ARTICLE AD BOX

Dogecoin’s (DOGE) steady price decline in the past few weeks has negatively impacted activity in its derivatives market.

At $2.51 billion as of the writing, the meme coin’s total open interest has cratered to its lowest level since the beginning of the year.

Dogecoin Derivatives Traders Say Their Goodbyes

An asset’s open interest measures the total number of outstanding options or futures contracts that have not been settled or closed.

When it increases, it indicates that new contracts are being created, suggesting growing interest or activity in the market. Conversely, when open interest decreases, it means that existing contracts are being closed without new ones being opened, which can indicate a decline in market activity or interest.

As of this writing, DOGE’s open interest is $2.51 billion. It initiated its downtrend on June 8 and has since declined by 80%. For context, the meme coin’s open interest was above $10 billion a month ago.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

Dogecoin Open Interest. Source: Santiment

Dogecoin Open Interest. Source: SantimentThe decline in its derivatives market activity is due to the steady dip in its value during the period under review. The ninth-ranked cryptocurrency asset by market capitalization trades at $0.10 at press time. Its price has fallen by 30% in the last month.

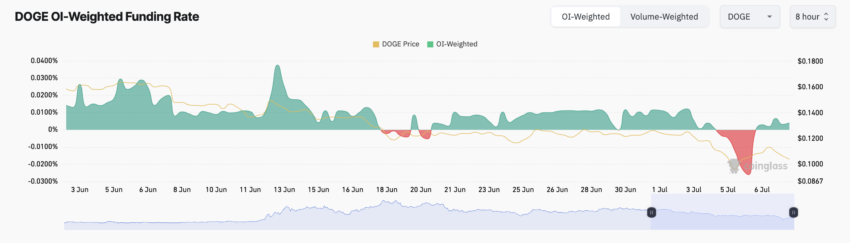

This unabated decline in DOGE’s value even prompted many of its futures traders to demand short positions on July 6. This is based on the readings from the coin’s funding rate, which was negative (-0.026%) on that day.

Dogecoin Funding Rate. Source: Coinglass

Dogecoin Funding Rate. Source: CoinglassFunding rates are used in perpetual futures contracts to ensure that the contract price stays close to the spot price.

When an asset’s funding rate is negative, more traders are holding short positions. This means more traders anticipate the asset’s price will decline than those expecting it to rise and sell at a higher price.

DOGE Price Prediction: A Rebound On the Horizon?

Despite the decline in DOGE’s value, its Chaikin Money Flow (CMF) has maintained an uptrend. As of this writing, DOGE’s CMF is above the zero line at 0.03 and currently trends upward.

Dogecoin Analysis. Source: TradingView

Dogecoin Analysis. Source: TradingViewThis indicator measures the flow of money into and out of an asset. When an asset’s price declines while its CMF climbs, it indicates a bullish divergence between price and money flow.

It suggests that despite the falling price, there is significant buying volume. This divergence implies that buyers are stepping in and accumulating the asset at lower prices, which may weaken the selling pressure.

If buying activity continues to gain momentum, DOGE’s price may rise to $0.11.

Read More: Dogecoin (DOGE) Price Prediction 2024/2025/2030

Dogecoin Analysis. Source: TradingView

Dogecoin Analysis. Source: TradingViewHowever, if the divergence is a false signal and selling pressure remains high, DOGE’s price may plummet to $0.08.

The post Dogecoin (DOGE) Open Interest Drops, Price Stable Above $0.10 appeared first on BeInCrypto.

.png)

4 months ago

1

4 months ago

1

English (US)

English (US)