ARTICLE AD BOX

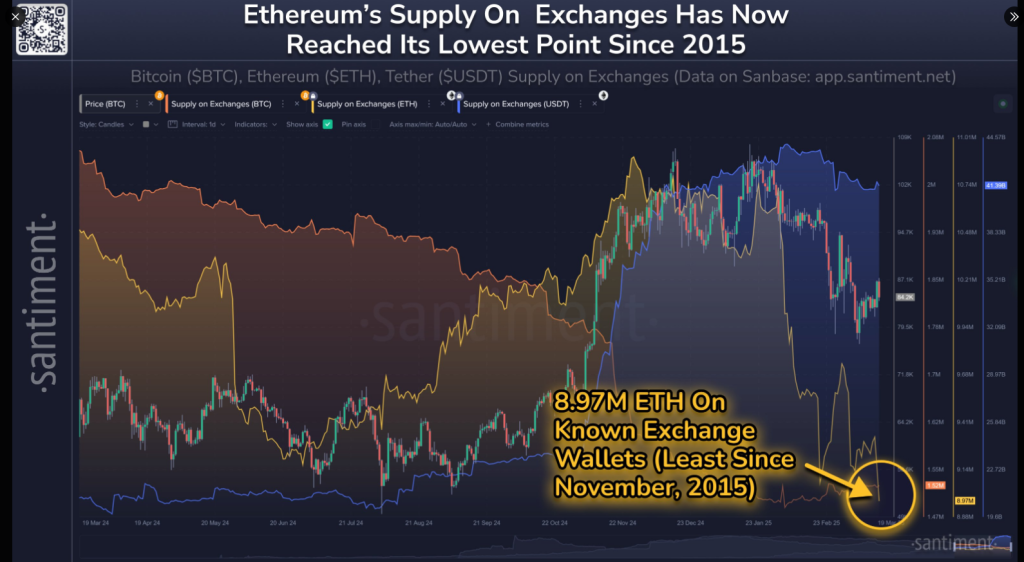

The supply of Ethereum on cryptocurrency exchanges has declined to a level not seen since November 2015, a key indicator of the dramatic change in how investors are storing the digital currency.

Based on recent data, around 8.97 million ETH are in their possession now. This shortage comes as the price of Ethereum has taken a precipitous decline.

Supply Tightens On Exchanges

The declining volume of Ether on exchanges is an indication that the holders are taking their money elsewhere in growing numbers. One of the main reasons behind this is the rise of decentralized finance, or DeFi for short, according to a recent examination by Santiment.

People are interacting with several DeFi protocols with their Ethereum to lend liquidity or earn rewards. Another principal element is the expansion of staking, whereby ETH owners “lock up” their coins to help secure the network and be rewarded while doing so. Therefore, there is fewer Ethereum to sell on the exchanges.

Thanks to the many DeFi and staking options, Ethereum’s holders have now brought the available supply on exchanges down to 8.97M, the lowest amount in nearly 10 years (November, 2015). There is 16.4% less $ETH on exchanges compared to just 7 weeks ago.

Thanks to the many DeFi and staking options, Ethereum’s holders have now brought the available supply on exchanges down to 8.97M, the lowest amount in nearly 10 years (November, 2015). There is 16.4% less $ETH on exchanges compared to just 7 weeks ago.  pic.twitter.com/r5957wPhLi

pic.twitter.com/r5957wPhLi

— Santiment (@santimentfeed) March 20, 2025

Ethereum Price Takes A Hit

Despite the lower supply of Ethereum on exchanges, which some would expect to drive prices up because of scarcity, the opposite has occurred. Based on latest figures, the price of Ethereum has dropped by about 45% from its December high.

On March 21, the price was about $1,899. Ethereum has been among the worst-performing major cryptocurrencies over the past few years.

The cause for such a decline in price is varied and can involve overall market sentiment, macroeconomic conditions, and increased competition from other blockchain systems.

Experts Share Their ThoughtsFinancial analysts are giving their opinions regarding what this means for the future value of Ethereum. Standard Chartered, a well-known financial institution, has recently reduced its year-end price target for Ethereum. They now predict a price of $4,000 at the end of the year, a significant drop from their previous estimate of $10,000.

The primary purpose of this revision is the rising competition from Ethereum’s competitor layer-2 networks, which aim to provide faster and cheaper transactions on the Ethereum foundation blockchain. Users and traffic on such networks can be different from the central Ethereum network.

Upsides On The Horizon?Despite the current price hiccups, there are potential explanations why a recovery could be realized. One possibility is staking exchange-traded funds, or ETFs. If regulations allow ETFs that directly stake Ethereum, it could attract more institutional investment and increase demand.

Featured image from Gemini Imagen, chart from TradingView

.png)

6 hours ago

1

6 hours ago

1

English (US)

English (US)