ARTICLE AD BOX

- The Czech National Bank is considering Bitcoin for foreign exchange reserves but requires board approval.

- The Czech government is also implementing pro-crypto measures, including tax reforms that benefit long-term Bitcoin holders.

The Czech National Bank is reportedly looking into the possibility of Bitcoin as a foreign exchange reserve option. Recently, Governor Aleš Michl expressed his desire to buy a small amount of Bitcoin to diversify the portfolio. Although this is not a huge investment, it is linked with other debates on Cryptocurrency usage in the country.

Czech Republic’s Growing Interest in Crypto

The Czech National Bank is evaluating Bitcoin as a strategic asset, but no concrete steps have been taken yet. Michl noted that any investment in Bitcoin would require the consent of the bank’s seven-person board of directors.

He said they could consider cryptocurrency as an instrument for diversification in the future as there is a positive attitude towards cryptocurrency within the Czech government. The recent events in the country, such as debates on the crypto tax overhaul, indicate that authorities are now welcoming digital assets.

The Czech government has submitted a plan to exclude digital asset transactions from capital gains tax if the assets are held for at least three years. This initiative, which also eliminates the need for reporting transactions below 100,000 koruna or about $4300, is positive for long-term investors.

International Bitcoin Reserve Interest Grows

Interest in Bitcoin as a reserve asset is gaining traction globally. In the United States, Wyoming Senator Cynthia Lummis has proposed the Bitcoin Act to initiate a deliberate purchase of Bitcoin, as CNF reported. Several states, including Ohio and Pennsylvania, are also exploring similar legislation because of the depreciation of the US dollar.

Japan and Switzerland are also looking to accumulate Bitcoin reserves. A petition is currently being conducted to support the idea of including Bitcoin and gold in the Swiss national reserves.

In Russia, Bitcoin reserves are being discussed as lawmakers act in response to international sanctions and changing economic environments. In Germany, the Liberal Party leader and former Finance Minister Christian Lindner claimed that Bitcoin could help decrease the reliance on the US dollar if used by either the European Central Bank or the Bundesbank.

The government of Bhutan is looking to cement the country’s status as a new economic power by launching a strategic cryptocurrency reserve that will contain assets such as Bitcoin, Ether, and Binance Coin (BNB). Gelephu Special Administrative Region, also known as Gelephu Mindfulness City, has declared its willingness to include these digital assets in its strategic reserves.

This global trend is also visible in Hong Kong. The Legislative Council member Wu Jiezhuang suggested that Bitcoin should be included in the city’s reserve funds to strengthen the economy, as reported by CNF. This comes after another legislator, Johnny Ng, said that if the US were to create a Bitcoin reserve, Hong Kong should also consider doing so.

Bitcoin Price Drops

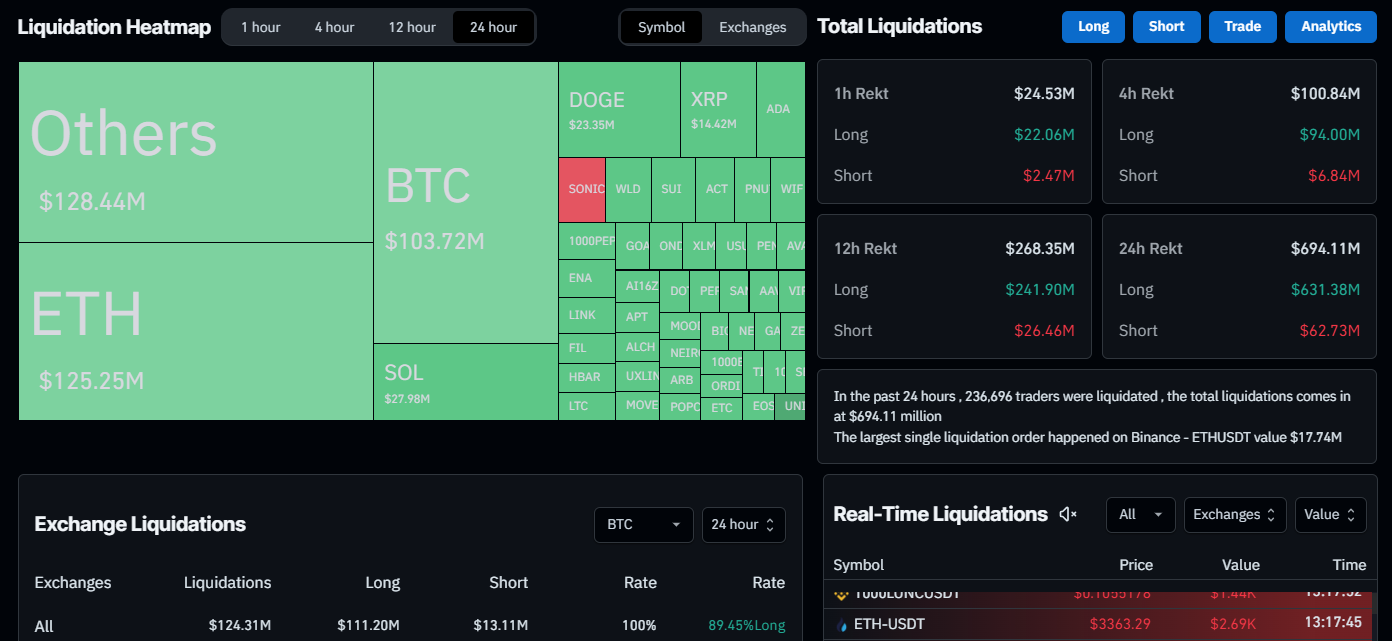

The price of Bitcoin has dipped below $95,278, a more than 5% drop from the previous day. The drop resulted in $694.11 million in liquidations across the cryptocurrency market within the last 24 hours, of which $124.5 million was in BTC.

[mcrypto id=”19649″]CoinGlass’s Bitcoin long-to-short ratio stands at 0.89, the lowest in more than a month. A ratio below one points to increased bearishness as more people open positions, expecting the price of BTC to fall. Also, the Bitcoin ETF inflow declined from $978.60 million on Monday to $52.40 million on Tuesday, pointing to lower institutional investments.

Source:Coinglass

Source:Coinglass.png)

8 hours ago

6

8 hours ago

6

English (US)

English (US)