ARTICLE AD BOX

In recent market activity, Ethereum, Solana, and Binance Coin have shown significant liquidations, indicating potential sell signals for investors. Amidst a bearish trend, these altcoins have faced notable corrections, impacting their market stability.

Market Analysis: A Wave of Liquidations

The latest trading day saw substantial losses for traders, with 59,370 accounts facing liquidations, amounting to a total loss of $170.64 million. Ethereum, Solana, and Binance Coin were among the hardest hit, each experiencing considerable market corrections. The largest single liquidation order occurred on OKX—an ETH-USD-SWAP valued at $4.00 million. These developments underscore the risks associated with these cryptocurrencies.

Ethereum (ETH): DeFi Leader Under Pressure

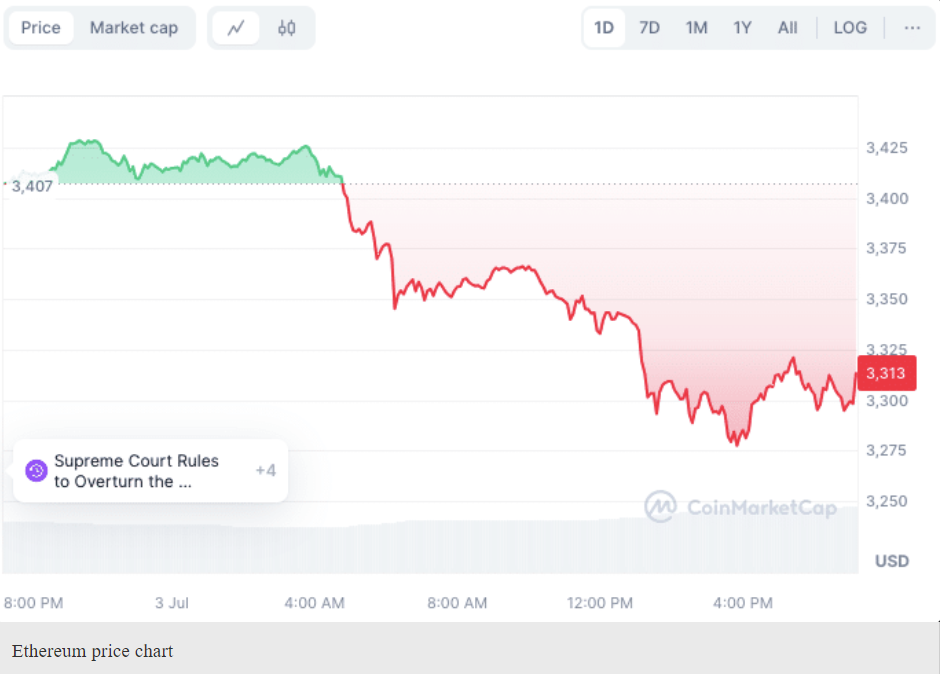

Ethereum, a cornerstone of the Proof-of-Stake blockchain sector, has experienced significant liquidations. Known for its smart contract technology, Ethereum serves more than just as a digital currency platform, enabling complex computations and decentralized applications. Despite its integral role in the DeFi space, Ethereum has faced a 3% price drop over the past day.

Currently trading at $3,312 with a 24-hour trading volume of $13 billion, Ethereum’s market cap stands strong at $398 billion. However, over the last month, it has seen a 12% decrease in value. With $44 million worth of positions liquidated in the past 24 hours, investors are cautious. This period marks a substantial liquidation phase, particularly for long positions.

Solana (SOL): High-Speed Network Faces Instability

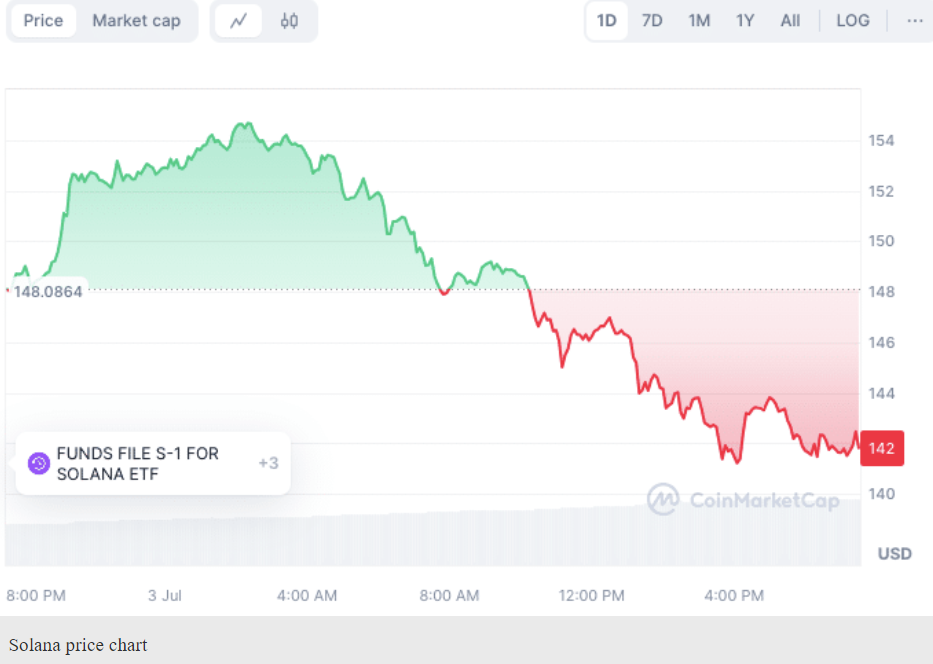

Solana, a prominent blockchain network, continues to attract attention due to its high transaction speeds and robust ecosystem. Despite these strengths, Solana’s price recently fell by 4%, reflecting market instability. Currently priced at $142, Solana has seen a remarkable 643% growth over the past year but faces recent challenges.

Ranked fifth on CoinMarketCap with a market cap of $65 billion, Solana has experienced $11.10 million in liquidations in the past 24 hours. Long positions accounted for $8.54 million of these liquidations, highlighting the network’s volatility amidst broader market corrections.

Binance Coin (BNB): Ecosystem Pillar Shows Weakness

Binance Coin, a crucial asset within the Binance ecosystem, operates on both the Binance Chain and Binance Smart Chain. Despite its significant role in facilitating transactions within the Binance platform, BNB has faced recent price declines. Trading at $557, BNB has dropped over 3% in the last day and 10% over the past month.

With a market cap of $92 billion, Binance Coin saw approximately $1.02 million in liquidations over the past 24 hours. This includes $1.01 million from long positions, suggesting investors should approach with caution. The recent inclusion of BNB Chain in Coinbase’s asset recovery tool marks a positive development, but the overall trend remains bearish.

Conclusion: Strategic Sell Signals

Given the substantial liquidations and ongoing market corrections, investors are advised to consider selling Ethereum, Solana, and Binance Coin. Keeping a close watch on these trends is essential for making informed decisions in a volatile market.

.png)

4 months ago

2

4 months ago

2

English (US)

English (US)