ARTICLE AD BOX

In the days leading up to the Bitcoin halving, the cryptocurrency market has experienced a significant downturn, raising concerns about a potential bear market.

Bitcoin saw a notable 19% price drop, while altcoins faced even steeper declines, with some plummeting by as much as 70%. This trend has sparked a debate among investors about the immediate future of cryptocurrencies as the halving approaches.

Bitcoin and Altcoins Nosedive Before the Halving

Historically, the Bitcoin halving — a scheduled reduction in the reward for mining new blocks — has been a catalyst for bullish market sentiment. The event effectively slashes the supply of new BTC, which in theory should increase the price if demand remains constant.

However, Garry Kabankin, Market Analyst at Santiment, told BeInCrypto that the market does not operate solely on fundamentals, particularly in periods surrounding such significant events. The recent price corrections in Bitcoin and altcoins may reflect a natural market response to speculative anticipation, rather than fundamental declines in value.

Indeed, the current market scenario reflects a speculative trading environment leading up to the halving.

“The steep drop in altcoins, even more so than Bitcoin, underscores the heightened volatility and speculative trading that can precede such events. It’s a reminder of the market’s sensitivity to supply dynamics changes, where the reduced block reward post-halving can lead to expectations of decreased supply pressure,” Kabankin explained.

Kabankin explains that observing miner behavior, such as changes in miners’ balance and total supply, can provide further insights. A decrease in miners selling their holdings pre-halving could suggest a bullish outlook, expecting higher prices post-event.

Nevertheless, the true impact of the halving will only become clear in the weeks following. As the market adjusts to the new supply rate, its implications for Bitcoin’s scarcity and value can be understood.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

Bitcoin Supply Held By Miners. Source: Santiment

Bitcoin Supply Held By Miners. Source: SantimentThe ongoing downturn is somewhat typical of the cyclical nature observed around past halvings. Essentially, anticipation leads to speculative runs followed by corrections. However, Kabankin points out that given the current on-chain metrics and social sentiment, a nuanced view is necessary.

“Historically, we’ve seen euphoria around halvings, often leading to a reevaluation of positions post-event. It’s crucial to monitor social sentiment and whale behavior for more immediate signs of market directio,” Kabankin added.

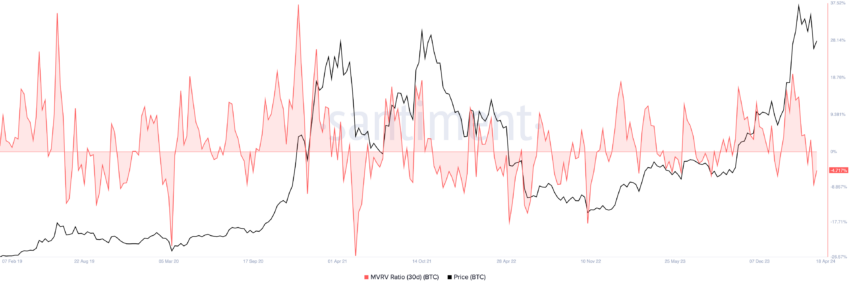

Moreover, the Market-Value-to-Realized-Value (MVRV) ratio offers a clear view of market sentiment. It indicates whether the asset is over or undervalued at any given time. According to Kabankin, investors should also closely monitor the mean coin age. Significant drops can signal increased movement and potential selling pressure, hinting at broader market shifts.

These indicators, combined with traditional support levels from technical analysis, can guide investors through uncertain times.

Bitcoin MVRV Ratio. Source: Santiment

Bitcoin MVRV Ratio. Source: SantimentKabankin believes that to spot the potential resumption of a bull run, investors should pay attention to a blend of social sentiment and on-chain metrics. A decrease in fear, uncertainty, and doubt (FUD) coupled with an increase in fear of missing out (FOMO), often precedes market upswings.

Furthermore, a significant uptick in stablecoin supply moving onto exchanges can signal readiness for buying action, hinting at bullish sentiment. Also, an increase in trading volume can indicate growing support for the trend. It may suggest a healthier buildup to a bull run.

“Looking at resistance barriers and on-chain signals is crucial for spotting potential turnarounds. One key metric to watch is the Mean Dollar Invested Age, especially when it starts decreasing, which can indicate that previously dormant tokens are moving, suggesting a potential shift in market sentiment,” Kabankin emphasized.

Bitcoin Mean Dollar Invested Age. Source: Santiment

Bitcoin Mean Dollar Invested Age. Source: SantimentAs the crypto market remains notoriously volatile, these signs are vital for predicting its next moves. The historical pattern post-Bitcoin halving has often ignited altcoin seasons. This is a direct result of investors searching for higher returns beyond the initial surge in Bitcoin. With recent dynamics and on-chain activities suggesting a buildup, another cycle might be on the horizon.

Read more: What Happened at the Last Bitcoin Halving? Predictions for 2024

The excitement around altcoins, as indicated by social metrics and trading volumes, points to a growing appetite among investors. However, it is crucial to monitor these trends closely, as rapid shifts can occur in the cryptocurrency markets.

The post Did Bitcoin Enter a Bear Market Before the Halving? Santiment Explains appeared first on BeInCrypto.

.png)

7 months ago

3

7 months ago

3

English (US)

English (US)