ARTICLE AD BOX

As the financial world gears up for a pivotal week, all eyes are on the United States’ economic calendar, with significant implications for the cryptocurrency markets. The focus is squarely on the Federal Open Market Committee (FOMC) meeting this Wednesday, where investors will be keenly observing the latest policy decisions and economic data. While stock markets have shown signs of life, the crypto markets continue to face significant challenges, with heavy resistance levels in play.

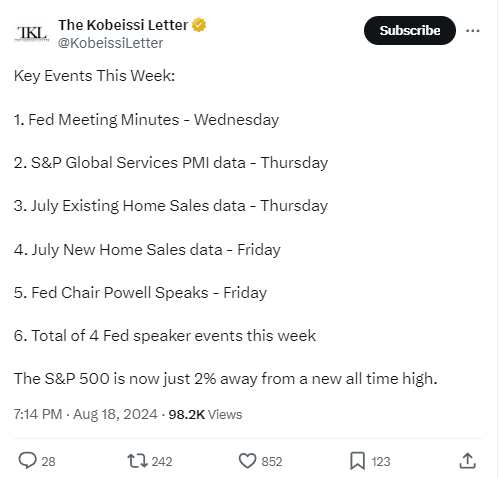

Key Economic Events: August 19 to 23

The week kicks off with the much-anticipated FOMC meeting on Wednesday. Investors are particularly interested in the minutes from July’s meeting, which are expected to offer critical insights into the Federal Reserve’s policy outlook. These minutes will detail the committee members’ stances on monetary policy and provide a deeper understanding of their views on the current economic landscape and future trends.

Following this, Thursday brings the release of August’s S&P Global Manufacturing and Services PMI reports. These reports are crucial as they offer a snapshot of business conditions within the U.S. manufacturing and services sectors, which are reflective of the broader economic climate. Policymakers closely monitor these reports as they serve as forward-looking indicators, often used to gauge the health of the economy.

The week culminates on Friday with a highly anticipated speech by Fed Chair Jerome Powell at the Jackson Hole Economic Policy Symposium. This annual global forum in Wyoming attracts central bankers, policy experts, and academics from around the world. Powell’s speech is expected to provide clues about the anticipated rate reductions in September and the potential trajectory of interest rates in the coming months.

source: x

source: xCrypto Market Sentiment: A Cautious Outlook

While traditional markets have shown signs of recovery, the cryptocurrency sector remains under pressure. Total market capitalization has slipped by 1.3% to $2.17 trillion, maintaining a range-bound movement since rebounding above the $2 trillion mark after a significant market sell-off earlier this month.

Bitcoin, the market’s flagship cryptocurrency, has struggled to maintain its position above $60,000, pulling back to around $58,700 during Monday’s Asian trading session. Ethereum has managed to perform slightly better, with a marginal gain, trading at $2,642 at the time of writing.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)