ARTICLE AD BOX

- The U.S. government’s strategic assets were already part of Saylor’s case.

- Schiff was quite critical of Saylor’s plan for the government to accumulate a large BTC reserve.

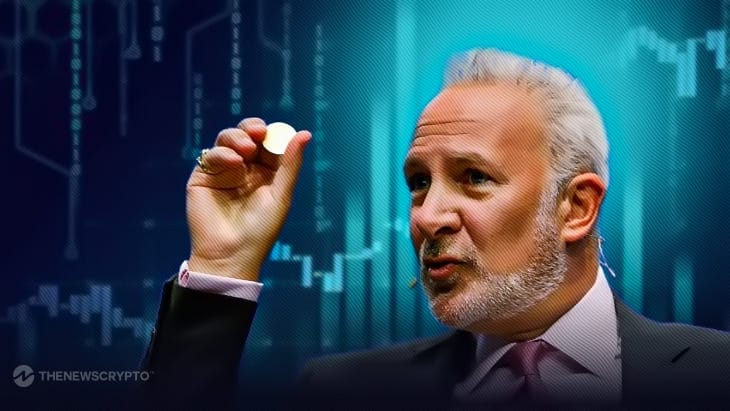

Renowned economist Peter Schiff severely criticized Michael Saylor, founder of MicroStrategy, for what Schiff called the “Bitcoin pyramid scheme.” After Saylor’s address at the Nashville Bitcoin Conference 2024, this back-and-forth took place. Saylor compared Bitcoin to “cyber Manhattan” and said that the US currency should be backed by the digital asset.

By bringing up famous purchases like the Louisiana and Alaska, Saylor was able to draw historical similarities in his analogies. The purchases, he said, fortified the dollar by bolstering the economy. Adopting Bitcoin, he stressed, may set the United States up for economic leadership in the future.

Moreover, the U.S. government’s strategic assets were already part of Saylor’s case. Also, he brought up the fact that the United States controls a large chunk of US territory and possesses most of the world’s gold. This is the strategy that the creator of MicroStrategy is advocating for Bitcoin.

Pyramid Scheme

Furthermore, much of the world’s gold is in American possession. He said that 28 percent of the landmass in the US is owned by the federal government. At the end of his speech, Saylor boldly said that the majority of Bitcoin should be owned by the U.S. government. Peter Schiff was quite critical of Saylor’s plan for the US government to accumulate a large BTC reserve.

Schiff said on X that Michael Saylor is seeking a government rescue for Bitcoin, which is ironic. A further point made by the economist is that he is aware of the Bitcoin blockchain’s impending chain failure and is plotting for the United States government to step in as a last-ditch buyer, thus bringing American taxpayers into the Bitcoin pyramid scheme as final beneficiaries.

Highlighted Crypto News Today:

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)