ARTICLE AD BOX

Crypto trader DeFiSquared shared a comprehensive analysis of the Worldcoin project and its native token—WLD. Their analysis delves into concerns about the project that Sam Altman of OpenAI co-founded, focusing on tokenomics design.

DeFiSquared explained that Worldcoin “realistically” might be the biggest wealth transfer of this cycle. Yet, this may not come as universal basic income as the project’s mission suggests.

DeFiSquared Accused Worldcoin (WLD) of Having “Predatory Tokenomics”

DeFiSquared shared some calculations regarding the WLD token’s hyperinflation. Currently, at a $60 billion fully diluted valuation (FDV), the token is being devalued by 0.6% daily due to emissions from grants and operator claims, mostly sold immediately.

DeFiSquared thinks many investors must be aware of the expected aggressive WLD sell-off. The Worldcoin Foundation announced it will sell $200 million more WLD tokens to trading firms. This transaction will add 18% of the entire circulating supply sold at a discount to counterparties.

“These $200 million of tokens come from the deceptively named ‘Community’ allocation of WLD token supply, yet are being sold to adversarial parties to benefit the foundation,” DeFiSquared noted.

Read more: How to Buy Worldcoin (WLD) and Everything You Need to Know

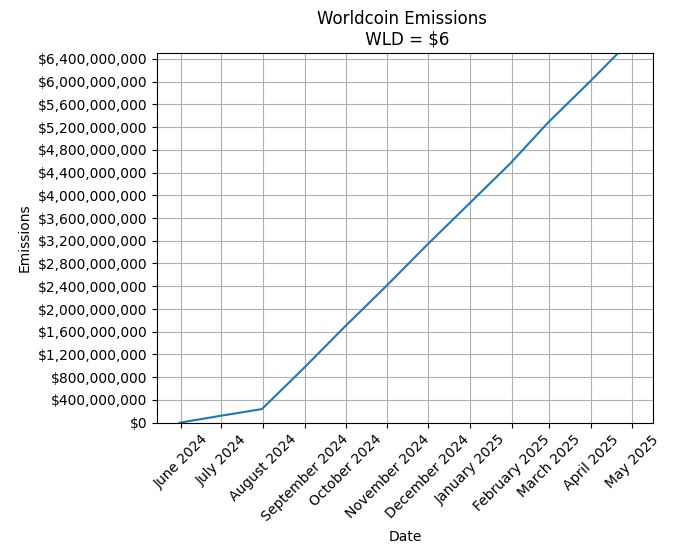

Worldcoin’s Emission Rate. Source: X/DeFiSquared

Worldcoin’s Emission Rate. Source: X/DeFiSquaredThe most important thing, according to DeFiSquared, is that in just 70 days, when the token allocation to venture capital (VC) and teams starts to open, the supply of WLD will increase by 4% per day. That’s nearly $50 million per day of “non-stop selling pressure” on WLD tokens that insiders hope to cash out at an FDV of US$60 billion.

Moreover, DeFiSquared alleged that crypto tokens like Worldcoin were designed to have “predatory tokenomics” since the beginning. DeFiSquared highlighted an event in December 2023 as the prime example of Worldcoin’s predatory tokenomics. At that time, they said that the Worldcoin Foundation intentionally terminated the market maker contract that prevented WLD prices from squeezing higher on low float.

They noticed that the low float, high FDV design is a similar tactic used by Sam Bankman-Fried, the co-founder and former CEO of crypto exchange FTX. This design also directly enriches insiders as they hedge their locked allocations at high valuations pre-unlock via perpetual or over-the-counter (OTC).

“Yet retail somehow sadly still thinks they’re beating the system trying to push the price up,” they suggested.

DeFiSquared also reminds investors to be alert to some strategically timed announcements between now and the token unlock period for WLD insiders in July. They see that the unlock will most likely create profitable exit liquidity for WLD insiders.

Exit liquidity is a common tactic in the crypto industry. Insiders use hype and announcements to increase the price of select crypto assets. After seeing the price rise, they will sell their holdings, leaving retail investors at potential losses.

Despite public assumptions, DeFiSquared thinks the project has no real connections to the popular artificial intelligence (AI) project—OpenAI. Therefore, they called it “a deceptive project.”

They also flagged that most retail buyers probably need to realize that Sam Altman has no active involvement in Worldcoin. DeFiSquared emphasized that the project is under a completely separate entity from OpenAI.

Historically, OpenAI’s development often influenced WLD’s price performance. BeInCrypto reported last week that WLD surged 30% amid rumors of a new OpenAI search engine product. Additionally, when OpenAI announced Sam Altman’s departure as the company’s CEO, WLD dropped over 13%.

Read more: Worldcoin (WLD) Price Prediction 2024/2025/2030

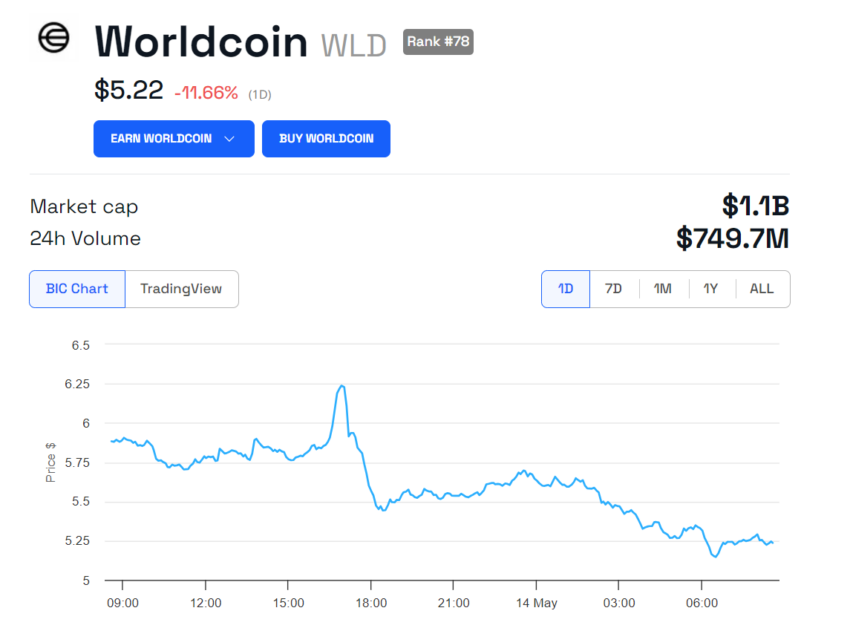

Worldcoin (WLD) Price Performance. Source: BeInCrypto

Worldcoin (WLD) Price Performance. Source: BeInCryptoHowever, OpenAI’s introduction of GPT-4o on Monday has not pushed WLD’s price. At the time of writing, WLD is trading at $5.22. This figure marks a decrease of 11.66% for the last 24 hours.

The post DeFi Analyst Breaks Down Issues with WorldCoin (WLD) Unlock Schedule appeared first on BeInCrypto.

.png)

6 months ago

2

6 months ago

2

English (US)

English (US)