ARTICLE AD BOX

Bitcoin (BTC), Ethereum (ETH), and the broader crypto market have notably recovered following Monday’s market meltdown.

After dipping to the $49,000 level on August 5, Bitcoin is now trading at $57,375. Similarly, Ethereum has regained its footing at $2,519 after plummeting to as low as $2,100 on the same day.

Bullish Sentiments Persist Despite Macroeconomic Risks

Data from Santiment revealed that the crowd played a massive part in crypto rebounding over the past 30 hours. Analysts attribute this rapid rebound to large-scale investors, commonly called whales, who have been actively accumulating these crypto assets.

Read more: Who Owns the Most Bitcoin in 2024?

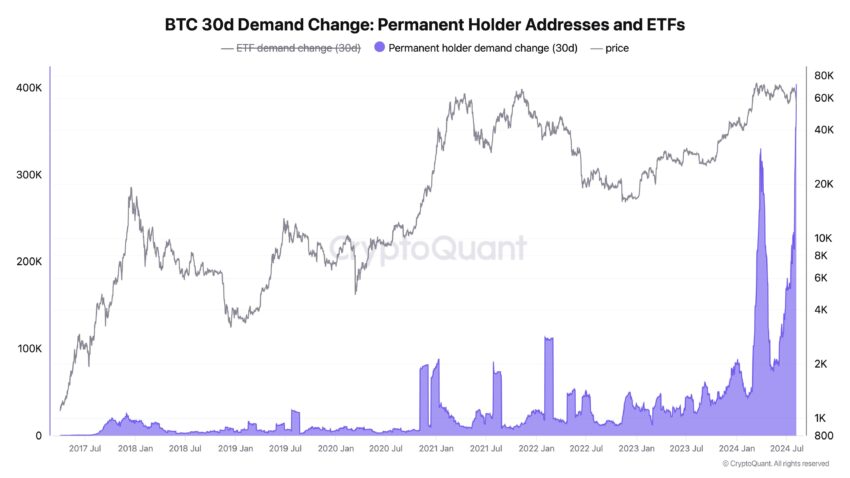

On-chain data from CryptoQuant shows that over 404,000 Bitcoins have moved to permanent holder addresses in the past 30 days. Ki Young Ju, CEO of CryptoQuant, stated that this is “clearly accumulation.” Ki also noted significant inflows of 40,000 Bitcoin to US spot exchange-traded funds (ETFs) over the last 30 days.

“New whales are accumulating,” he said.

Bitcoin Demand Change. Source: CryptoQuant

Bitcoin Demand Change. Source: CryptoQuantAdditionally, Ki pointed out the absence of major selling activity by “old whales,” referring specifically to the large investors who have held their positions for over three years. He noted that these whales sold their holdings to new whales between March and June.

Despite bullish sentiments, Ki acknowledges potential macroeconomic risks that could lead to forced sell-offs. He cited large deposits like those by Jump Trading as examples. Moreover, he noted that some on-chain indicators turned bearish but are borderline.

Amid rising worries about the crypto market’s future due to a recent crash, Ki remains optimistic. He believes that the bull market is still strong.

“If the market doesn’t recover in two weeks, I’ll reconsider. I follow smart money, so if I’m wrong, it means the new whales are either misguided or underestimated the macro environment,” he said.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

A recent report by CoinGecko further strengthens Ki’s belief. The report stated that the crypto market’s crash during COVID-19 was still five times worse than the recent sell-offs.

“In the last ten years, the worst global crypto market correction has been the -39.6% COVID-19 crash on March 13, 2020. […] In comparison, the largest crypto market sell off to date this year was significantly less severe at only -8.4%, which took place on March 20, 2024,” the report reads.

The post Crypto Whale Accumulations Drive Swift Market Recovery, Say Analysts appeared first on BeInCrypto.

.png)

3 months ago

2

3 months ago

2

English (US)

English (US)