ARTICLE AD BOX

- Prominent institutions are depositing substantial amounts of Ethereum (ETH) on centralized exchanges.

- Celsius Network initiated a significant deposit of 10,000 ETH (equivalent to $23.56 million) into Coinbase.

- Multiple addresses associated with Celsius Network indicate strategic moves, with recent deposits totaling 47,100 ETH.

Prominent institutions, including Celsius Network and Alameda Research, are depositing substantial amounts of Ethereum (ETH) onto centralized exchanges like Coinbase.

This strategic shift comes at a time when Ethereum’s performance has lagged behind other major cryptocurrencies, such as Bitcoin and Solana, in the ongoing bullish market.

Celsius Network’s Noteworthy Ethereum Deposits

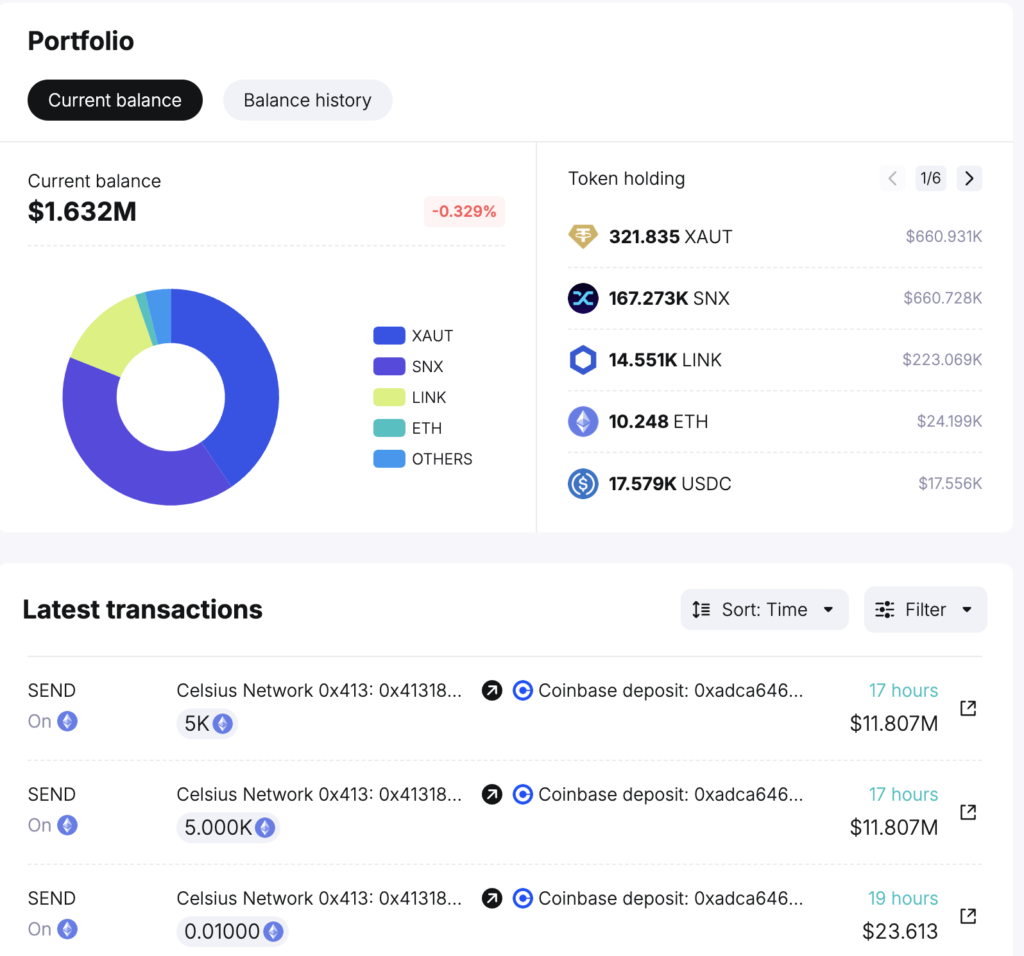

Spotonchain, a blockchain analytics platform, has revealed that Celsius Network initiated a substantial deposit of 10,000 ETH, equivalent to $23.56 million, into Coinbase. The transaction, carried out by the Celsius Network address 0x4131, occurred in two batches of 5,000 ETH each, as depicted in the provided screenshot.

The Celsius Network address currently retains 10.2 ETH, valued at over $24,000, and boasts a total crypto asset holding worth $1.632 million. Spotonchain has identified multiple addresses associated with Celsius Network, signaling a series of strategic moves by the institution.

In the last two weeks alone, Celsius Network addresses have funneled an impressive 47,100 ETH, totaling $107.7 million, into Coinbase. This surge in deposits follows Celsius Network’s court-approved decision in June 2023 to convert altcoins into Bitcoin and Ethereum.

Alameda Research and FTX Join the Wave

Adding to the intriguing trend, Alameda Research, a prominent entity in the crypto space, has been actively transferring Ethereum to Coinbase. On a recent Tuesday, the company executed a transfer of 1,550 ETH, amounting to $3.67 million.

Since October 2023, both FTX and Alameda Research have orchestrated deposits totaling 39,120 ETH, valued at an impressive $79.5 million, into various crypto exchanges.

Even Donald Trump, the former President of the United States, appears to be part of this trend. Recent reports from December 28 indicate that Trump has purportedly liquidated $2.8 million worth of ETH on centralized exchanges.

As Ethereum grapples with its underperformance compared to peers like Bitcoin and Solana, the increased supply of ETH on centralized exchanges introduces a layer of uncertainty.

.png)

11 months ago

4

11 months ago

4

English (US)

English (US)