ARTICLE AD BOX

- Activity in Ethereum L2 increases markedly in 2023, with transactions in Arbitrum and Optimism growing significantly, driving their prices upwards.

- Technical analysis reveals fluctuations in ARB and OP, with upside reversal potential for ARB and volatility forecast for OP.

The year 2023 has witnessed a significant change in the Ethereum ecosystem, with a notable increase in activity in its Layer Two (L2) protocols. According to IntoTheBlock, a blockchain intelligence firm, transactions on L2s increased 90 times compared to 2021. This change is due to the adoption of scalability solutions such as Arbitrum (ARB) and Optimism (OP), which has had a noticeable impact on both their usage and the value of their native tokens.

Troubleshooting Scalability Issues in Ethereum

Ethereum’s L2s were developed to solve scalability issues faced by users on the main chain, which processes approximately 15 transactions per second and carries high gas rates. Optimistic rollups, including Arbitrum and Optimism, allow users to process transactions with increased speed and at reduced costs.

In 2023, activity on Ethereum has increasingly moved to L2s, with L2 transactions increasing by 90x compared to 2021 pic.twitter.com/FhWJ1WG2ju

— IntoTheBlock (@intotheblock) December 30, 2023

ARB and OP Price Impact

The price of ARB has risen 54% in the last 90 days, while OP has enjoyed a 170% increase over the same period. These returns have led to ARB and OP being considered tokens to watch in 2024.

Technical Analysis of Arbitrum (ARB)

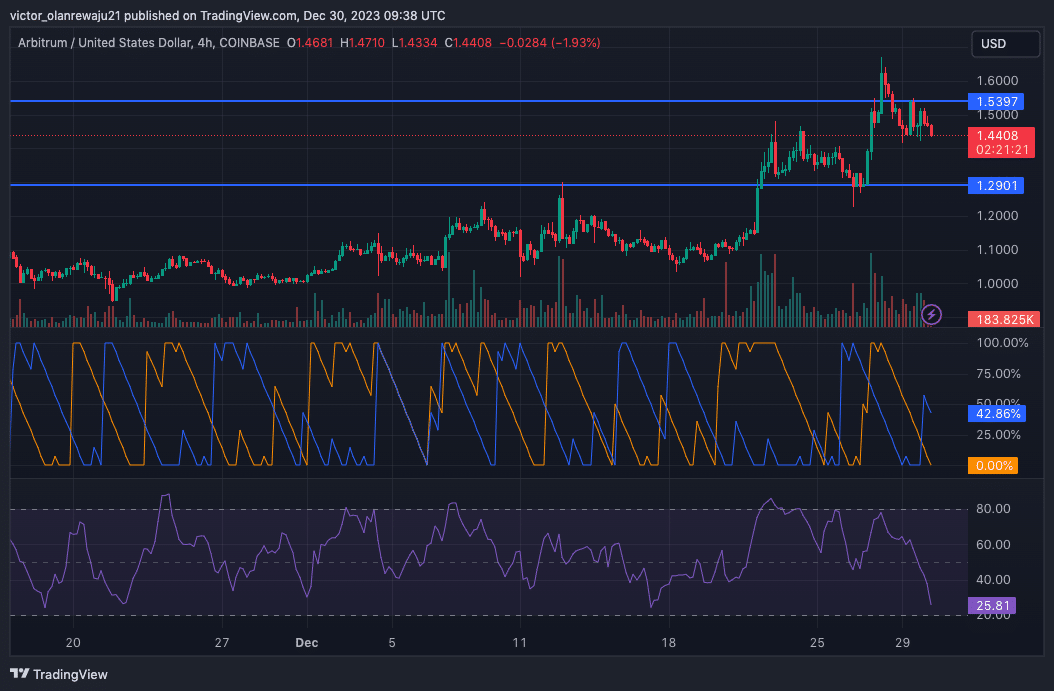

Despite reaching a high of $1.64 on Dec. 28, ARB faced rejection and its price fell to $1.44. Technical analysis suggests possible additional selling pressure.

ARB/USD 4-Hour Chart (Source: TradingView)

ARB/USD 4-Hour Chart (Source: TradingView)The Aroon indicator signals a bearish trend, with a chance of losing support at $1.40. However, there is support at $1.29 that could lead to a short-term bounce. The Money Flow Index (MFI) indicates that ARB is oversold, which could precede a reversal to the upside.

Optimism Technical Analysis (OP)

OP’s market structure is similar to that of ARB. It is currently trading at $3.63, with Bollinger Bands (BB) indicating high volatility. This suggests significant fluctuations in price. If selling pressure increases, OP could fall to $3.34, but an increase in buying pressure could take it towards $4.

OP/USD 4-Hour Chart (Source: TradingView)

OP/USD 4-Hour Chart (Source: TradingView)The Relative Strength Index (RSI) shows that buyers don’t have much control, which could result in a drop below $3.63 if the bulls don’t intervene.

Changes for Ethereum L2 and Its Tokens

Increasing activity on Ethereum’s L2s, especially Arbitrum and Optimism, shows a significant shift in user preference and a potential positive impact on the value of its tokens. As Ethereum continues to scale and offer more efficient solutions, ARB and OP are shaping up to be key assets in the cryptocurrency landscape. However, investors and users need to keep an eye on market trends and technical analysis to trade in this sector.

.png)

1 year ago

7

1 year ago

7

English (US)

English (US)