ARTICLE AD BOX

The post Ethereum News Today: Is ETH About to Explode with 40% Locked in Smart Contracts? appeared first on Coinpedia Fintech News

As Ethereum’s presence in smart contracts nears the 40% threshold, the scarcity of this cryptocurrency is becoming more evident. However, recent market trends paint a complex picture for ETH enthusiasts.

Ethereum’s Growing Scarcity

The increasing allocation of Ethereum into smart contracts signifies a tightening supply. With nearly 40% of ETH now locked in these contracts, the available amount for trading and other uses diminishes. This scarcity could potentially lead to significant price movements if demand surges, making ETH a crypto asset to watch closely. In the last 24 hours, the price of Ethereum has marked a rise of around 4.8%, and in the last 7-days, the price has recorded an increase of over 5.5%.

Ethereum Market Indicators Show Mixed Signals

Despite the promising scarcity narrative, several market indicators suggest challenges ahead for Ethereum:

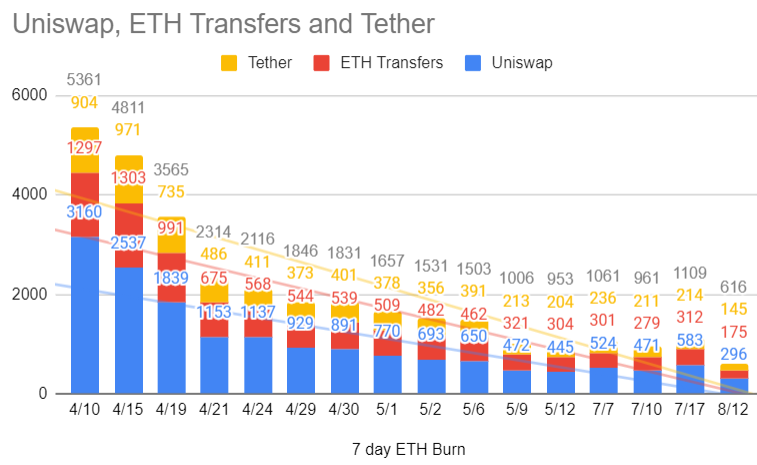

Burn Rate Decline: The burn rate, which is a measure of ETH being removed from circulation, has hit an all-time low. This decline contributes to higher net issuance. This raises concerns about inflationary pressures on Ethereum.

Layer 2 Adoption Concerns: The transition to Layer 2 solutions, aimed at improving scalability and efficiency, has not spurred the anticipated usage levels. This slow adoption raises questions about Ethereum’s ability to handle growing demand.

Stablecoin Dominance: Ethereum’s primary utility appears to be shifting towards facilitating stablecoin transactions. This reliance on stablecoin movement may not be sustainable for long-term growth.

Declining Uniswap Volume: Uniswap, which is one of the major decentralized exchanges on the Ethereum network, is experiencing dwindling volumes. Current activity hovers just above 10% of what was observed in March. What this indicates is reduced trading enthusiasm.

Ethereum Price Movements Reflect Volatility

The current price of Ethereum is $2,648.2, marking a decline from $3,188.5 at the beginning of August 2024. This drop is part of a broader trend, with a significant decrease observed between July 29th and August 7th, when the price fell from $3,314.4 to $2,333.3. Earlier in the year, ETH began at around $2,349.5, experiencing a sharp rise between January 25th and March 11th, peaking at $4,069.5. The price then entered a sideways market, stabilising between $3,669.4 and $3,888.8 from May 20th to June 10th.

Etheruem’s journey in 2024 showcases a blend of scarcity-induced potential and market-induced challenges. As the crypto community watches closely, the balance between these dynamics will shape Etheruem’s trajectory in the coming months.

Also Check Out: Markets Could Remain Highly Volatile: Here are the Cryptos to Monitor This Week

.png)

4 months ago

4

4 months ago

4

English (US)

English (US)