ARTICLE AD BOX

As April 2024 draws near and the Bitcoin halving approaches, one analyst is redirecting attention to explore its potential impact on the stock prices of Bitcoin mining companies, amid widespread speculation about the cryptocurrency’s price.

“Mining stocks seem like an easy win,” he stated.

Crypto Analyst Has Positive Outlook for Bitcoin Miners

According to crypto analyst Jason A. Williams, Bitcoin holders can expect an entirely different experience following the upcoming halving, compared to previous cycles. Williams believes it could be a turn of tables, as it could be a positive one for Bitcoin miners:

“The event, not as ruthless. Not as unforgiving to inefficient miners. Block fees are at or exceeding the block reward.”

Read more: How To Mine Cryptocurrency: A Step-by-Step Guide

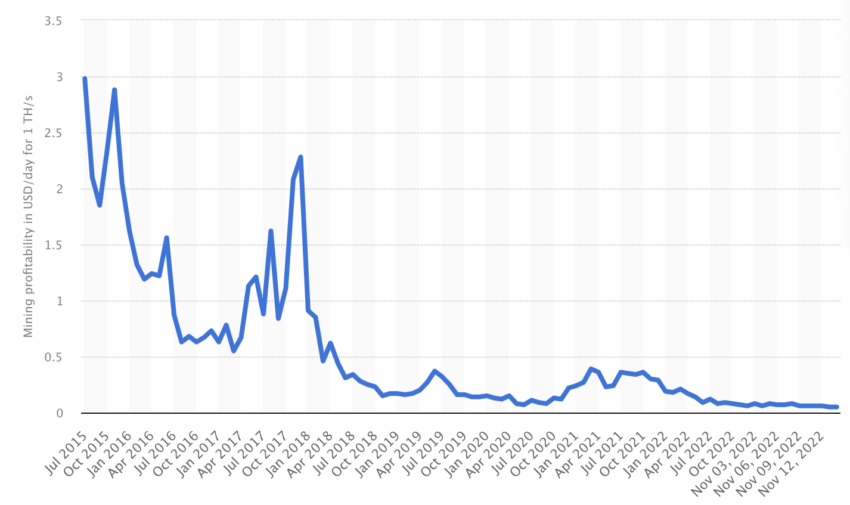

However, Statista data up to November 2022 indicates a significant decline in the profit growth of Bitcoin mining over the years.

Mining profitability of Bitcoin per day from July 2015 to November 14, 2022. Source: Statista

Mining profitability of Bitcoin per day from July 2015 to November 14, 2022. Source: StatistaThis comes amid news that Bitcoin miners are stocking up on new mining machines ahead of the halving in April 2024.

Investors Pouring Millions into Bitcoin Mining Equipment

On December 11, BeInCrypto reported that major crypto mining companies have spent $747 million on facilities and equipment in December alone, ahead of next year’s Bitcoin halving.

Meanwhile, some of the bigger companies are keeping their eye on smaller companies to potentially acquire them. It was noted that Marathon Digital is holding around $700 million for acquisitions.

Several crypto execs believe Bitcoin could rise significantly in 2024. Michael Saylor, chairman of MicroStrategy and Bitcoin maximalist, told CNBC in November that Bitcoin’s price could increase by 10x. He recently said:

““One day, we will all brag about buying five-figure Bitcoin.”

Read more: How To Build a Mining Rig: A Step-by-Step Guide

Best crypto platforms in Europe | December 2023

The post Crypto Analyst Bullish on Bitcoin Mining Stocks As Halving Nears appeared first on BeInCrypto.

.png)

1 year ago

7

1 year ago

7

English (US)

English (US)