ARTICLE AD BOX

On June 25, the Ethereum Name Service (ENS) price fell to $22.95 amid market hesitation. Then something intriguing happened—the price began to climb, eventually rising to $25.13 in the early hours of June 26.

This 8.82% price increase made ENS the highest gainer among the cryptocurrencies in the top 100. Despite the hike, market participants’ behavior displays a more fascinating trend that may affect ENS’ value.

Investors Set To Offload 812,000 Tokens

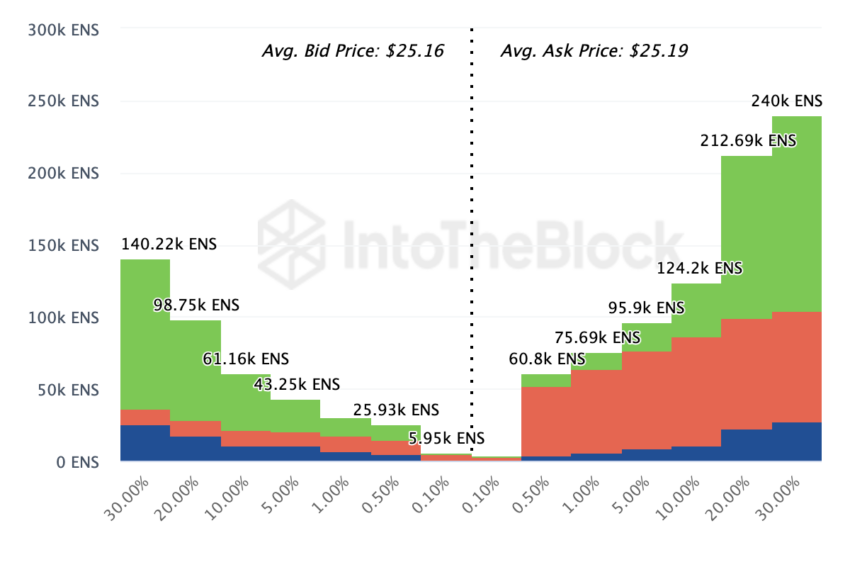

As things stand, ENS investors seem unconvinced that the token’s price will continue to climb. As such, many of them have placed orders to sell. Evidence of this decision is reflected in the Exchange-OnChain Market Depth.

The Exchange-OnChain Market Depth provides real-time trading activity on exchanges. Divided into two, the bid side shows the number of buy orders, while the sell ask region reveals the number of tokens that could put selling pressure on the price.

According to IntoTheBlock, investors look prepared to sell a total of 812,870 tokens at an average price of $25.19. At that price, the value of tokens let go will be $20.32 million.

Read More: Ethereum Name Service (ENS): Everything You Need to Know

ENS Exchange-Onchain Market Depth. Source: IntoThBlock

ENS Exchange-Onchain Market Depth. Source: IntoThBlockHowever, buy orders fall short, with only 399,800 tokens ready to save the cryptocurrency from another downtrend. Considering the difference in the ask and bid values, the ENS price may not add to its current gains.

Apart from this, the pattern shown by the total amount of holders puts ENS at risk of falling below $24. According to Santiment, the holder count has decreased from 66,300 on April 18 to 65,100 at the time of writing.

Situations like this imply that some holders are not liquidating a part of their holdings. Instead, they are selling all. If this continues, it will signal a lack of confidence in Ethereum Name Service’s future potential and a potential decrease in price.

ENS Total Amount of Holders. Source: Santiment

ENS Total Amount of Holders. Source: SantimentAs shown above, historical analysis traced back to December 2023 supports the thesis. During that period, ENS price was $21.97. Less than a week after the number of hodlers dived, the value declined to $17.89.

ENS Price Prediction: Bulls Are Pulling Out

Regarding the price’s next movement, the 4-hour chart shows that it has been able to exit the correction (marked in the red box) that took place between June 23 and 24. Even though the price continues to increase, it faces resistance at $25.69.

Failure to curb the hurdle at this value may send ENS back to $23.52. If the downward pressure persists, ENS may slide to $21.84, which holds major support.

Given the current conditions, the Average Directional Index (ADX) exhibits weakness for the uptrend. The ADX is a technical indicator used to determine the strength of a trend. Typically, readings at 25 or above imply a strong directional movement.

However, as of this writing, the ADX reading was 21.13 while facing downwards. Should the directional strength continue to decrease, ENS price will have no option but to descend.

Read More: Ethereum Name Service (ENS) Price Prediction 2024/2025/2030

ENS 4-Hour Analysis. Source: TradingView

ENS 4-Hour Analysis. Source: TradingViewMeanwhile, this price prediction will be invalidated if demand for the token rises. One factor that can trigger the demand is the Ethereum Name Service migration announced last month because less expensive transaction costs make it easy for market participants to buy a token. If this pattern plays out, ENS may attempt to retest $28.35.

The post Ethereum Name Service (ENS) Price Rebounds, Cracking Top 100 appeared first on BeInCrypto.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)