ARTICLE AD BOX

- Long-term holders of Ethereum, XRP, and Dogecoin are experiencing changes.

- Ethereum is on top of the list with a 645,000 rise in HODLer wallets, Ripple with 58,000, and Dogecoin with 29,000.

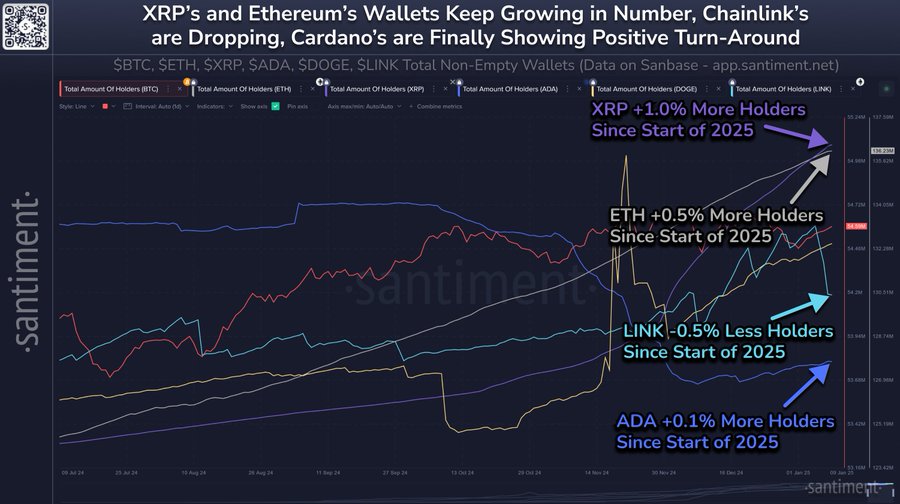

The current cryptocurrency market is showing some signs of trends as HODLer activity in Ethereum (ETH), XRP, Dogecoin (DOGE), and Cardano (ADA) are showing changes. Insights from crypto analytics platform Santiment highlight these developments, shedding light on ecosystem growth and investor confidence.

Ethereum and XRP Lead HODLer Growth

According to Santiment, six major digital currencies were examined, noting that Ethereum and XRP would be leading the pack in 2025. Ethereum saw a staggering rise of 645,000 in HODLer wallets, reaffirming its status as the preferred altcoin among retail investors. XRP trailed, recording an addition of 58,000 long-term wallet holders, signifying that it remains a favoured asset, irrespective of the market conditions.

Source:X

Source:XOn the other hand, Chainlink had 3,300 fewer HODLer wallets, which is worthy of questioning the platform’s ability to retain long-term investors. Cardano, which has been implementing community-driven projects, added 2,800 wallets to its network. Dogecoin, the only memecoin in the survey, had a 29,000 wallet addition as the asset remained popular among holders.

Therefore, the total number of HODLers is one of the most important market indicators. An increasing HODLer count suggests that more people are becoming confident in a project, which may contribute to stability and token appreciation. However, a decline could imply uncertainty or a loss of interest on the part of the investor.

Santiment data also confirm that Ethereum is among the top altcoins with stable and growing adoption rates, while XRP has been gradually rising despite legal issues. The community interest and speculative demand make it a possible long-term coin in the altcoin market.

Altcoin Market Trends

Ripple CEO Brad Garlinghouse recently revealed that the firm holds over $100 billion worth of XRP, which he sees as part of the company’s value. Ripple’s presence and authority are still on the rise, and this is only boosted by such activities as a one-on-one meeting with President-elect Donald Trump. Such advancements are taking place at the same time as Ripple is fighting a legal battle with the US Securities and Exchange Commission (SEC).

Institutional interest in altcoins is also increasing as well. As a result of this, Ethereum exchange-traded funds (ETFs) have been popular. The largest ETH fund on the market is BlackRock’s ETHA fund, with $3.68 billion in inflows, while Grayscale’s ETHE reports an identical outflow.

Fidelity follows suit with the FETH fund, which has attracted $1.39 billion in inflows, placing it in second place in the institutional investment space. Other Ethereum-linked products like Bitwise’s ETHW have also performed well, accumulating a total of $11.74 billion in the last five months.

Recently, Cardano’s collaboration with FC Barcelona has been in the spotlight, as CNF reported. Lauding the partnership, Cardano’s Frederik Gregaard stated that the collaboration intends to transform fan interactions via blockchain.

Dogecoin driven by its active community and endorsement by Elon Musk is still a key player within the altcoin market. These include Musk’s support and initiatives like the Department of Government Efficiency (D.O.G.E) which helps cement Dogecoin as one of the popular meme coins.

.png)

4 hours ago

2

4 hours ago

2

English (US)

English (US)