ARTICLE AD BOX

El Salvador’s misguided critics got some new ammunition this week.

A recent survey revealed just 7.5% of Salvadorans use Bitcoin for transactions, and that 92% of Salvadorans do not. But while some (cue: Steve Hanke) may look at these numbers and think “Oh, well that experiment failed,” I disagree.

Even putting aside the increased tourism, business activity, and international notoriety, El Salvador’s Bitcoin legal tender law has been a success.

El Salvador currently has a population of around 6.3 million, meaning 475,000 (7.5%) people are now using Bitcoin for transactions. The fact that almost half a million citizens now use BTC in their daily life for transactions is pretty impressive, but the Lindy effect means we can expect this figure to increase with time.

Considering the history of El Salvador, it was obvious from the beginning that the entire country was not going to start using this new payments technology from day one. El Salvador has a history of failed currency regimes. It takes time for any new system to build trust.

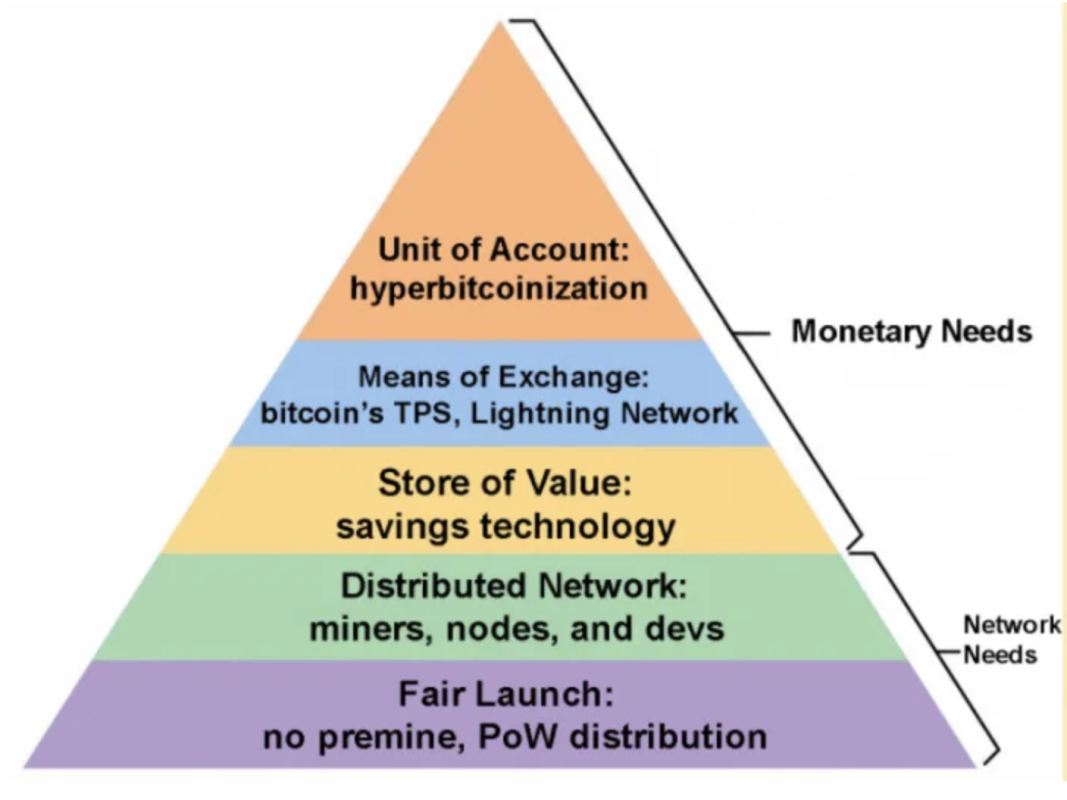

As I pointed out three years ago, I believe Bitcoin needs to become a store of value first before it can become a medium of exchange. Bitcoin today, even with it being a $1.4 trillion dollar asset, is still just a drop in the ocean compared to vast global wealth.

There is still a common consensus in the general public that Bitcoin is risky to get into, and that will need to change before more people in more countries start using it on a daily basis.

Bitcoin is still a new asset class that is growing up. The more it grows up, the more credibility it earns, the more price increases, the more innovation happens that sprouts new transactional and custody solutions to meet non-technical people where they are.

This will take a long time, but it’s a process that is underway.

I see many Bitcoiners online who are so bullish that they believe that adoption as an everyday transaction method will happen suddenly over the next few years, but this discounts real-world data, like this survey, which shows the process is much slower.

All this is to say that if Bitcoin is going to see worldwide merchant adoption and use by everyday individuals, we’re going to need to see a much higher price, Bitcoin will need to be easier to use, and more trusted than it is today.

Exactly how long will it take? I don’t know for certain. But if you think of it as a loading bar, we’re already 7.5% complete on our way to 100% of Salvadorans transacting in Bitcoin.

Remember, this is progress. Nothing happens overnight.

This article is a Take. Opinions expressed are entirely the author's and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

.png)

1 month ago

1

1 month ago

1

English (US)

English (US)