ARTICLE AD BOX

- Dogecoin is trading around $0.23 after facing rejection at $0.27, and it may drop to $0.20 if bearish pressure continues.

- Analysts predict DOGE could rise to $0.84 by March.

The price of Dogecoin (DOGE) could skyrocket in the next few weeks, with some analysts already forecasting that it will reach a record-high performance by 2025 March. For DOGE to hit $2, it must surge by more than 800%, which is something that has not been witnessed in quite some time. Despite being a volatile token, rising market attention may continue to elevate it to new heights.

More recently, as we reported, Binance US resumed operations in USD, which will positively impact cryptocurrency traders. The decision makes it possible for people to deposit, withdraw, and even trade DOGE directly with the dollar. The rise in meme coins came in response to recent changes in American legislation and regulatory policies that lifted some of the constraints on digital asset exchanges. Dogecoin, as a leader in this category, might show the highest growth rate. Despite experiencing a 12% dip in the past week, the bullish outlook is recovering, which could imply that the start of a rally is imminent.

Trading Volume and Market Indicators

After Binance’s decision, Dogecoin’s trading volume increased, pushing its value to $0.25 before a retracement. However, the recent pullback evidenced by the lower prices and volumes shows that there is active buying interest and accumulation among traders. Traders anticipate a price increase, with market activity remaining strong.

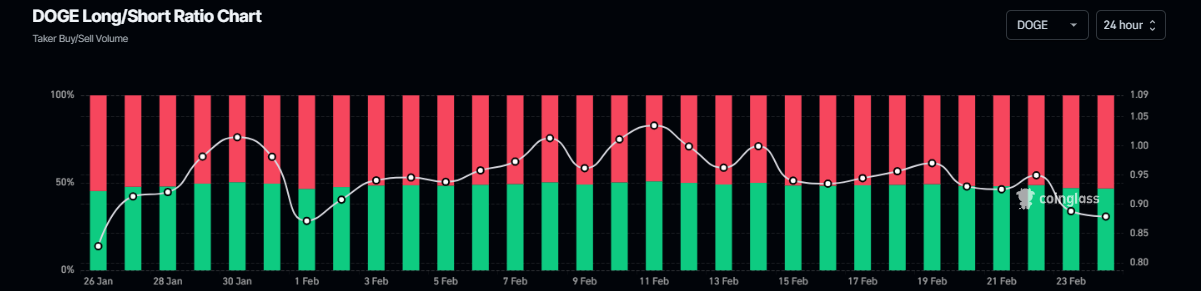

Currently, DOGE is around $0.23 after experiencing an 8.55% decline in the previous week. Coinglass data shows long to short ratio is still below one, showing that more traders are placing their funds on higher price drops. Technical aspects imply that it might decline to $0.20 should the result of pressure continue.

Dogecoin failed to sustain the price above $0.27, which is the 50% Fibonacci retracement level, and consequently, sold off by 8.55%. At the time of writing, it is still 4.6% down, trading just above $0.23. If that’s the case, DOGE is most likely to revisit the $0.20 level it was trading at on February 3.

The Relative Strength Index (RSI) is at 32, which is close to the lower limit of the oversold signal at 30. This shows a great bearish pressure in the short term. In the same period, Coinglass’ DOGE long-to-short ratio has reduced to 0.87, furthering the bearish sentiment among traders.

Source:Coinglass

Source:CoinglassETF Developments and Potential Price Impact

A significant factor influencing Dogecoin’s outlook is Grayscale’s application for a DOGE exchange-traded fund, which was recently approved by the U.S. Securities and Exchange Commission, as CNF reported.

Although it does not necessarily mean endorsement, it is proof of the budding institutional embrace of the asset. An ETF approval can greatly enhance DOGE’s trading volume and overall price level.

Investor sentiment has followed the speculation about the ETF in question, with some analysts expecting a price spike. According to CoinCodex, DOGE may rally to 235% to $0.84 by March 22 before crashing to $0.45 by mid-2025.

.png)

3 hours ago

2

3 hours ago

2

English (US)

English (US)