ARTICLE AD BOX

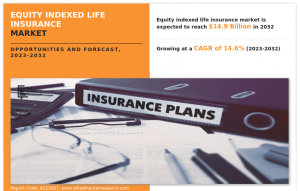

Equity Indexed Life Insurance Market Poised for 14.6% CAGR Growth, Targeting USD 14.90 Billion by 2032

— Allied Market Research

NEW CASTLE, DELAWARE, UNITED STATES, April 19, 2024 /EINPresswire.com/ — Allied Market Research published a report, titled, “Equity indexed life insurance Market Whole Life Insurance, Universal life Insurance, Variable Universal Life Insurance, Indexed Universal Life Insurance and Others), Mode (Online, and Offline), and Distribution Channel (Insurance Companies, Agency and Brokers, and Banks) Global Opportunity Analysis and Industry Forecast, 2022-2032.”. According to the report, the global Equity indexed life insurance industry generated $ 3.9 billion in 2022 and is anticipated to generate $ 14.9 billion by 2032, witnessing a CAGR of 14.6% from 2023 to 2032.

Insurance companies are progressively giving customization choices for equity-indexed life insurance contracts. This trend enabled policyholders to adjust their coverage and investing plans to better fit with their financial goals and risk tolerance. Furthermore, insurance companies are creating more complex and adaptable crediting systems based on equities indexes. This enabled policyholders to receive potentially larger returns, providing an appealing alternative to typical fixed or variable life insurance. In addition, within the insurance industry, there is an increasing emphasis on transparency and customer protection. Regulatory organizations are actively monitoring the EILI market to ensure that policyholders fully understand the product and the risks it entails. Moreover, Many EILI plans are being promoted with income riders, such riders give policyholders the opportunity to convert their accumulated cash value into a guaranteed income stream after retirement, responding to the demands of individuals looking for retirement planning options. Therefore, these equity indexed life insurance market trends are helping the market grow.

In an era of market volatility and low interest rates, individuals are seeking investment options that provide potential for growth while ensuring a level of security. Equity indexed life insurance policies offer a unique combination of market-linked returns with a guaranteed minimum interest rate, making them an attractive choice for those looking to balance risk and potential rewards in their long-term financial planning.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/223491

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/223491

Prime Determinants of Growth

The prime determinants of growth for the equity indexed life insurance market hinge on several crucial factors. Firstly, the prevailing economic environment plays a significant role. In periods of low interest rates and market volatility, individuals are drawn to investment options that offer both growth potential and downside protection, precisely the strengths of equity indexed life insurance. Additionally, demographic shifts and an aging population contribute to market expansion. As individuals seek to secure their financial future and pass on wealth to beneficiaries, these policies become an appealing instrument. Moreover, heightened awareness and education about the benefits of equity indexed life insurance, along with advancements in financial technology, have enhanced accessibility and understanding, driving further growth in this market.

The whole life insurance segment to maintain its leadership status throughout the forecast period

Based on the type, the whole life insurance segment held the highest market share in 2022, accounting for nearly two-fifths of the global equity indexed life insurance market revenue and is estimated to maintain its leadership status throughout the forecast period, driven by people seeking long-term financial protection and a way to accumulate savings over time. The growth factors include a stable, guaranteed death benefit and tax advantages. However, the variable universal life insurance segment is projected to manifest the highest CAGR of 19.5% from 2023 to 2032, VUL policies provide flexibility for policyholders to invest their premiums in various investment options such as stocks, bonds, or mutual funds. This flexibility attracts individuals looking for potential higher returns on their investments while still securing life insurance coverage.

The online segment to maintain its leadership status throughout the forecast period

Based on the mode, the online segment held the highest market share in 2022, accounting for more than two-thirds of the global equity indexed life insurance market revenue, owing to the convenience of online applications and instant quotes simplifies the purchasing process, attracting a broader. However, the offline segment is projected to manifest the highest CAGR of 16.7% from 2022 to 2032, attributing to the expanding aging population seeking stable investments for retirement, and the desire for financial protection in uncertain times.

The agency and brokers segment to maintain its leadership status throughout the forecast period

Based on distribution channel, the agency and brokers segment held the highest market share in 2022, accounting for nearly half of the global equity indexed life insurance market revenue, this is attributed to the fact that agents and brokers provide ongoing support, ensuring policyholders understand their investments and helping them make informed decisions, thereby increasing customer retention and market stability. However, the banks segment is projected to manifest the highest CAGR of 16.9% from 2022 to 2032. Banks leverage their existing customer relationships to cross-sell EILI policies, capitalizing on the trust customers have in their financial institutions. This built-in trust factor can significantly boost the EILI market’s growth.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A223007

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A223007

North America to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022. Growing interest in insurance products that offer potential for higher returns compared to traditional whole-life or term-life policies is one of the major factor for the growth of the market in this region. However, the Asia-Pacific region is expected to witness the fastest CAGR of 18.1% from 2023 to 2032 and is likely to dominate the market during the forecast period. As people’s incomes rise, they have more disposable income to invest in insurance products like EILI. In addition, EILI has gained popularity in Asia-Pacific due to its potential for both life insurance coverage and investment growth.

Leading Market Players: –

American International Group, Inc.

AXA

John Hancock

MetLife Services and Solutions, LLC.

Mutual of Omaha Insurance Company

Penn Mutual

Progressive Casualty Insurance Company

Protective Life Corporation

Prudential Financial, Inc.

Symetra Life Insurance Company

The report provides a detailed analysis of these key players in the global equity indexed life insurance market. These players have adopted different strategies such as expansion, merger, and product launches to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/d01a42df294fc57147d919608021341f

𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @ https://www.alliedmarketresearch.com/checkout-final/d01a42df294fc57147d919608021341f

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the equity indexed life insurance market forecast from 2022 to 2032 to identify the prevailing equity indexed life insurance market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the equity indexed life insurance market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global equity indexed life insurance market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the equity indexed life insurance market players.

The equity indexed life insurance market report includes the analysis of the regional as well as global equity indexed life insurance market trends, key players, market segments, application areas, and market growth strategies.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/223491

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/223491

Equity Indexed Life Insurance Market Key Segments:

By Type:

Whole Life Insurance

Universal Life Insurance

Variable Universal Life Insurance

Indexed Universal Life Insurance

Others

By Mode:

Online

Offline

By Distribution Channel:

Insurance Companies

Agency and Brokers

Banks

By Region:

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Augmented Analytics in BFSI Market https://www.alliedmarketresearch.com/augmented-analytics-in-bfsi-market-A11748

Insurance BPO Market https://www.alliedmarketresearch.com/insurance-bpo-market-A74553

Operational Risk Management Consulting Services in Manufacturing Market https://www.alliedmarketresearch.com/operational-risk-management-consulting-services-in-manufacturing-market-A74585

U.S. Insurance Brokerage for Employee Benefits Market https://www.alliedmarketresearch.com/us-insurance-brokerage-for-employee-benefits-market-A278701

Spain Health Insurance Third-Party Administrator Market https://www.alliedmarketresearch.com/spain-health-insurance-third-party-administrator-market-A264461

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int’l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://www.quora.com/profile/Pooja-BFSI

David Correa

Allied Market Research

+1 5038946022

email us here

![]()

The content is by EIN Presswire. Headlines of Today Media is not responsible for the content provided or any links related to this content. Headlines of Today Media is not responsible for the correctness, topicality or the quality of the content.

The post Equity Indexed Life Insurance Market Poised for 14.6% CAGR Growth, Targeting USD 14.90 Billion by 2032 appeared first on Headlines of Today.

.png)

1 year ago

4

1 year ago

4

,

,

English (US)

English (US)