ARTICLE AD BOX

Break free from debt with Gene Jolley’s innovative approach: Debt Snowball Method and Tax-Free Account Strategy

— Albert Einstein

GROTON, VT, UNITED STATES, January 13, 2024 /EINPresswire.com/ — *Gene Jolley, a seasoned financial professional with over two decades of experience, is on a mission to help people get out of debt and live debt-free.

“Understanding how compound interest works is crucial,” Jolley explained. “With powerful tools, we aim to empower individuals to make informed financial decisions and achieve lasting financial freedom. Our approach involves utilizing the debt snowball method combined with a specially designed life insurance policy to pay off debt quicker and build a tax-free account.”

**About the Financial Empowerment Initiative**

Gene Jolley’s goal is to educate people about what they are actually paying on their debts. Often, the effective interest rate is close to 30% of their monthly payment amount going to interest alone. This initiative is dedicated to providing individuals with the knowledge and tools needed to break free from the cycle of financial challenges and take control of their financial destiny. Jolley aims to reveal the hidden costs of debt and guide individuals toward smarter financial decisions, ultimately leading to a happier and financially secure life.

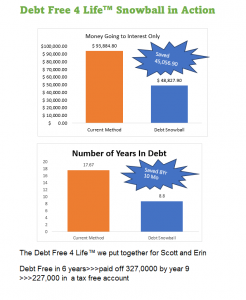

**Example: Meet Erin & Scott from Debt Free 4 Life**

Meet Erin & Scott from our free book Debt Free 4 Life. They have the typical debts: credit card debt of $3,064, auto debt of $27,000, and a mortgage of $297,000. They are paying $3,500/mo in debt obligations. Paying the minimum amount, they will be in debt for 17.67 years. With an effective interest rate of 25%, $907 is going to interest alone. Using our method, they would be debt-free in 6 years, and by year 9, would have $227,000 in a tax-free account. (*Results not typical. Results vary based on the number of debts, minimum payments, interest rates, available budget to allocate to the DF4L Plan, the performance of the insurance carrier’s cash value, and loan rates.*)

**Key Insights on Financial Freedom**

Jolley sheds light on the financial challenges faced by many Americans, including the impact of compound interest on monthly financial commitments. His advocacy aims to address common financial mistakes and equip individuals with the understanding needed to navigate the financial landscape successfully, utilizing advanced tools for financial empowerment.

**Financial Awareness for Long-Term Success**

With a keen focus on financial education and the support of tools, Jolley’s initiative aims to raise awareness about critical financial concepts. By avoiding common pitfalls and gaining a deeper understanding of financial mechanics, individuals can make informed decisions to improve their financial well-being, including leveraging the debt snowball method and tax-free account strategy.

**Addressing the Financial Landscape**

Jolley recognizes the financial complexities individuals face and aims to demystify the financial sector. The initiative acknowledges that there is no one-size-fits-all solution to achieving financial freedom and strives to help individuals determine the most suitable path based on their unique circumstances, incorporating innovative tools like the debt snowball method and tax-free account strategy.

**Empowering Individuals for a Financially Secure Future**

Gene Jolley’s financial empowerment initiative provides individuals with the knowledge and resources to strategically manage their finances. By understanding the inner workings of the financial industry and utilizing state-of-the-art tools, individuals can accelerate their journey to financial freedom, leveraging the debt snowball method and a specially designed life insurance policy.

**Media Contact:**

Gene L Jolley

Gene L Jolley

email us here

Visit us on social media:

Facebook

LinkedIn

YouTube

Effective Interest Rate on Monthly Debt Payments

![]()

Source link

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.

.png)

10 months ago

6

10 months ago

6

,

,

English (US)

English (US)