ARTICLE AD BOX

- The crypto market led by Bitcoin recorded a slight pullback on Sunday, “dragging” the total market capitalization down by 2.4%.

- A very reliable indicator has highlighted that the bullish momentum that drove the Bitcoin price to almost $100k is not being replenished, and this could be devastating if any negative news emerges.

The crypto market recorded a temporal downtrend following weeks of consistent uptick which forced most of the leading assets into the overbought territory.

According to our market data, Bitcoin (BTC), which was just some $346 shy of the $100,000 price point, withdrew to $95,500 on Sunday, November 24. Similarly, Stellar Lumens (XLM) declined to $0.44 from its monthly high of $0.63. Ethereum (ETH), Dogecoin (DOGE), Litecoin (LTC), Cardano (ADA), and Shiba Inu (ADA) were no exception either. From our research, the total market capitalization declined by 2.4% within the period.

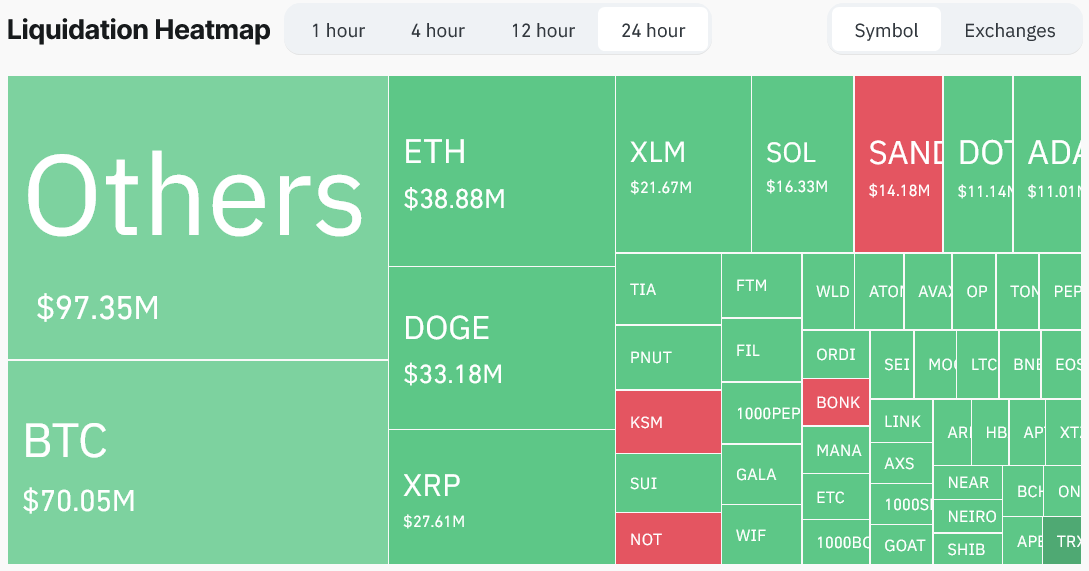

The Recorded Liquidations and Institutions Involvement

Further exploring the sudden pullback, CNF discovered that crypto-tracked futures recorded a massive liquidation of $500 million in both longs and shorts. Specifically, $366 million of the recorded liquidations were in longs, while $127 million were in shorts, according to data retrieved from Coinglass. For the small altcoins and the futures tracking midcaps, more than $100 million were recorded in liquidation.

Source: Coinglass

Source: CoinglassMeanwhile, the market appears to have recovered in the early hours of Monday, November 25, as Bitcoin stages a bullish reversal into $98k while the broad market losses reduce to under 2%.

According to the COO of crypto exchange BTSE, Jeff Mei, Bitcoin could likely return to $100k since key indicators suggest the large involvement of institutional investors. Per his observation, funds would soon move into Ethereum Exchange Traded Fund (ETF) and Solana once its ETF gets approved. Mei also predicted that this bull run could continue into 2025.

It’s clear that Bitcoin has been leading the market, a key indicator that much of the demand is driven by institutions buying ETFs. Hitting the $100k mark is very likely in the coming week. We also believe that institutions will start buying into the Ethereum ETFs soon and, hopefully, the Solana ones once they’re approved…With the stock market making steady gains and the Trump transition team meeting with several crypto executives to discuss pro-crypto policies, it looks promising that this rally will continue into 2025.

The Disadvantage of the Current Position of Bitcoin

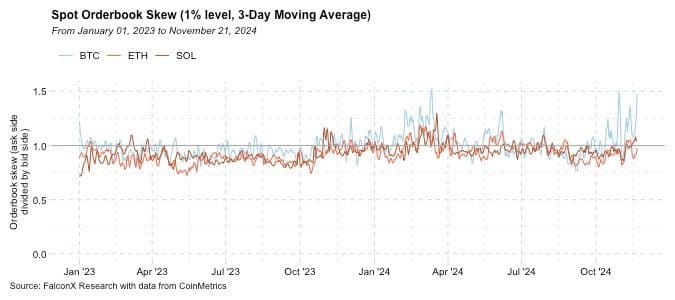

While analysts believe that the current position of the Bitcoin price and the $100k price point is just separated by an “air gap”, the “order book skew ratio” suggests otherwise. According to our analysts, this indicator measures the number of traders or investors on the ask side against those on the bid side.

Based on the reading, the three-day moving average of the 1% skew appears elevated. Fascinatingly, this has only happened thrice since 2022. What this means is that the “firing power” of the investors that drove the price from $66k to $99k has considerably reduced.

Source: FalconX

Source: FalconXAccording to crypto prime broker FalconX, any slight negative news at this point could be catastrophic.

As we near $100K, the skew approaches levels seen only three times since 2022. While this doesn’t threaten the medium-term rally, it suggests that the struggle to break above the $100K level could be intense.

.png)

2 hours ago

1

2 hours ago

1

English (US)

English (US)