ARTICLE AD BOX

Ethereum’s network deflationary status is waning post-Dencun Upgrade, with data showing a notable increase in ETH supply since mid-April.

The Dencun Upgrade in March, while beneficial in reducing transaction fees, has affected Ethereum’s deflationary status, a key selling point for long-term holders.

Over 112,000 Ethereum Added to Overall Supply

Despite initial hopes, Ethereum is now experiencing its longest inflationary period since its transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). According to ultrasound.money, over 112,000 ETH have been added to the overall supply since mid-April, counteracting the anticipated deflationary effects.

The Dencun Upgrade, particularly its EIP-4844 model, aimed to solidify Ethereum’s status as “ultra-sound money.” While it successfully lowered transaction fees, it inadvertently decreased the total amount of ETH burned on the mainnet. This reduction has resulted in a slower burn rate, pushing Ethereum back into inflationary territory.

“At the current rate of network activity, Ethereum will not be deflationary again. The narrative of ‘ultra-sound’ money has probably died or would need much higher network activity to come back to life,” CryptoQuant analysts highlighted.

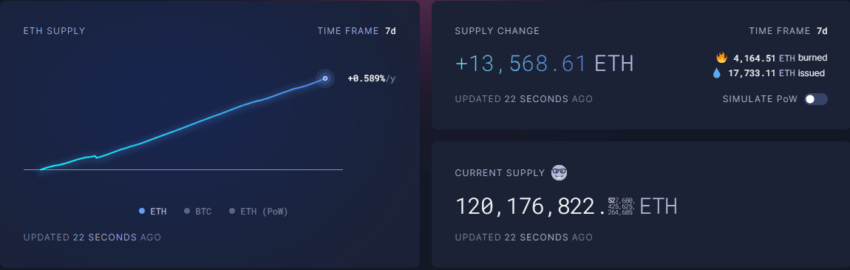

With the inflation rate at 0.59% per year, the “ultra-sound money” narrative is diminishing. Indeed, Ethereum is currently issuing more units than it burns, contradicting the earlier deflationary narrative.

Read more: What Is the Ethereum Cancun-Deneb (Dencun) Upgrade? Here’s A Deep-Dive

Ethereum Supply. Source: Ultrasound.Money

Ethereum Supply. Source: Ultrasound.MoneyDespite these changes, the Ethereum network is witnessing significant scaling activity. zkLink CEO Vince Yang noted that the EIP-4844 upgrade is beneficial for Ethereum, especially for Layer 2 networks.

“Scaling activity on Ethereum is at its highest thanks to the significant reduction of gas costs to execute transactions on Layer-2s. Compared to earlier this month, Ethereum’s combined transactions have exploded to an all-time high from 140 to 285 TPS,” Yang told BeInCrypto.

This scaling activity is crucial for the development of new blockchain applications, positioning Layer 2 and Layer 3 solutions advantageously.

Meanwhile, staked Ethereum is peaking, with anticipation for spot Ethereum ETFs growing. Bloomberg senior ETF analyst Eric Balchunas predicted that spot-based Ethereum ETFs might start trading by July 2, following positive comments from the US SEC on the S-1 filings.

Recently, VanEck filed Form 8-A for a Spot Ether ETF, reinforcing the sentiment of a potential launch soon. This optimism mirrors the swift approval process seen with spot Bitcoin ETFs launched in January.

The post Ethereum No Longer Ultra-Sound Money Amid Supply Spike appeared first on BeInCrypto.

.png)

4 months ago

6

4 months ago

6

English (US)

English (US)