has suggested in a recent tweet that Ethereum’s Layer 2 solutions will thrive.

$ARB continuing the correction, but I still believe that we’re in a phase where Layer 2’s are going to be doing great on the Ethereum blockchain. pic.twitter.com/6ROUo9IquJ

— Michaël van de Poppe (@CryptoMichNL) April 9, 2024

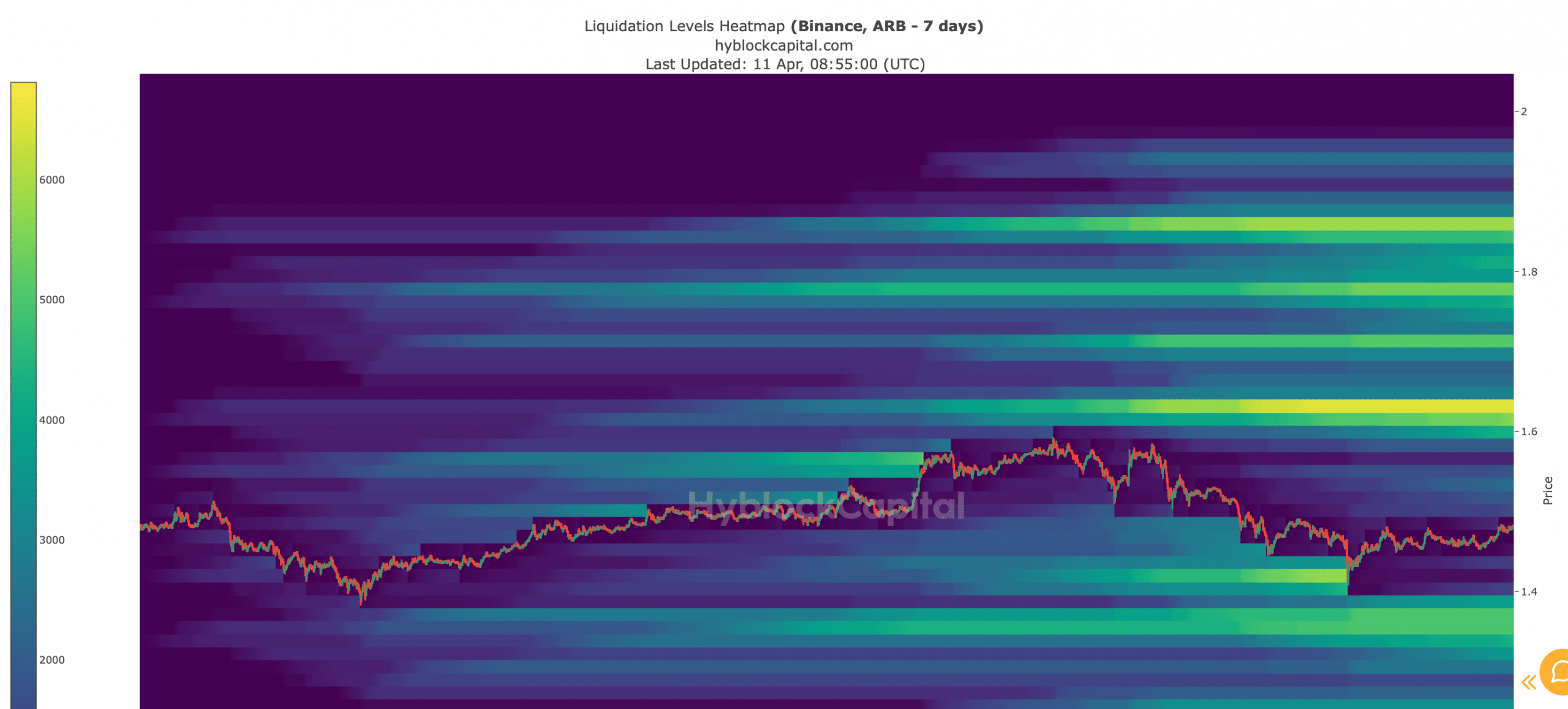

Considering potential targets for a bullish rally, we examined data from Hyblock Capital. Analysis suggests that ARB’s liquidity may substantially increase upon reaching $1.63, marking a possible immediate target.

Source: Hyblock Capital

Further upward movement could see Arbitrum hitting $1.7 and $1.85 in the coming weeks.

Analyzing Santiment’s data reveals strong whale activity around ARB, alongside increased investor confidence as reflected in the rising number of holders.

Despite concerns raised by the NVT ratio indicating possible overvaluation, technical indicators remain bullish. Arbitrum’s daily chart shows an upward trend in the Money Flow Index (MFI) and an uptick in the Chaikin Money Flow (CMF), suggesting favorable conditions for a potential bull rally.

The post Could this be Arbitrum’s Moment for a Major Surge? Key indicators suggest… appeared first on DailyCoinPost.

.png)

7 months ago

7

7 months ago

7

English (US)

English (US)