ARTICLE AD BOX

Deutsche Bank Research has ignited a significant debate within the financial sector with its recent analysis of stablecoins. It also highlighted potential risks in the operations of Tether’s USDT.

The study reviewed 334 currency pegs since 1800 and found that only 14% have remained stable. This insight casts doubt on the longevity of stablecoins like USDT, which strive to maintain equal value with fiat currencies like the US dollar.

How Tether Responded to Deutsche Bank Report

Stablecoins, especially USDT, play a critical role in the crypto market by offering traders a stable asset amid the sector’s typical volatility. USDT’s market cap has surged beyond $100 billion, often outpacing Bitcoin in daily trading volumes.

However, Deutsche Bank’s report questions the stability and transparency of Tether’s practices, referencing past regulatory issues that have raised skepticism about its reliability.

Read more: A Guide to the Best Stablecoins in 2024

In 2021, Tether faced a $41 million fine from the Commodity Futures Trading Commission and a $18.5 million settlement with the New York Attorney General. These penalties stemmed from misleading claims about the sufficiency of its reserve holdings.

Such incidents underscore lingering doubts about the strength of Tether’s financial backing and its overall credibility.

The bank’s analysts stress that historically, pegged currencies that survived were backed by strong reserves, enjoyed high credibility, and were tightly regulated—qualities they suggest many prominent stablecoins lack. The dramatic failure of Terraform Labs’ TerraUSD and its sister token Luna, which wiped out $40 billion from the crypto market, is an example of potential instability.

Furthermore, the report points to Tether’s dominant position in a market characterized by speculative practices and opacity. This monopoly and a questionable compliance record could pose broader risks to the cryptocurrency ecosystem.

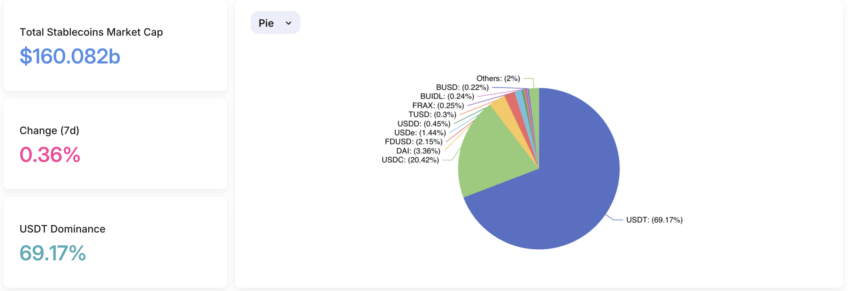

Also in February, another bank – JPMorgan, raised concerns about the increasing dominance of Tether’s USDT. According to DefiLlama, USDT has over 69% dominance in the stablecoin market.

Read more: 9 Best Crypto Wallets to Store Tether (USDT)

USDT Dominance. Source: DefiLlama

USDT Dominance. Source: DefiLlamaDespite these challenges, Tether’s CEO, Paolo Ardoino, remains optimistic.

“Tether’s market domination may be a ‘negative’ for competitors including those in the banking industry wishing for similar success but it’s never been a negative for the markets that need us the most. We’ve always worked closely with global regulators to educate them on the technology and provide guidance on how they must think about it,” Ardoino said.

Moreover, the US is contemplating the stablecoin regulations, and the European Union plans to start implementing the Markets in Crypto-Assets Regulation (MiCA) by mid-year. These legislative changes could significantly influence the compliance and operational standards for stablecoin issuers like Tether.

The post Deutsche Bank Raises Concerns About Tether’s Stablecoin Operation appeared first on BeInCrypto.

.png)

6 months ago

2

6 months ago

2

English (US)

English (US)