ARTICLE AD BOX

In a surprising turn for the struggling NFT market, a rare CryptoPunk from the Ape Punk collection has sold for approximately $1.5 million, offering a glimmer of hope amid declining sales and dwindling interest in digital assets. The transaction underscores the ongoing appeal of exclusive NFT collections, despite the broader market downturn.

Ape Punk Sale Nets Huge Profit

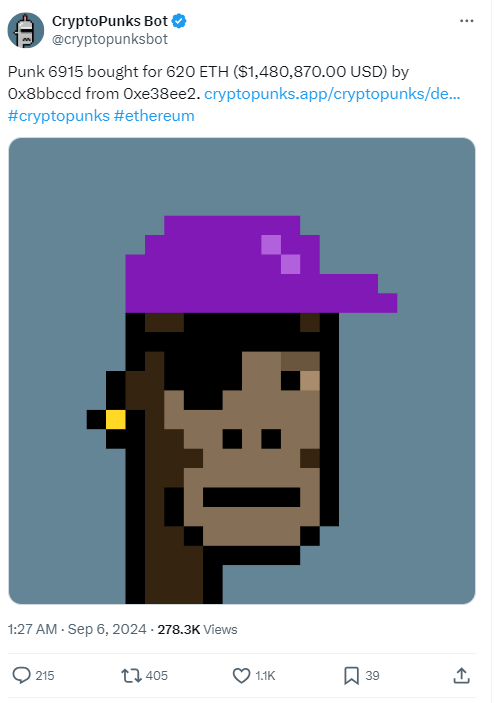

CryptoPunk 6915, one of the 24 highly coveted Ape Punks, was recently sold for 620 ETH, equating to around $1.48 million, by a collector known only as “0x8bbccd.” This sale, recorded by CryptoPunks Bot, represents a staggering 59,390.10% profit for the seller, who originally acquired the NFT for just 3.5 ETH ($2,455) in December 2017. The seller, identified as “0xe38ee2,” continued their streak by also selling CryptoPunk 9479 for 35 ETH ($82,466) shortly after.

This latest transaction comes amid a challenging period for the NFT market, where demand has been waning. However, rare pieces like the Ape Punks, issued by Larva Labs, continue to command substantial prices, fueling some renewed optimism.

CryptoPunks Continue to Lead NFT Market

CryptoPunks, known for being one of the earliest and most valuable NFT collections, remain at the forefront of the NFT space. While the Ape Punk sale is impressive, it’s far from the collection’s peak sales figures. In February 2022, CryptoPunk 5822 was sold for a jaw-dropping 8000 ETH, or $23.7 million. Similarly, in March 2024, CryptoPunk 3100 fetched $16.03 million, followed by CryptoPunk 7804 selling for $16.42 million just weeks later.

These high-value sales have made CryptoPunks one of the most recognizable brands in the NFT world, and the recent $1.5 million sale has once again caught the attention of investors and collectors alike. Despite the market’s challenges, the iconic collection recorded a 24-hour sales volume of approximately $1.68 million.

Wider Market Struggles Amid Regulatory Concerns

Although the recent sales have provided a boost to the NFT community, the broader market continues to face difficulties. According to data from Cryptoslam, NFT sales volume has dropped by 42.15% in the past month, while total transactions have declined by 24.48%, signalling weakening demand for digital assets. The current economic environment and cautious buyer sentiment have contributed to this decline.

Compounding these challenges, the U.S. Securities and Exchange Commission (SEC) has issued a Wells notice to OpenSea, one of the largest NFT marketplaces. This move has intensified concerns about the future regulation of NFTs, with growing fears that they may be classified as securities, leading to more stringent oversight.

.png)

2 months ago

1

2 months ago

1

English (US)

English (US)