ARTICLE AD BOX

For some time, predictions spread that Dogecoin (DOGE) would reach $1. Unfortunately, the optimism around that forecast has been dealt a huge blow as on-chain data evaluates the broader reaction to recent events and the meme coin’s potential.

On June 17, DOGE followed the widespread market decline, losing 9.82% of its value over the past 24 hours. However, traders with open contracts in the market are also affected.

Heavy Losses Force Traders to Change Stance

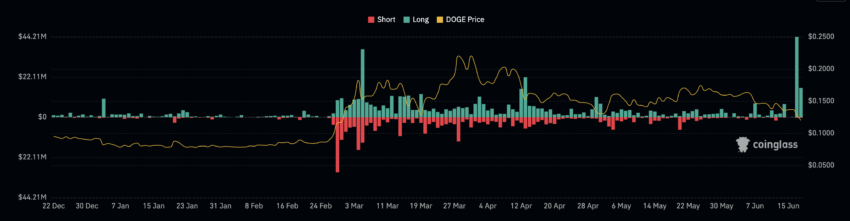

According to Coinglass, DOGE liquidations between June 17 and 18 totaled $60.27 million. On Monday, the value of liquidations was $44.21 million, while the wipe-out as of this writing is $16.06 million.

Dogecoin Total Liquidations. Source: Coinglass

Dogecoin Total Liquidations. Source: CoinglassLiquidations occur when an exchange forcefully closes a trader’s position to prevent further losses. This can be due to an insufficient margin balance to keep the position open or extreme market volatility with a price direction against the bet.

Beyond the value of liquidations, we found that most positions affected were longs. Longs are traders who bet on a cryptocurrency price increase. Shorts, on the other hand, predict a decrease.

The total Dogecoin long liquidations are $59.84 million; for shorts, it is $633,910. Following the capitulation, traders continue to overlook bullish positions in preference for the bearish side.

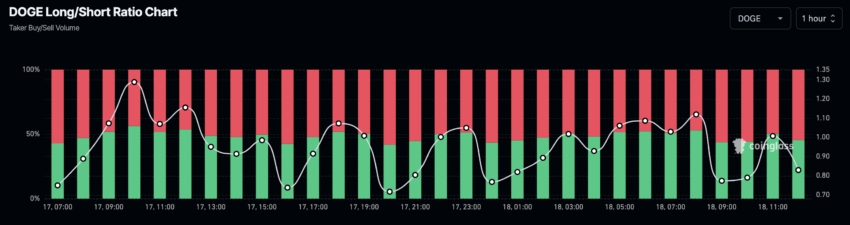

The Long/Short Ratio, which reflects the sentiment of traders in the market, proves this sentiment. It considers the number of long positions and divides it by the number of short positions.

When this indicator’s reading is above 1, it means traders have optimistic expectations about a cryptocurrency. Conversely, a reading below 1 implies that the average trader’s expectations are gloomy. DOGE’s Long/Short Ratio within the past hour stands at 0.82 at press time.

Read More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Difference?

Dogecoin Long/Short Ratio. Source: Coinglass

Dogecoin Long/Short Ratio. Source: CoinglassDOGE Price Prediction: Repricing Begins

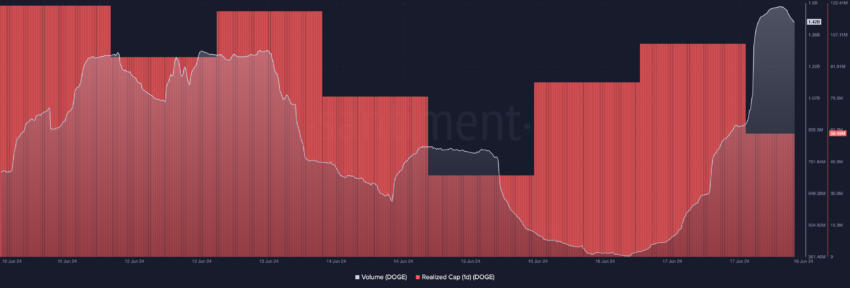

Now, let’s look at the price potential of the coin. From an on-chain perspective, BeInCrypto analyzes Dogecoin’s volume and Realized Cap.

Volume refers to the total value of coins over a given period. But this metric, apart from measuring interest, can tell where the price will head next. Rising volume alongside an increase in price may lead to higher value.

If volume decreases while price increases, it means most participants are selling. When this happens, the uptrend weakens, and the price slowly moves downward. For DOGE, the volume rose above $1 billion while the price continued to fall.

Should this trend continue, the volume may continue to strengthen DOGE’s decline. Per the price targets, the memecoin may slide to $0.10 in a highly bearish situation. The Realized Cap also supports this move.

Realized Cap is the aggregate value of capital that has flowed into a cryptocurrency subtracted from the ones flowing out in losses. A steep increase in the metric implies that investors are accumulating cheap coins. Later on, this foreshadows a price increase.

Dogecoin Volume and Realized Cap. Source: Santiment

Dogecoin Volume and Realized Cap. Source: SantimentRead more: How to Buy Dogecoin (DOGE) With eToro: A Complete Guide

However, Dogecoin’s one-day Realized Cap has fallen to 59.49 million. This means that coins are being revalued as transactions increase. Therefore, the impact on DOGE’s price may be a lengthy consolidation between $0.10 and $0.12.

To invalidate this prediction, DOGE has to be one of the first movers when the market rebounds. This can be possible with the backing of other memecoins. For example, meme coins outperformed other market categories during the March rally. If that happens again, DOGE may rise to $0.15.

The post Dogecoin (DOGE) Traders Concede Defeat After Liquidations Surpass $60 Million appeared first on BeInCrypto.

.png)

4 months ago

3

4 months ago

3

English (US)

English (US)