ARTICLE AD BOX

- The Crypto Fear and Greed Index at 39 signals investor uncertainty, often leading to panic selling or strategic accumulation by experienced traders.

- Historical trends suggest that extreme Fear phases present buying opportunities before potential market recoveries, particularly ahead of events like Bitcoin Halving.

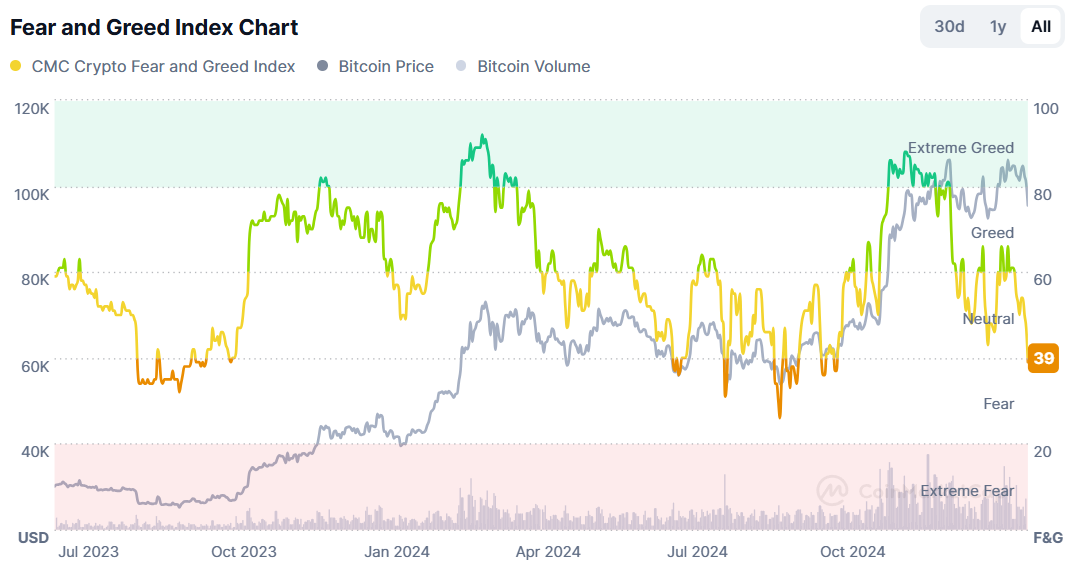

Currently, according to CMC, the Crypto Fear and Greed Index stands at 39, indicating that the market is still fearful. For those unfamiliar, this index gauges investor opinion of the cryptocurrency market on a 0 to 100 range. The market suffers more anxiety the lower the number is. On the other hand, if the number gets close to 100, greed is clearly controlling.

Is this figure a warning that crypto values might drop further more? Alternatively, is it a warning that it is time to “buy the dip” prior to the uptrend starting?

Source: CoinMarketCap

Source: CoinMarketCapWhat Usually Happens When the Index is in the Fear Zone?

Looking back, every time the index falls into the Fear zone, two sides respond in somewhat different ways. Usually panicking, retail investors sell their holdings. Prices are declining; they worry about losing more, and so they hurry to sell their assets.

Selling pressure rises, therefore, and prices can drop even further. Conversely, institutional and experienced investors find this to be a chance. Momentary fear has little effect on them; instead, they begin to gather undervalued crypto assets.

History reveals that many experienced traders seize the opportunity to purchase cheap assets when the index falls into the severe Fear zone. One typical instance happened in March 2020 when the epidemic led Bitcoin to plunge sharply to about $3,800, but in just a few months the price skyrocketed once more.

Will the 2025 Bull Run Start Here?

Given the Bitcoin halving in 2024, many experts think 2025 would be a new bull run year for cryptocurrency. Using past trends, the price of Bitcoin often rises significantly in the next 12 to 18 months following each halving. Naturally, though, macroeconomic circumstances also play a significant part.

Though more of a market sentiment indicator than a price forecast tool, the Fear and Greed Index is nonetheless Should the index be in the Fear zone right now, many people still find great difficulty joining the market. If the past trend continues, though, this is the opportunity for large investors to begin building Bitcoin and other assets prior to a significant climb.

Invest Now or Wait? Making the Right Move in a Fearful Market

So, is the appropriate moment for investment now? It varies according to every strategy. Wait for confirmation of an increase if you choose to play it safe; it would be wiser. For those who sense opportunity in market panic, however, they can take into account the Dollar-Cost Averaging (DCA) strategy, which buys in stages to lower the volatility risk.

History clearly reveals that individuals who can remain cool and make data-driven decisions while the index is in Fear typically fare better the long run.

.png)

2 hours ago

2

2 hours ago

2

English (US)

English (US)