ARTICLE AD BOX

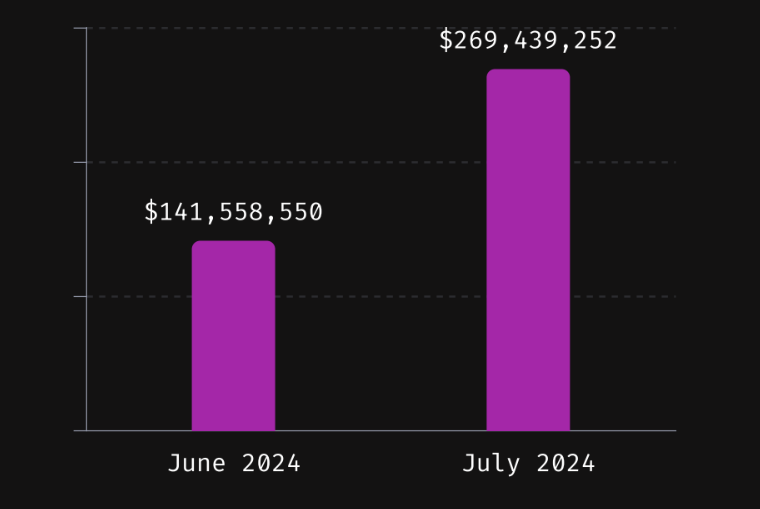

The cryptocurrency world faced significant security challenges in July 2024, with a staggering loss of nearly $269.5 million due to 14 hacking incidents. This alarming data comes from a recent report by Immunefi, a leading bug bounty and security services platform.

Alarming Surge in Crypto Hacks

Immunefi’s data highlights that July witnessed $269,439,252 being stolen in a series of hacks and fraud incidents, marking a 90% increase from the previous month. However, this figure also represents a 15.9% decrease compared to July 2023, when losses were recorded at $320,498,660.

Source: Immunefi

Source: Immunefi

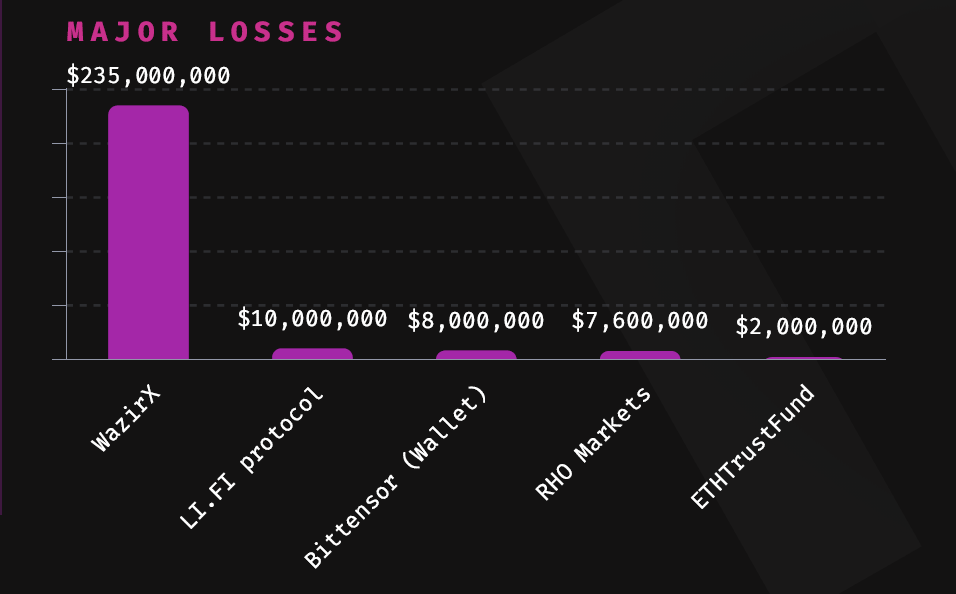

The most significant losses came from two major projects: the Indian crypto exchange WazirX, which lost $235 million in a hack, and the LI.FI protocol, which suffered a $10 million breach.

Predominance of Hacks Over Fraud

Hacks remain the primary cause of losses in the crypto ecosystem, with $266,481,700 stolen across 12 incidents in July. In contrast, fraud accounted for only $2,957,552 across two incidents, making up just 1.1% of the total losses. This stark contrast highlights the growing sophistication and frequency of hacking activities targeting the crypto sector.

Centralized Finance (CeFi) Takes the Brunt

Centralized finance (CeFi) bore the majority of the financial hit in July, representing 87% of the total volume of funds lost. A single incident involving WazirX accounted for the bulk of these losses. The report emphasizes that most of the losses in 2024 can be attributed to attacks on CeFi infrastructure, with over $636 million of the $1.19 billion stolen year-to-date being linked to CeFi breaches.

Source: Immunefi

Source: ImmunefiThe Lazarus Group and High-Profile Hacks

The notorious North Korean Lazarus Group resurfaced as a significant threat, being implicated in the WazirX hack and the DMM Bitcoin hack in May. The group, known for its sophisticated cyberattacks, has been connected to several high-profile breaches, including those involving Atomic Wallet, CoinEx, Alphapo, Stake, and CoinsPaid.

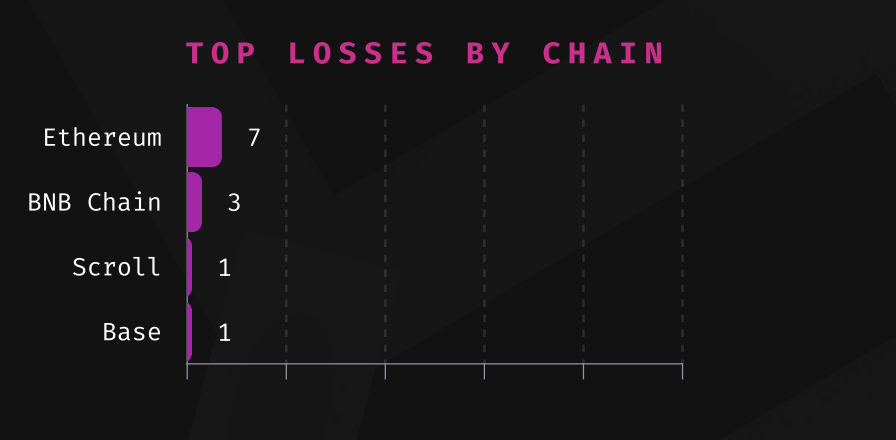

Ethereum and BNB Chain: Prime Targets

Ethereum and BNB Chain emerged as the most targeted blockchain networks in July, collectively representing 71.4% of the total losses. Ethereum faced seven attacks, accounting for 50% of the total losses, while BNB Chain experienced three incidents, constituting 21.4% of the losses. Other networks like Scroll and Base also reported individual incidents, each contributing to 7.1% of the total losses.

Source: Immunefi

Source: ImmunefiImmunefi’s Role in Mitigating Losses

Despite the alarming figures, Immunefi continues to play a crucial role in safeguarding the crypto ecosystem. The platform offers over $157 million in available bounty rewards and has paid out over $100 million in total bounties to date, saving more than $25 billion in user funds. This proactive approach underscores the importance of robust security measures in protecting digital assets.

.png)

5 months ago

3

5 months ago

3

English (US)

English (US)