ARTICLE AD BOX

SALT LAKE CITY, UT, UNITED STATES, April 8, 2024 /EINPresswire.com/ — An EV consumer’s current options to get the $7,500 tax credit are to:

a. Purchase an eligible U.S. assembled electric vehicle (a lot of restrictions, frequent eligibility changes, and, as of March, about a dozen models are eligible for $7,500 credit) or

b. Lease any other EV on the market and get as much credit as the lessor is willing to give, typically called the “leasing loophole.” Many EV customers don’t like leases with all of the associated costs and restrictions (they aren’t building equity, have limited miles, could have to pay for dings and scratches, the lessor gets the tax credit and may or may not pass part or all of it on, etc.).

Now, the EV “Buying Loophole ”, a third patent-pending option, eliminates the purchase restrictions of Internal Revenue Code IRC 30D, allowing anyone (not just those making less than the $150k/$300k income limitations) to buy (not just lease) almost any EV (not just those assembled in the U.S. and with sufficient U.S. content), and get the $7,500 tax credit. Not only is the Buying Loophole less costly than the “leasing loophole”, the EV buyer can deduct the cost of the EV, creating tax savings often exceeding another $7500. (How and why is documented in the solutions described below (and on www.7500taxcredits.com)).

”, a third patent-pending option, eliminates the purchase restrictions of Internal Revenue Code IRC 30D, allowing anyone (not just those making less than the $150k/$300k income limitations) to buy (not just lease) almost any EV (not just those assembled in the U.S. and with sufficient U.S. content), and get the $7,500 tax credit. Not only is the Buying Loophole less costly than the “leasing loophole”, the EV buyer can deduct the cost of the EV, creating tax savings often exceeding another $7500. (How and why is documented in the solutions described below (and on www.7500taxcredits.com)).

The “Loophole Solution” is available free for a limited time using the coupon code “launch”. It describes how easily and inexpensively a potential EV buyer can establish their own business that’s eligible for the tax credit under the Commercial Clean Vehicle Credit (Internal Revenue Code (IRC) 45W). The buyer is able to make the tax credit and interest, depreciation and related EV expenses pass-through to the owner, often exceeding $15,000 in tax savings. It documents why this approach works and the IRS safe harbors. Buyers with tax or legal backgrounds may be able to implement this approach just given the concept.

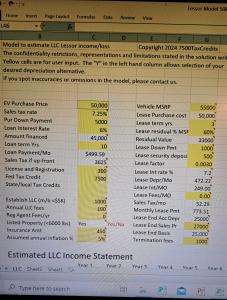

For those wanting more assistance, 7500TaxCredits has created an “Implementation Solution” that includes more comprehensive citations, references, examples and a step-by-step outline to help EV buyers navigate the process and avoid potential pitfalls. They have also developed a Microsoft Excel financial model allowing buyers to see the estimated results (income/loss and cash flow) for a sample purchase, and after entering their own unique data. The proprietary Implementation Solution and financial model will save buyers (and their professional advisors) time, research effort, and money.

Using the new Buying Loophole, EV buyers can establish a business entity, purchase an EV, claim the Commercial Clean Vehicle tax credit and avoid the onerous restrictions of an individual EV purchase.

How is the 7500TaxCredits Buying Loophole different than an individual purchase or lease of an EV?

1. The purchase is structured so the cost is tax deductible (also works for non-EV’s).

2. Buyers can purchase multiple EVs with full tax credit on each purchase instead of once every three years.

3. There are no buyer income limits, the $150k individual or $300k couple income restriction doesn’t apply.

4. There are no price restrictions, $80k+ SUVs and $55k+ sedans are eligible.

5. The tax credit goes to the buyer owned entity versus to an external lessor.

6. U.S. vehicles that are only partially eligible can usually get the full tax credit.

7. There are no vehicle battery assembly and content chemical sourcing restrictions.

8. It can be implemented through the buyer’s dealer of choice.

We estimate that 500,000 EVs were sold last year, to buyers that could have been eligible for the full $7,500 in tax credits using this approach but received none—that’s $3.75 billion in tax credits left on the table.

Background: The Inflation Reduction Act of 2022 authorized $7,500 in tax credits for electric vehicles (EVs) purchased from 2023 through 2032. There are numerous U.S. content requirements and buyer restrictions. The Act also authorized the credit for buying commercial vehicles without consumer restrictions. The IRS issued rulings that a lessor’s purchase of a vehicle to lease to a consumer constituted a commercial sale, eligible for the tax credit (see Topic G at https://www.irs.gov/pub/taxpros/fs-2023-22.pdf for a full description.) This has been labeled as the “leasing loophole” in the EV industry, has been extensively written about and has driven the % of leased vehicles from low historic levels to over 40% in the last year, forecast by some to hit 60% this year. The 7500TaxCredits approach will be attractive to the next 500,000+ buyers who won’t otherwise get any tax credits, buyers wanting to write-off their vehicle purchase and those reluctant lessees who lease solely to be eligible for the tax credit but would much rather purchase.

Bruce Collet

7500TaxCredits

+1 801-554-3791

cbc@7500taxcredits.com

![]()

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.

The post Electric Vehicle “Buying Loophole™” can qualify for $15,000 or more in tax savings appeared first on Headlines of Today.

.png)

1 year ago

5

1 year ago

5

English (US)

English (US)