ARTICLE AD BOX

The post Crypto On-Chain Report 2023: Analyzing a Year of Dynamic Shifts appeared first on Coinpedia Fintech News

2023 has unfolded as a landmark year for the crypto market, showcasing resilience and innovation despite significant challenges. As the year ends, we reflect on a year full of change and innovation in crypto. The market has been driven by investor sentiment, and the spirit of decentralization has been strong.

One of the key storylines of 2023 has been the legal challenges faced by Binance, the largest crypto exchange. However, even as Binance has faced these challenges, the market ecosystem around it has continued to flourish. This shows the resilience and adaptability of the crypto sector.

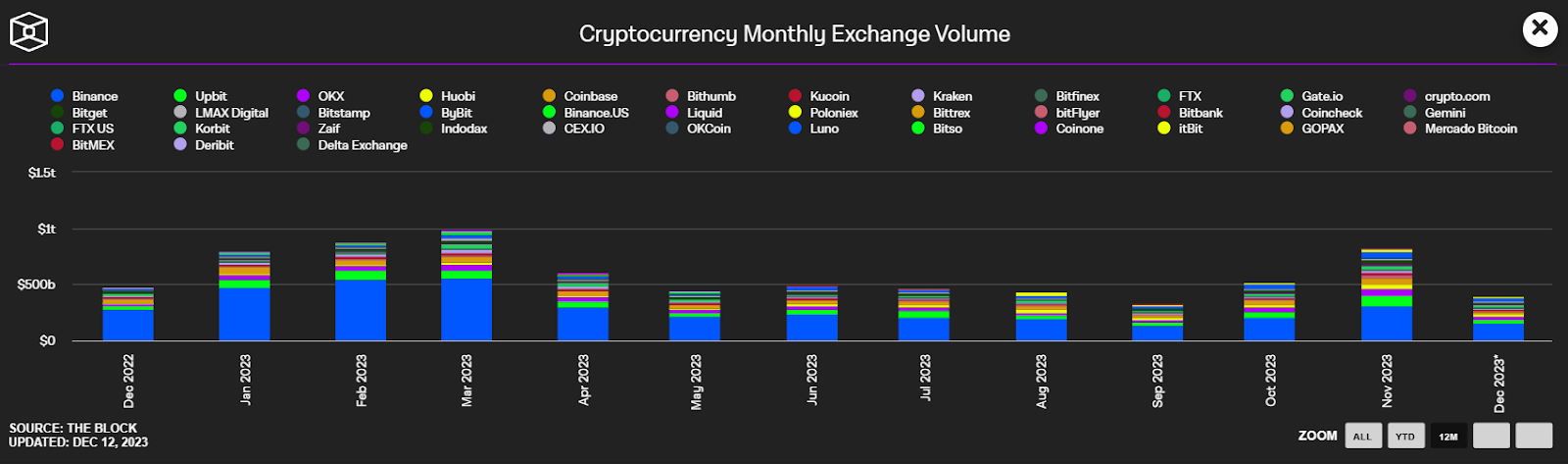

Binance leads the pack in monthly exchange volume market share with 38.50%.

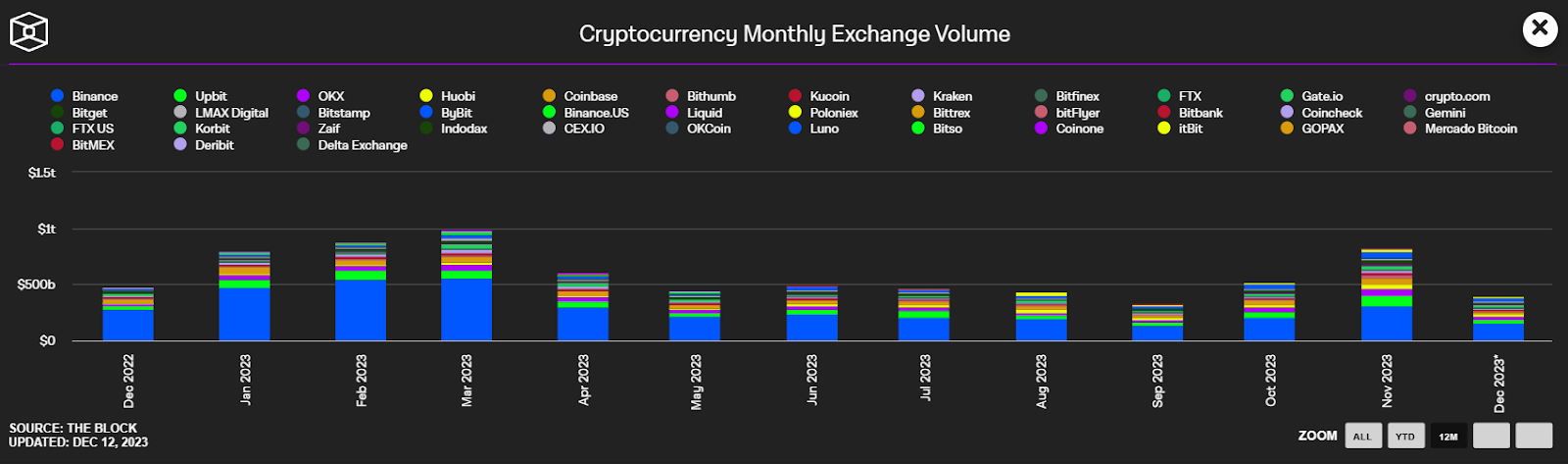

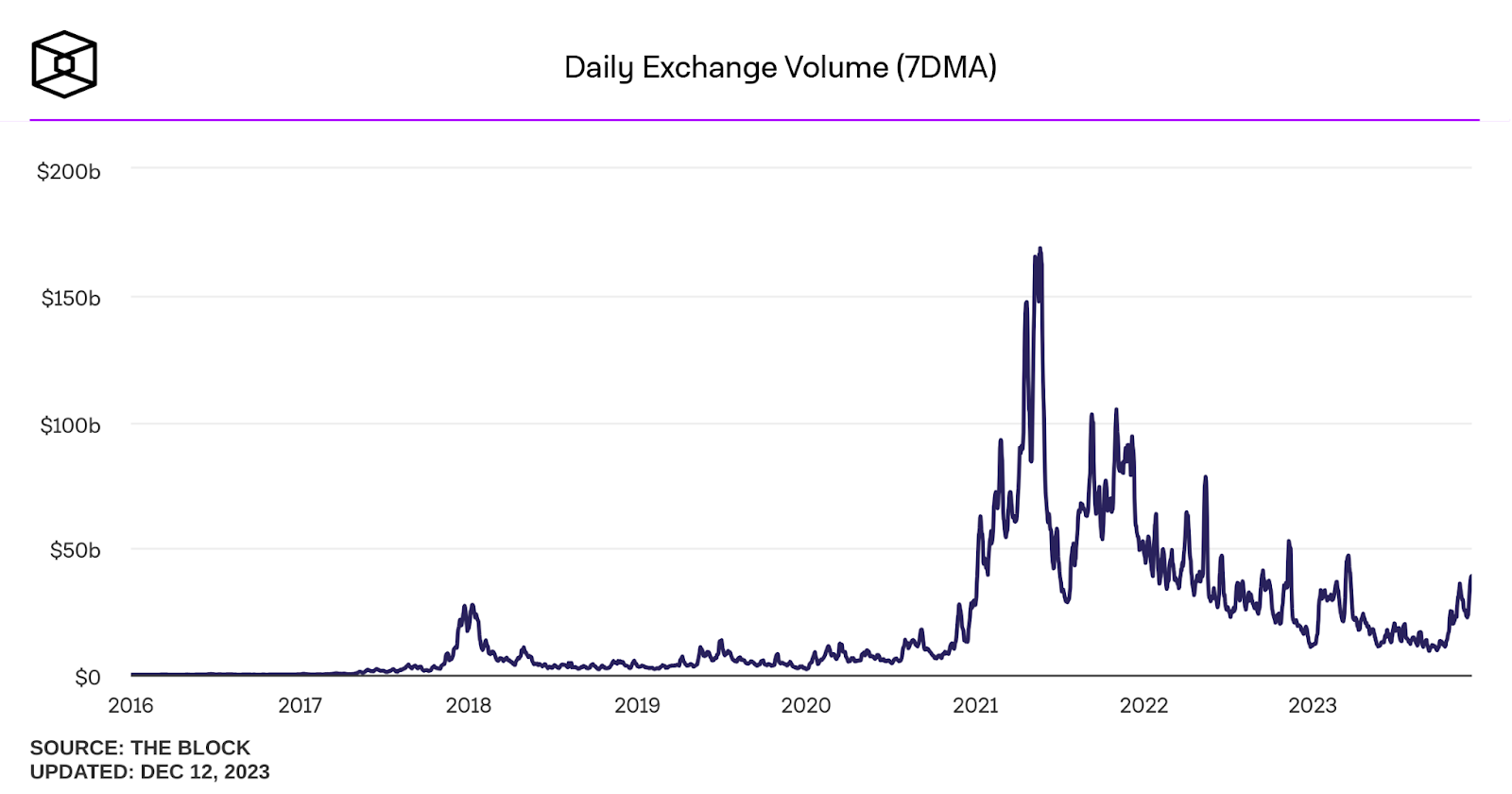

The 2023 crypto exchange volume was a thrill ride, kicking off with a bang as Bitcoin’s $474 billion drove a whopping $800 billion market volume in January alone. The market was on fire by March, soaring to a staggering $983 billion.

Binance was the star player, grabbing $556 billion of that. But then, plot twist—the market hit a bumpy patch, and by September, it had dipped to $323 billion, with Binance clutching $130 billion.

Fast forward to November, and it’s a comeback story. Volumes rocketed to $826 billion, with Binance flexing up to $310 billion. With the ongoing trend, the monthly exchange volume is expected to cross the trillion-dollar mark this December.

The takeaway? Binance may have ridden a seesaw, but it’s still a heavyweight. Meanwhile, contenders like Upbit and OKX aren’t just warming the bench—they’re scoring points, shaking up the game, and showing the crypto world is more than a one-trick pony.

Binance, while still a significant force, has seen its dominance fluctuate throughout the year. The competition has heated up with exchanges like Upbit and OKX carving notable market shares, indicating a diversifying market that is becoming increasingly robust against single points of failure or regulatory pressures.

Nevertheless, Binance leads the pack in this metric with 37.53% till November and 38.5% till December 12th. Still, the collective contribution of other exchanges, including Huobi and Coinbase, adds to a healthy competitive ecosystem that fosters innovation and choice for crypto enthusiasts.

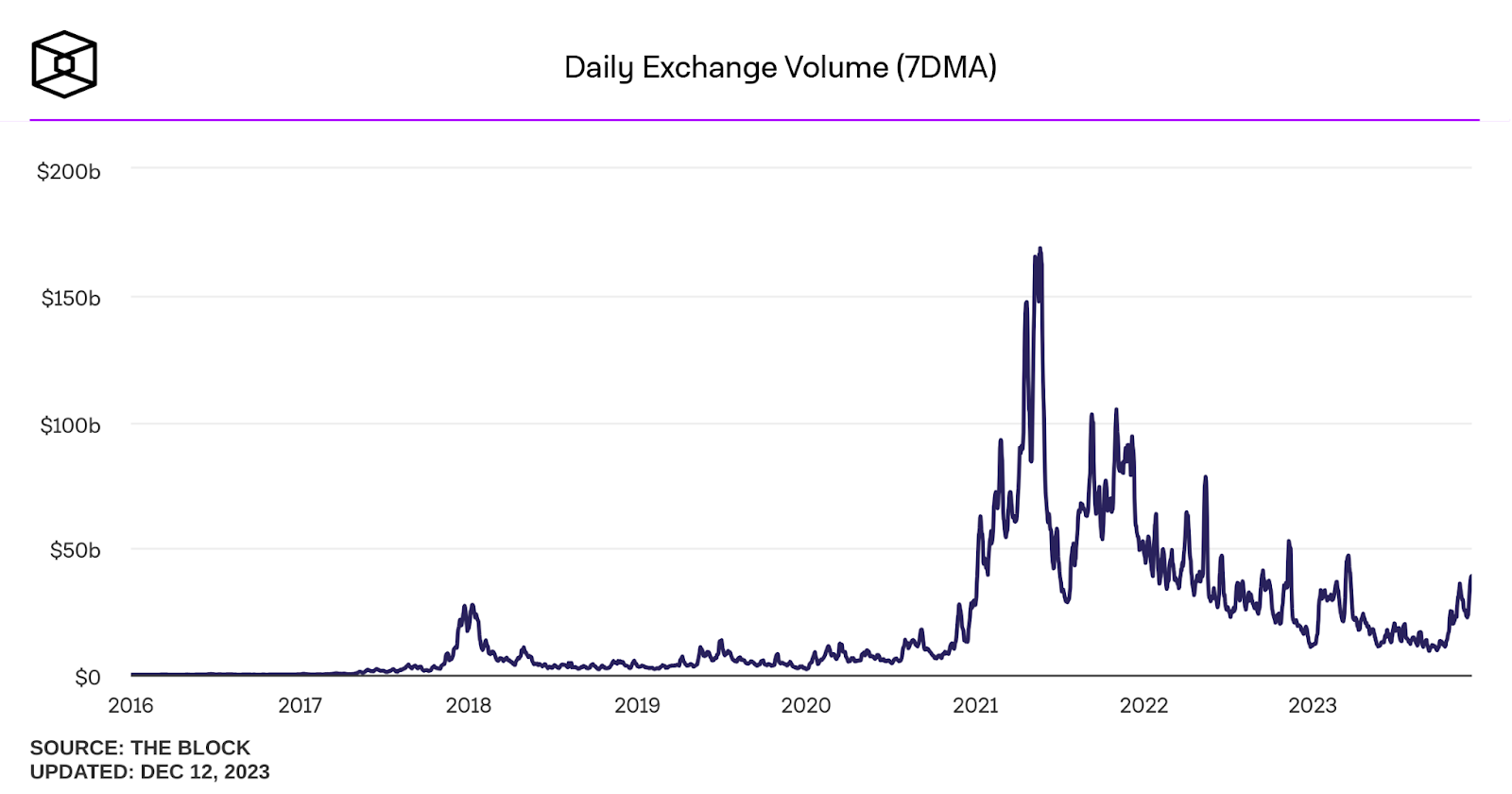

When averaged over seven days, the daily exchange volume is a reliable indicator of the market’s health. This smoothed metric filters out the daily noise, offering a clear view of enduring market activity. It’s akin to a gauge that measures the steady heartbeat of the crypto economy, revealing both the quiet periods of rest and the surges of vigorous trading.

This ebb and flow is a testament to a liquid market that, despite fluctuations, maintains a baseline of recovery activity over the past few weeks, indicative of sustained interest. This unwavering engagement assures the market’s resilience and capacity to remain a hub of opportunity for investors worldwide.

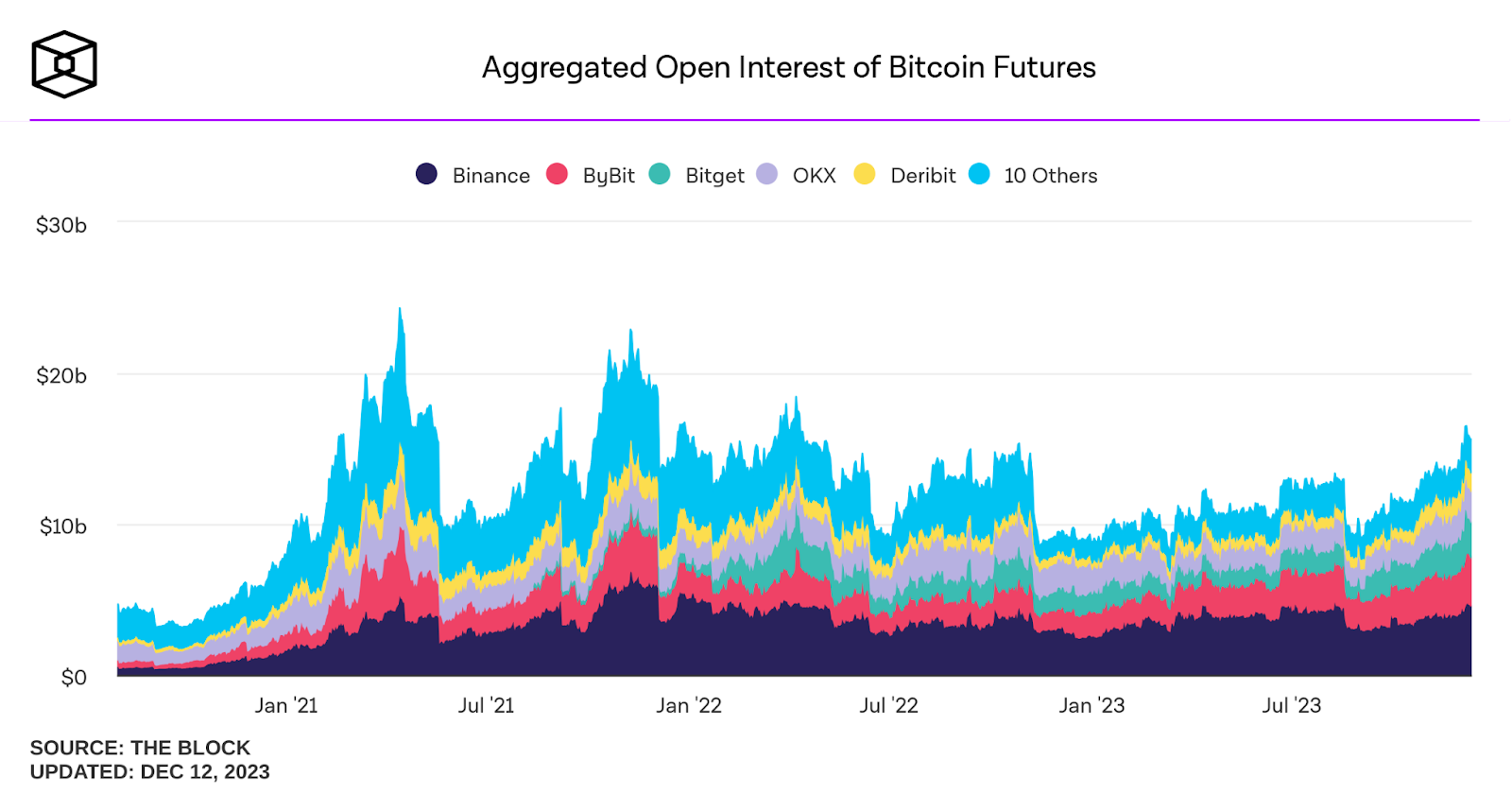

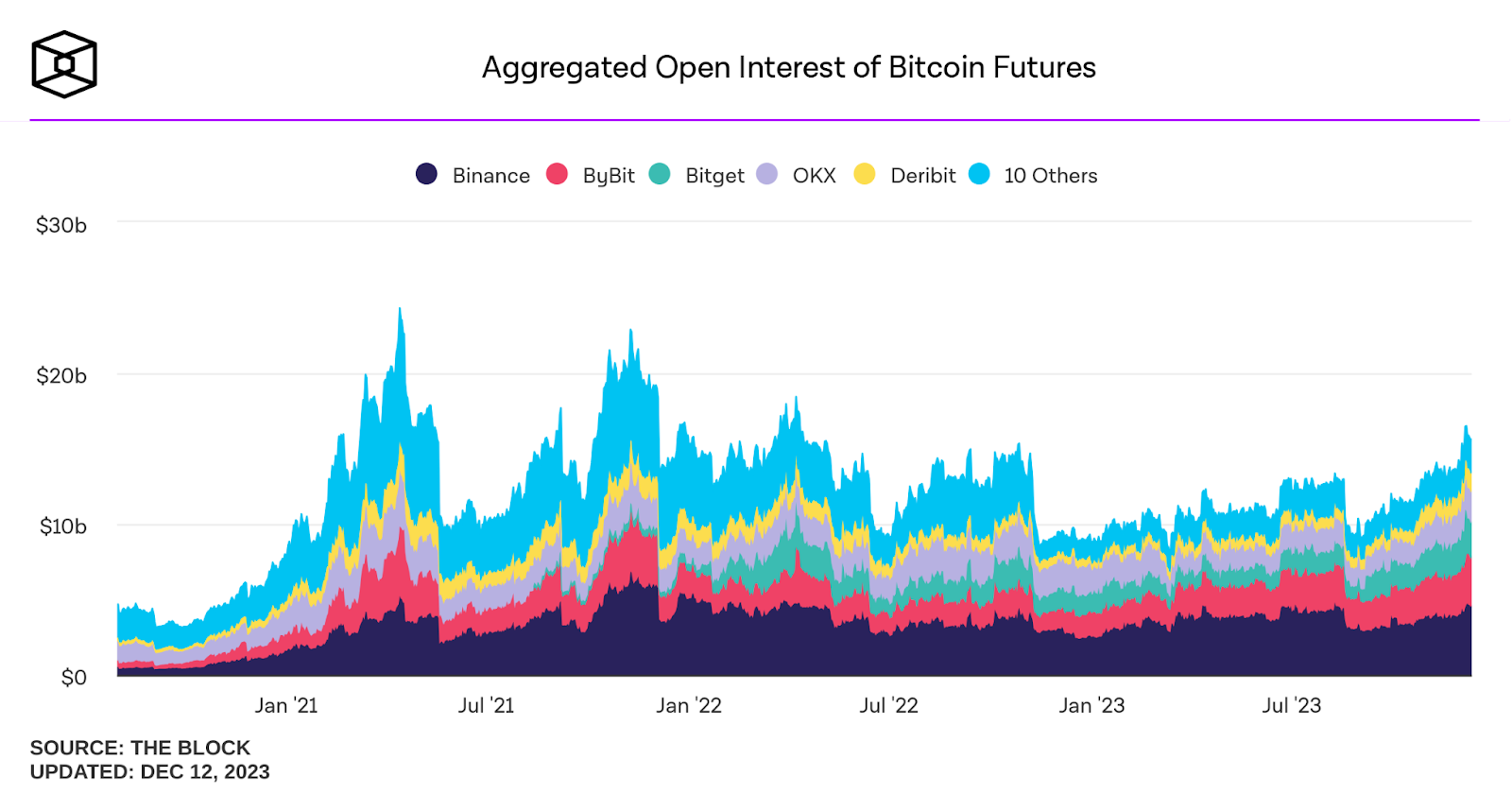

Bitcoin Open Interest swelled to nearly $13 billion, and the year-to-date figures have climbed to an impressive $15.62 billion.

The landscape of Bitcoin futures trading in 2023 has been marked by significant growth, with aggregated open interest surging as the year progressed. Starting the year with a total open interest of $8.67 billion, Binance began at $2.5 billion, positioning itself as a substantial stakeholder in the futures market.

After a peak in July, which saw the market swell to nearly $13 billion, the year-to-date figures have climbed to an impressive $15.62 billion. Binance, maintaining its lead, has seen its open interest rise to $4.5 billion, constituting approximately 28.81% of the total market—a clear indicator of its pivotal role in the futures landscape.

This data is numerical and a narrative of confidence and commitment from traders on platforms such as Binance, Bybit, BitGet, and OKEx. The synchronous trend in open interest across these exchanges underlines the market’s collective bullish outlook and the sustained interest in Bitcoin as a derivative product.

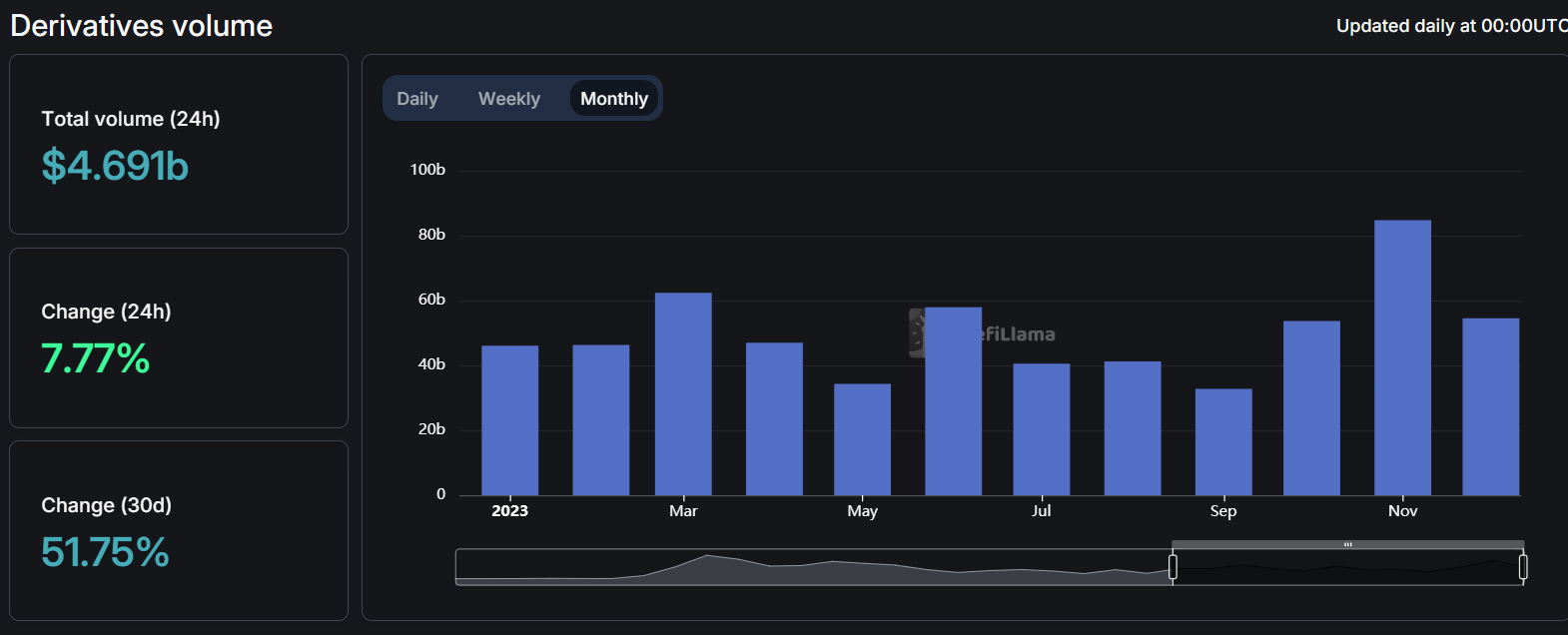

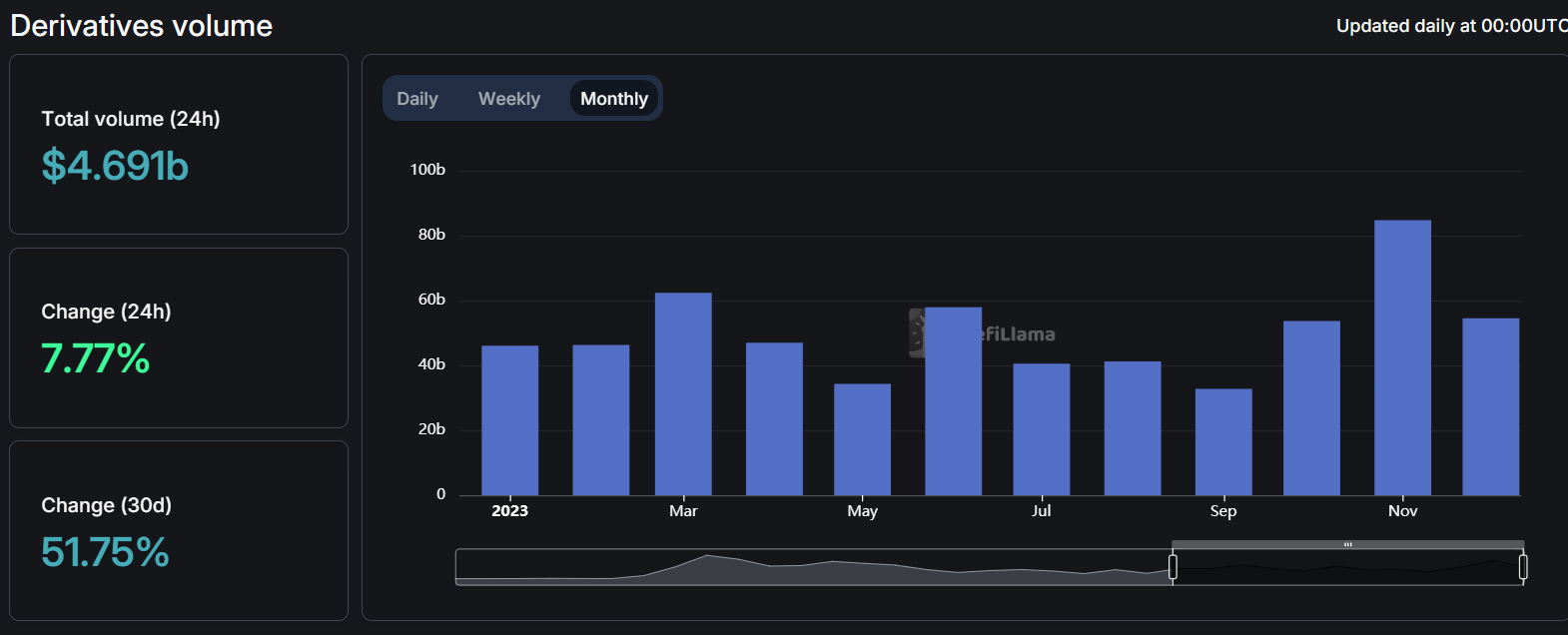

Volume and open interest reached new Month-on-Month basis heights in November

Turning to the traditional finance sphere, the CME’s Bitcoin futures have told a story of resilience and rising momentum. Beginning the year with a volume of $31.01 billion and open interest of $1.64 billion, the CME’s journey through 2023 has been a testament to the ebb and flow of trader sentiment and market dynamics.

The upward trend, gaining traction in September, propelled the volume and open interest to new heights in November—$4.02 billion in volume and a burgeoning open interest of $4.84 billion as of mid-December.

The growth in open interest, particularly from September, parallels the volume’s uptrend, underscoring a robust engagement from institutional and sophisticated traders. This uptick is a significant marker of the institutional embrace of Bitcoin as an asset class and reflects the deepening entrenchment of cryptocurrency within the broader fabric of financial trading.

For stakeholders in the crypto and traditional markets alike, the CME’s figures are a bellwether for institutional sentiment and a signal of the crypto market’s expanding reach.

Crypto Markets Defy DOJ Drama in 2023!

As the curtains close on a tumultuous yet triumphant year for the crypto industry, it’s evident that the markets’ resilience has been nothing short of remarkable. Binance, the titan of crypto exchanges, was under the regulatory spotlight, grappling with significant legal challenges. Despite fears of market panic and customer exodus, the reality unfolded differently.

In August, whispers of potential DOJ charges against Binance sent ripples of concern across the crypto community. The anxiety was not without merit; history has shown that such indictments can trigger a domino effect of withdrawals, leading to liquidity crises.

Yet, when the “historic” settlement was announced, with Binance shouldering a hefty $4.3 billion penalty and its charismatic leader CZ stepping down, the anticipated turmoil did not materialize.

Instead, while experiencing a brief uptick, withdrawals did not signal a loss of faith in Binance’s stability. The exchange’s proof of reserves painted a reassuring picture of $65 billion in assets, confirming its financial robustness.

The Binance saga, while significant, proved to be a hiccup in the grander scheme of the crypto market’s narrative in 2023. It highlighted the sector’s capacity to absorb shocks and the unwavering trust of its participants.

As we look to the future, the incident is a stark reminder of the sector’s agility and the undiminished allure of digital assets. The market’s journey through 2023 has reinforced the notion that resilience is not just a buzzword in the crypto world—it’s the industry’s bedrock.

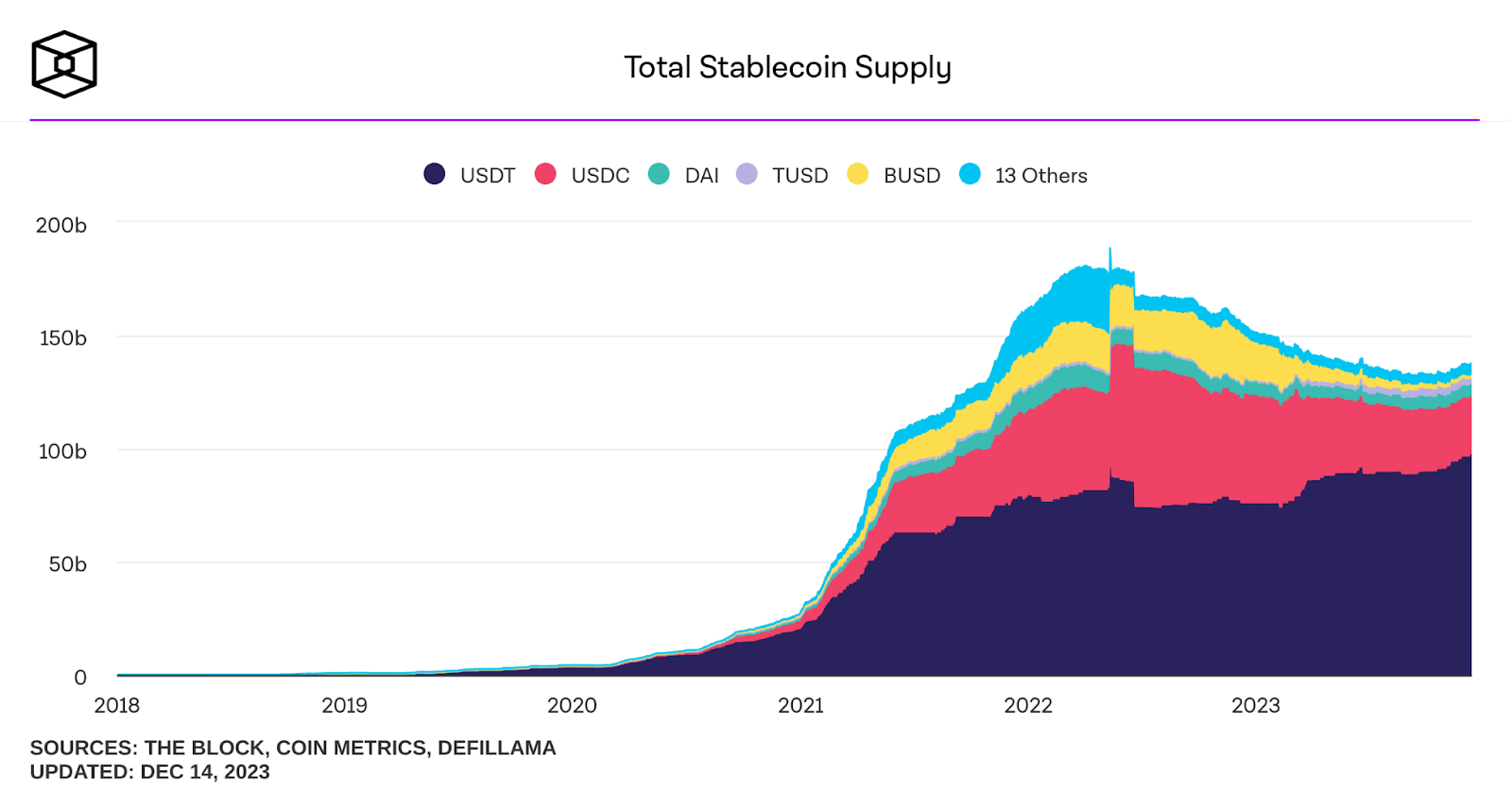

USDT commands a dominant 71.17% of the stablecoin market share of the $129 Million Stablecoin Industry

Defillama

DefillamaThe stablecoin arena has seen a gripping 2023, with the total supply initially peaking at $129 billion. Fast forward to December 14th, and the pot’s simmered to $137 billion. The pie’s been sliced, with USDT gobbling up the lion’s share of 70%, hoarding $97.5 billion. USDC isn’t far behind, stashing 18.69% or $25.6 billion. DAI’s in the mix, too, clutching 3.86% with $5.29 billion.

USDT’s the juggernaut, holding ground as the go-to stablecoin. USDC and DAI, trailing but not dragging, are carving their niches. Though the stablecoin supply dipped mid-year to $139 billion, the slight slip to $137 billion hasn’t dimmed the market’s spark. These numbers aren’t just digits—they’re the story of a market pulsing with life, of traders hedging against volatility with stablecoins they trust

The DEX market stands at $50 billion, with sights set on breaking past that $100 billion mark

The DEX market cap has had a rollercoaster year in 2023. Starting at a humble $67.65 billion, it surged to a towering peak of $133 billion in March, showcasing a market on a bullish tear. But then, gravity kicked in, and the market cap began its descent, bottoming out at $44.56 billion in September—a stark reminder of the volatility inherent in the crypto world.

Defillama

DefillamaYet, when the market slowed, DEX staged a comeback, clawing its way back to $97.45 billion in recent months. The resilience of the DEX market is now on full display, as it stands at $50 billion by mid-December, with sights set on breaking past that $100 billion mark before the year’s curtain call. With a weekly change roaring at 33.34%, it’s a signal that traders are far from calling it quits.

The DEX vs. CEX showdown is equally riveting, with DEX claiming 18.57% of the total exchange volume pie.

DeFi Thrives with $112 Billion Market Cap and $4.5 Billion Volume

2023 for DeFi was a ride with dizzying highs and sobering lows, beginning with a respectable $67.32 billion TVL and a $694 million volume. By March, the sector surged to a high of $95.28 billion, with volumes swelling to $2.72 billion, showcasing the bullish undercurrents.

But DeFi wasn’t spared from volatility; mid-March brought a gut-wrenching dip, plunging the TVL to $81.02 billion despite a volume spike to $7.927 billion.

Defillama

DefillamaBut just like a phoenix, DeFi rose again with the market’s October rally, pushing the TVL past the $100 billion mark to stand tall at $107 billion, paired with a robust $4.32 billion volume. Amidst this, the stablecoin market cap contributed a hefty $129 billion. Currently, with a $4.5 billion volume and $97.97 billion in total funding, DeFi isn’t just surviving; it’s thriving,

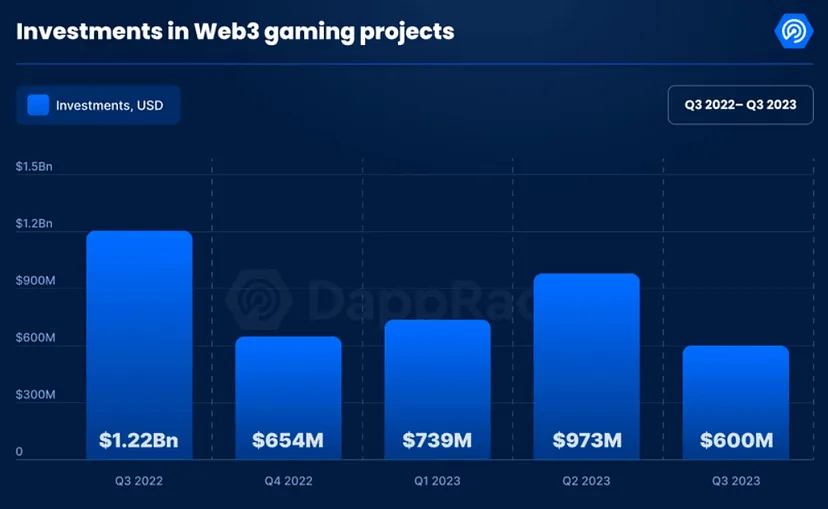

The Gaming sector dominates the dApp ecosystem, with a 33% market share of Unique Address Wallets (UAW)

Gaming in the dApp world is hitting the fast lane, with unique wallet addresses zooming in by the day. It’s not just a trend; it’s a takeover. The numbers from June to October 2023 project a positive trend. Further, web3 gaming hit 1 million daily active wallets in December.

DAPPRADAR

DAPPRADARInvestors are all-in, betting big on Web3 gaming. The cash flow’s been wild, with $739 million in Q1 and $973 million in Q2. Even a dip to $600 million in Q3 hasn’t slowed the pace. Over a year, we’re talking billions pumped into gaming dApps, proving that the stakes are sky-high in the future of play.

.png)

11 months ago

5

11 months ago

5

English (US)

English (US)