ARTICLE AD BOX

- If the price manages to go below $2244 level, then it will likely test $2179 support level.

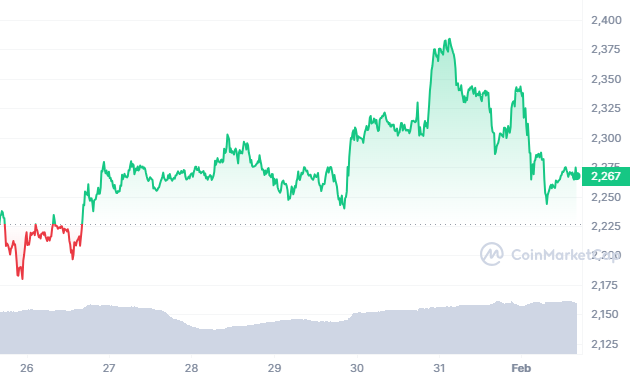

- At the time of writing, Ethereum is trading at $2270, down 1.56% in the last 24 hours.

January recorded heavy selling pressures in the crypto market, disappointing investors, while the NFT sector saw substantial rises. Consequently, NFT collection index prices increased by almost 10% in January, far outperforming Ethereum which increased by little more than 2%.

According to renowned cryptocurrency expert Michaël van de Poppe, Ethereum is preparing for a substantial price increase in the next three to six months and is still poised for $3,500-4,000. Testing of Ethereum’s Dencun upgrade will begin on the Holesky testnet on February 7, 2024. Developers will make the choice after testing whether to activate it on the main blockchain.

Ethereum is clearly in the lead, with a Total Value Locked (TVL) of $34.81 billion, or 72.49% of the total. Next on the list is BNB Smart Chain, with $3.80B and a 7.92% dominance.

All Eyes on Upcoming Upgrade

Concerns over the absence of a public testnet deployment have pushed back the intended deployment date from late 2023 to early 2024. The scalability and efficiency of Ethereum are the objectives of this upgrade. The enthusiasm and anticipation of this update, says van de Poppe, will act as positive forces for the price of Ethereum.

At the time of writing, Ethereum is trading at $2270, down 1.56% in the last 24 hours as per data from CoinMarketCap. Moreover, the trading volume is down 0.86%.

Source: CoinMarketCap

Source: CoinMarketCapIf the price manages to go below $2244 level, then it will likely decline further to test $2179 support level. On the other hand, if the price manages to go above $2288 level, then it will likely test $2324 resistance level.

.png)

10 months ago

3

10 months ago

3

English (US)

English (US)