ARTICLE AD BOX

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

Visit unchained.bitcoinmagazine.com for resources and special offers to upgrade your bitcoin security.

Visit unchained.bitcoinmagazine.com for resources and special offers to upgrade your bitcoin security.

Once someone decides that they want to hold bitcoin in self-custody, they will soon discover that hardware wallets are the most secure tools for managing bitcoin keys. The next question becomes whether to use a singlesig wallet or a multisig wallet.

If you choose to use multisig to secure your long-term savings, you will also need to decide whether you want to set it up all by yourself, or in collaboration with others. Both of these approaches have their own set of trade-offs, and in this article we will compare and contrast them.

Do-it-yourself (DIY) multisig

An attractive characteristic of bitcoin is that it allows people to become more self-sovereign with their wealth. If you’re someone who emphasizes the importance of this feature, your initial reaction to collaborative custody multisig may be one of skepticism. You might instead be considering setting up multisig by yourself, without involving anyone else in your arrangement.

A multisig wallet can be set up by using one of several free and open source wallet softwares, such as Caravan, Sparrow Wallet, or Electrum. They allow you to combine extended public keys (xpubs) to build the multisig quorum you want. This approach has a couple of advantages—it gives you the opportunity to customize the structure to suit your needs and potentially retain more privacy than collaborative multisig.

Collaborative custody multisig

Although “collaborative custody” may seem like an alternative to self-custody, these labels are not mutually exclusive. In a thoughtfully designed multisig structure, both terms can accurately describe the same situation.

Bitcoin self-custody is typically defined by who possesses the power to spend the bitcoin. If you hold bitcoin in self-custody, then you’re the only one with unilateral power to spend your bitcoin. Collaborative custody means you're collaborating with another party to help you manage or spend the bitcoin. In a 2-of-3 multisig where you hold two keys and a collaborative partner holds one key, both features are available! You can still move your bitcoin without relying on the collaborative partner, but you can also receive assistance from them when needed. Additionally, your collaborative partner cannot move your bitcoin without your consent.

Collaborative custody multisig can be set up with two or more people. If you have someone in your life that is technical and trustworthy, you could work with that person to set up collaborative custody. However, the most popular approach is to form a partnership with a business that specializes in collaborative multisig. Choosing an established company with a great reputation will grant you access to a team of experts you can trust for help, without giving up control over your bitcoin.

If you work with one or more collaborative key agents, you will simplify your setup by reducing the number of items you need to keep track of yourself. The partnership can also provide you with a resource to help you think through wallet maintenance, such as retaining the wallet configuration information, re-securing your bitcoin if a key becomes lost or compromised, navigating technical difficulties, and managing UTXOs. An institutional collaborative partner can provide the added benefit of actively monitoring for any suspicious activity in connection with your bitcoin wallet, as well.

Trade-offs

Privacy

As mentioned previously, collaborative custody will typically involve sharing some information with your collaborative partner about your bitcoin. This is necessary to get the most value and support out of the relationship.

In most cases, your collaborative partner will be able to see your bitcoin balance, and observe the bitcoin addresses that you interact with while sending and receiving bitcoin. This is why you should only ever consider collaborative partnerships with people or businesses you can trust to respect your privacy.

At Unchained, we are transparent about this reality. The privacy of our clients is taken seriously, and you can view the details of our privacy policy here.

Ease of setup and operation

The biggest downside to attempting multisig on your own is the lack of reliable technical support available for you and your beneficiaries. Multisig is more involved than singlesig, and has several components that must be properly managed. Otherwise, you might find yourself in a difficult situation when trying to access your bitcoin in the future.

Visit Unchained.com for $100 off any Unchained financial services product with code “BTCMAG100”

Visit Unchained.com for $100 off any Unchained financial services product with code “BTCMAG100”

For example, you will need to know a little about xpubs and BIP 32 derivation paths to understand the specifics about how your multisig wallet is configured. This information can be found in a wallet descriptor or wallet configuration file, which is an important item you will be responsible for keeping in your possession. If this file is lost, then you are at risk of losing access to the bitcoin in your multisig wallet, even if you still have a controlling number of keys within the multisig quorum.

A partner like Unchained can help you recover your bitcoin as long as you have access to at least one of your keys.

A partner like Unchained can help you recover your bitcoin as long as you have access to at least one of your keys.

Additionally, with an abundance of bitcoin software and hardware designed by various parties, you may run into occasional interoperability issues that can be confusing and frustrating to navigate. These bumps in the road are not uncommon while using bitcoin, and multisig can add another layer of complexity. If you aren’t very technical, or confident about the mechanics of bitcoin and multisig, you may need to rely on outside assistance in these situations. Without an established collaborative partnership, you may be vulnerable to receiving incorrect (or even malicious) advice.

Spending convenience

If you want to get the most out of multisig, then you’ll want to geographically separate the keys. Keeping the keys together in the same location would resemble a more cumbersome version of singlesig. Separating the keys is what adds security and removes single points of failure, but it will also mean that it’s less convenient to make a withdrawal.

If you operate a multisig wallet on your own and separate the keys, then you will have to travel to different locations in order to take any bitcoin out of your wallet. This might not seem like a big deal, if you are holding your bitcoin savings for the long term, and have no plans for regular withdrawals. However, you could still be put into a difficult position if a situation occurred where you needed to access your bitcoin, but your movement was restricted due to unforeseen circumstances, such as a local crisis.

If you use a collaborative custody setup, such as a 2-of-3 quorum where you keep one key at home, one key away from home, and a key agent partner holds the third key, then you have an avenue to accessing your bitcoin that doesn’t require travel. You can sign a withdrawal using your key at home and call upon your collaborative partner to use their key, so that your bitcoin can be spent more conveniently.

Inheritance

Even if you are personally confident with the technology behind bitcoin and multisig wallets, a concern might be inheritance. If you want your beneficiaries to have access to your bitcoin in the event of your death or incapacitation, and they are not as familiar with bitcoin as you are, it can be challenging to find a good solution.

In a DIY multisig setup, creating functional instructions for your loved ones on how to find your multiple, separate keys and recover your bitcoin is not always as simple as it sounds, especially if you want to leave no room for error. Your loved one will need to know how to access and use your wallet configuration file, find your multiple seed phrases and load them into one or more hardware wallets, and use those devices to perform signatures for the withdrawal.

Collaborative custody can make for a much smoother experience. Since your collaborative partner will typically have the wallet configuration file, one of the keys in a standard 2-of-3 quorum, and the technical expertise required for recovery, your executor or trustee will barely need to do any work at all. As long as they can access just one of your seed phrases, and they also understand they are supposed to reach out to your collaborative partner in the event of your demise, they wouldn’t need to know any additional details about how bitcoin works! Your collaborative partner could simply instruct your executor or trustee on how to load the seed phrase into a signing device and sign a transaction to move your bitcoin to the wallets of your beneficiaries.

For example, in the case of Unchained, our Inheritance Protocol guides the user through everything they need to know for setting up simple and secure recovery. Our model makes it easy to safely transfer possession of your bitcoin to beneficiaries designated by a will or trust.

Access to financial services

One unique advantage of collaborative custody institutions is that they can grant you easy access to other bitcoin financial services. Besides inheritance, this could include retirement, trading, loans, or other business needs. If you don’t have a collaborative custody partner, you may be able to find companies that offer some of these services in the context of bitcoin. However, there is an important difference.

Collaborative custody institutions have a vested interest in a long-term relationship, because you can use your keys to permissionlessly withdraw your funds and exit the partnership at any time. Your collaborative partner can do nothing to stop this, other than provide high quality services to maintain your desire for the partnership to continue.

Other business models will not necessarily have your best interests in mind. As witnessed in recent years, many large bitcoin exchanges and lending services have demonstrated a shortsighted approach, treating client funds with gross negligence, even to the point of losing peoples' bitcoin with little opportunity for recourse. The principles of self-custody and low time-preference relationships are what can help protect you from these kinds of breaches of trust.

Visit Unchained.com for $100 off any Unchained financial services product with code “BTCMAG100”

Visit Unchained.com for $100 off any Unchained financial services product with code “BTCMAG100”

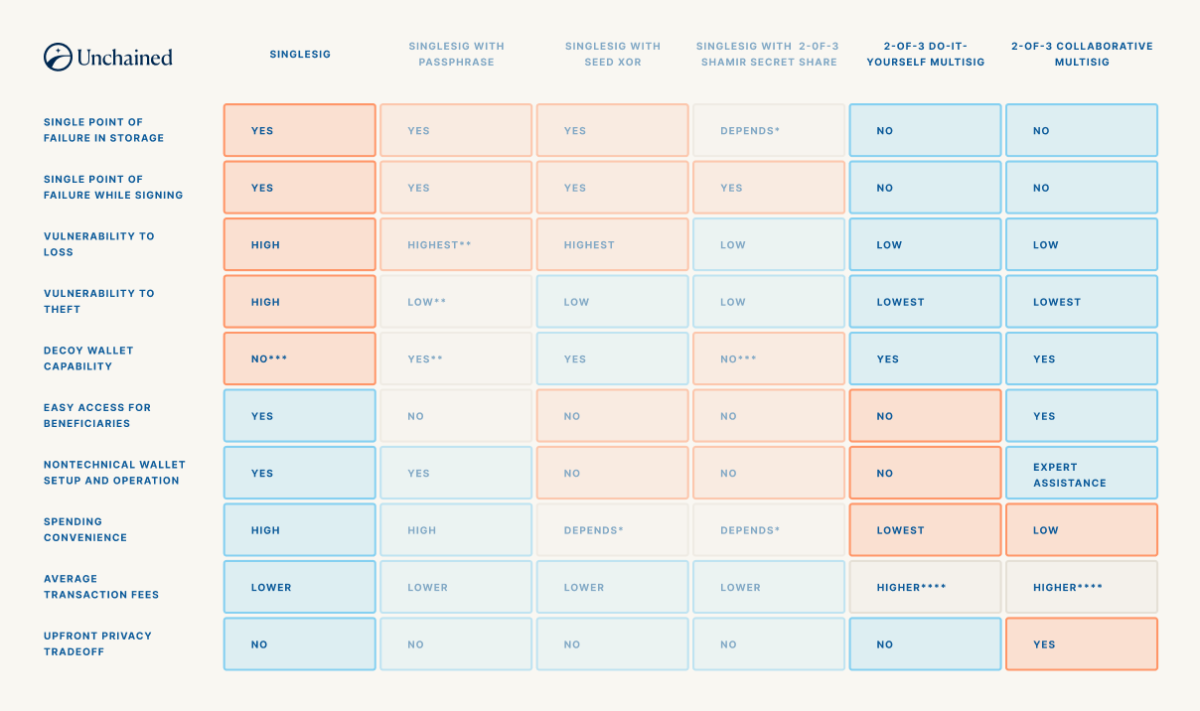

Comparison chart

Bringing back the chart from our article comparing singlesig wallets to multisig wallets and highlighting the sections that focus on DIY multisig and collaborative multisig, we can observe the main differences in these models.

Although you may give up some privacy, collaborative custody can simplify the process of setting up your wallet, operating it securely, and building a functional inheritance plan. Either method you choose will provide the strong security advantages that multisig offers beyond singlesig.

*This depends on whether or not you have wiped your hardware wallet in addition to splitting up your physical seed phrase with SSS or Seed XOR.

*This depends on whether or not you have wiped your hardware wallet in addition to splitting up your physical seed phrase with SSS or Seed XOR.**Weak passphrases have a chance of being guessed, but strong passphrases are easier to forget yourself.

***Decoy wallets are technically possible with nonstandard derivation paths or other methods, but are not recommended because it can introduce new risks.

****With increased Taproot adoption, multisig will have the same fee structure as singlesig.

Should I use collaborative multisig or set it up on my own?

The best self-custody setup for each bitcoin holder depends on their goals and preferences. If you are technically proficient with multisig and want to prioritize privacy above the benefits that are unlocked by collaborative custody, then a DIY multisig might be the best choice for you. However, collaborative custody multisig is often recommended as the best solution for the typical individual to help ensure that catastrophic mistakes are avoided.

If you pursue a collaborative custody partnership with Unchained, you can sign up for a Concierge Onboarding to get your multisig vault set up properly and help you understand bitcoin security best practices. You will also have the option of setting up our streamlined Inheritance Protocol, and be enabled to call upon our experts for ongoing education and assistance.

Originally published on Unchained.com.

Unchained is the official US Collaborative Custody partner of Bitcoin Magazine and an integral sponsor of related content published through Bitcoin Magazine. For more information on services offered, custody products, and the relationship between Unchained and Bitcoin Magazine, please visit our website.

.png)

6 months ago

2

6 months ago

2

English (US)

English (US)