ARTICLE AD BOX

- Bitcoin’s (BTC) recent double-bottom pattern hints at potential recovery amid volatile market conditions.

- A weaker dollar and potential quantitative easing could create favorable conditions for crypto market growth.

Crypto influencer Lark Davis is weighing in on the possible implications of Bitcoin’s recent rebound, which is gaining traction amid volatile market movements. In his most recent YouTube livestream, Davis discussed general market dynamics and highlighted important trends and elements influencing the path of Bitcoin.

From technical pattern talks to macroeconomic issues, his research offers investors negotiating these uncertain times important background.

How the 50-Day EMA Impacts Bitcoin Trends

Starting with the price action of Bitcoin, Lark Davis first discussed the relevance of the recent dip and eventual comeback. Touching levels last seen in late December, the movement of the cryptocurrency nearly exactly reflected a double-bottom pattern.

If this pattern persists, Davis stated, “We could potentially witness a classic rebound.” He advised viewers against too early exuberance, though, pointing out that market behavior—especially shaped by U.S. trading hours—may still affect results.

Source: Lark davis on Youtube

Source: Lark davis on YoutubeKey resistance and support levels are still very important; the $92,000 mark is a necessary line in the sand. “If daily candles close below this level, it opens the door to further declines, maybe targeting $85,000 or less,” Davis says.

Additionally underlined by him is the relevance of the 50-day exponential moving average (EMA) as a possible indicator of upward momentum.

How Dollar Strength and QE Influence Crypto Markets

Davis explored the effects of macroeconomic variables, especially the value of the U.S. dollar. For risk assets like Bitcoin, a strong dollar usually means difficulties; recent swings in the Dollar Index have added additional strain.

“Trump’s prior presidency leaned toward a weaker dollar policy,” Davis said, implying that a possible change in leadership could bring good conditions for Bitcoin and other cryptocurrencies.

He also discussed inflation issues, referencing data on growing ISM prices paid and how Federal Reserve actions might be affected.

Declaring, “The Fed’s tools are limited, and QE could be the only way to stabilize the situation,” Davis said that quantitative easing (QE) might be unavoidable. He expected the declaration of QE to probably cause a large surge in risk assets, including Bitcoin.

Staying Calm Amid Market Cycles and Dips

Beyond macroeconomic and technical analysis, Davis looked at market sentiment and advised novice investors to avoid panic-selling in lean times. Davis emphasized the importance of maintaining perspective in long-term investments, stating that seasoned holders should accept these dips as a normal part of the investment process.

Source: Lark davis on Youtube

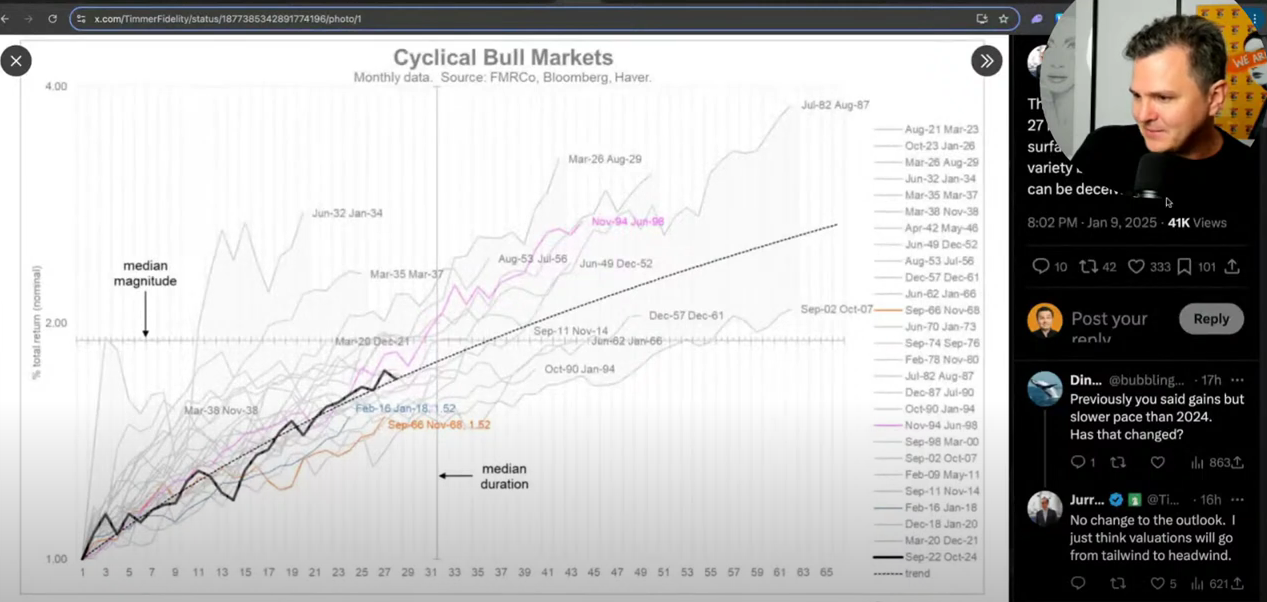

Source: Lark davis on YoutubeDavis also tackled the larger market cycle, contrasting present circumstances with the bull run of 2016-2017. He proposed that there might be parallels, especially with regard to the possible restoration of favorable conditions of liquidity.

He conjectured, “2024 and 2025 could mirror the explosive growth we witnessed in previous cycles if we see another wave of quantitative easing and a weaker dollar.”

The observations of Lark Davis create a complex picture of the present crypto space. For those who remain aware and ready, there are still chances even if macroeconomic headwinds and volatile market circumstances remain hurdles.

His advice to “stay bullish” comes with the requirement of keeping reasonable expectations and a defined plan.

.png)

2 hours ago

1

2 hours ago

1

English (US)

English (US)