ARTICLE AD BOX

On-chain data shows that Ethereum whales are making substantial purchases in anticipation of a potential price surge.

A crypto whale is an individual or entity that holds a significant amount of a particular digital asset. During the past week, on-chain analysts identified several wallets in that capitalized on the price volatility to buy Ethereum.

Ethereum Whales Accumulate

On January 5, Spot On Chain noted that a prominent whale ‘0x9314’ spent $48 million to buy 21,192 ETH at an average price of $2,265 per coin. The whale, which began its buying spree last January, has acquired nearly 80,000ETH, majorly from decentralized exchanges (DEXs) and Binance, at an average price of $1,790.

These purchases were financed with loans from DeFi protocols Aave and Liquidity, suggesting bullish speculation on ETH’s future price surge. Meanwhile, the whale’s investment has accrued a notable 26% profit, amounting to more than $36.84 million.

Read more: How Vitalik Buterin’s Roadmap Update May Push Ethereum to New All-Time High

LookOnChain also identified two whales that acquired a significant amount of Bitcoin and Ethereum following their recent price drawdown. Per the analyst, these entities cumulatively bought more than 1,300 ETH at $2,225.

Ethereum Whales Accumulation. Source: Santiment

Ethereum Whales Accumulation. Source: SantimentBlockchain analytical firm Santiment further confirmed that Ethereum’s largest self-custody wallets were accumulating the top cryptocurrency at a “rapid pace.” The firm stated that the top 150 of these wallets hold more than 56 million ETH, an all-time high.

“Notably, the largest ETH non-exchange whales are accumulating at a rapid pace, while exchange whales stay low,” Santiment added.

What’s Next For ETH Price?

The spike in whale activity have raised speculation about Ethereum’s potential price surge in the foreseeable future.

“Ethereum Support and Resistance Flip! All eyes are on the Bitcoin Spot ETF, but little do they know that ETH will have its Spot ETF soon too! The price is still underrated,” CryptoBusy, a technical analyst, wrote.

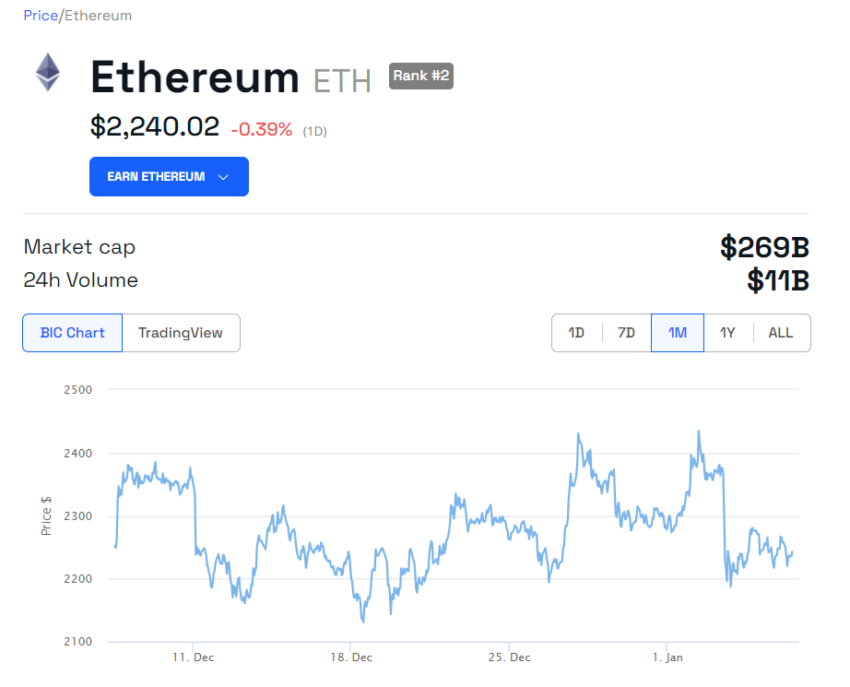

Pricing data from BeInCrypto reveals Ethereum has maintained stability above the $2,150 mark since the year’s onset, trading around $2,240 with a marginal 0.39% decrease in the last 24 hours. However, the asset is also down by 2.5% over the past seven days.

Ethereum Price Performance. Source: BeInCrypto

Ethereum Price Performance. Source: BeInCryptoLast year, Ethereum notably exhibited a comparatively lower price performance than other assets like Solana. It recorded a modest 90% gain compared to triple-digit upticks observed in BTC and SOL. Consequently, ETH is more than 50% down from its 2021 all-time high of $4,864.

Read more: Why Ethereum Is Bound for Significant Gains in 2024

Despite the subdued performance, market analysts have maintained positive forecasts for ETH price. Asset manager VanEck predicts Ethereum’s price could be more than $50,000 by 2030.

Top crypto platforms in the US | January 2024

The post Ethereum Whales Boost Holdings to Record Levels Amid Market Optimism appeared first on BeInCrypto.

.png)

10 months ago

14

10 months ago

14

English (US)

English (US)