ARTICLE AD BOX

Ethena Labs presented its new roadmap, promising a convergence between DeFi, CeFi, and TradFi.

Its synthetic stablecoin, USDe, aims to replicate what Tether’s USDT did in 2014 and MarkerDAO did in 2017.

Ethena’s Vision: DeFi, CeFi, TradFi Convergence

According to the DeFi protocol, USDe succeeds because its reserves represent more than double the open interest in each combined perpetual DEX.

Ethena explained in its roadmap that it can provide valuable ‘non-toxic’ flows to exchanges DEX and CEX by using USDe as collateral and triggering open interest. It emphasized that they act as a neutral infrastructure, which has resulted in up to $1.25 billion in protocol allocation towards USDe.

“As other stable coin issuers grow and proliferate through DeFi, Ethena will expand along with them. The foundation in the futures markets is higher real yields. USDe will be the core element on which these interest rate markets will be built,” Ethena said.

Read more: What Is Ethena Protocol and its USDe Synthetic Dollar?

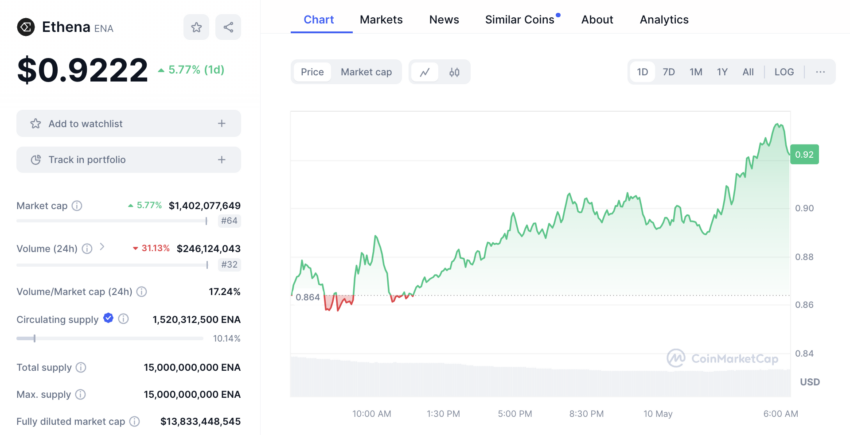

ENA Price Performance. Source: CoinMarketCap

ENA Price Performance. Source: CoinMarketCapAfter launching its roadmap, Ethena’s native token, ENA, soared more than 8%, rising from $0.85 to $0.93. ENA is in a bullish rally, having risen 18.22% last week and 47.24% since its launch, with a market capitalization of $1.41 billion.

The post Ethena’s New Roadmap Unites DeFi, CeFi, TradFi appeared first on BeInCrypto.

.png)

6 months ago

6

6 months ago

6

English (US)

English (US)