ARTICLE AD BOX

The newly approved spot Ethereum exchange-traded funds (ETFs) could trigger a supply crunch for the second-largest cryptocurrency by market cap.

Ethereum’s supply on centralized exchanges has hit an eight-year low, with only 12.78 million ETH available. This amount constitutes roughly 11% of the total supply.

Ethereum Demand Shock Expected

Analysts have noted that investors are withdrawing their ETH from exchanges just as the asset is poised to experience a surge in institutional demand. Such a decline in exchange balances is usually a bullish sign. It indicates that investors expect price growth and have no plans to sell their holdings in the short term.

This week, the US Securities and Exchange Commission (SEC) approved several Ethereum ETFs, which many believe could boost demand for the cryptocurrency.

Mara Schmiedt, CEO of Alluvial, points to the significant institutional interest generated by spot Bitcoin ETFs since their launch in January. These ETFs now hold 800,000 BTC, demonstrating a growing institutional appetite. Consequently, she predicts Ethereum could see similar demand, potentially leading to a significant demand shock.

“What happens if there is $20 billion taken out of the market? It could be a tipping point in terms of supply and demand. We haven’t really seen this kind of rapid demand shock in the market before,” Schmiedt said.

Read more: How to Invest in Ethereum ETFs?

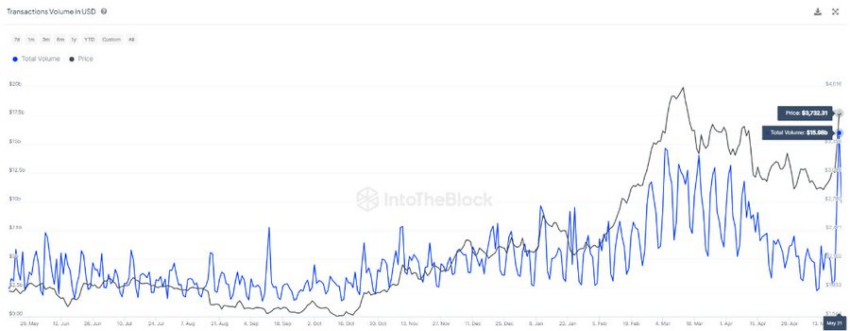

Notably, ETH is already experiencing a surge in institutional activity. Blockchain analytics platform IntoTheBlock reported that anticipation around Ethereum ETF approval pushed the on-chain trading volume to a two-year high of $15.98 billion, largely driven by crypto whales.

Of the $15.98 billion, $14.33 billion came from transactions exceeding $100,000, typically conducted by whales. This accounts for 90% of the total traded volume on that day.

Ethereum On-chain Activity. Source: IntoTheBlock

Ethereum On-chain Activity. Source: IntoTheBlockIntoTheBlock explained that the approval of ETH ETFs marks a significant milestone in cryptocurrency acceptance. It continued that this move would likely increase ETH whales’ activity, as seen in recent large-volume transactions.

“The shifting landscape, underscored by substantial on-chain trading volumes, suggests a growing institutional and investor confidence in Ethereum. This trend is poised to gain momentum, potentially leading to even greater market movements,” IntoTheBlock added.

The post Ethereum Supply Crunch Looms with ETFs Approval, Whale Activity appeared first on BeInCrypto.

.png)

5 months ago

4

5 months ago

4

English (US)

English (US)